Nudge from the US, Significant Push from China

Finally, the stars were aligned, and the market took full advantage of it. Although the news out of Frankfurt did not ruffle feathers, it did not send shockwaves across the markets either. The ECB left its benchmark rate unchanged and gave no clue when lowering borrowing costs could become justified. The message is that peak rates have been reached, rate cuts are coming, timing is precarious. US data was considerably more productive. The country’s economy expanded 3.3% in 4Q 2023, consumer spending was stable and weekly jobless claims were up 25,000. The economy remarkably weathered the storm caused by past rate rises and it remains ebullient at the beginning of 2024 with rate cuts impending. Equites edged higher and bond yields lower. The deep cut in China’s bank reserves, which is set to inject more than $140 billion into its frail economy was another welcome development, its long-term impact, nonetheless, as discussed below, is questionable.

An obstinate Israel, which refuses to effectively discuss truce, let alone a sustainable peace plan unless Hamas is obliterated will ensure continuous shipping disruptions in the Red Sea. Whilst oil supply from the Middle East has been hindered but not halted the picture is markedly different now in Russia. It appears that Ukrainian drones are able to reach refineries deep into Russian territory causing actual disruptions in supplying refined products, to which the market reacted with an impressive buying spree. It provided invaluable help for an upside break out of the recent trading range handing the momentum over to those with bullish propensity.

GMT | Country | Today’s data | Expectation |

13.30 | US | Core PCE Price Index YoY (Dec) | 3% |

13.30 | US | PCE Price Index YoY (Dec) | 2.6% |

Headwinds of Changes

For the past 24 years, since China joined the World Trade Organization, the country’s economic progress was astronomical. It expanded by leaps and bounds and consequently the world’s second biggest economy was the engine room of global economic growth and the heartbeat of oil demand growth. At times of worldwide turbulence, it served almost as an automatic stabilizer. In fact, the Chinese economy started to grow in the early 1990s (albeit from a low level hence the mesmerizing percentage rates) but it truly started to become rich and lift 100s of millions of its citizens out of poverty in the new millennium as a strong middle class emerged. Between 2000 and 2019 the GDP registered an average 9% growth rate annually.

The unquenchable thirst for oil was equally jaw-dropping. In 1995, for example, China demanded 3.33 mbpd of oil, which was less than 5% of the world’s total, fast forward 23 years to 2018 in which China’s demand representation increased to 13%. In this period global oil demand increased 42%, China’s fourfold. In 1995 the country contributed 13% to the annual growth in oil demand, in 2018, 33%. In the year of the pandemic global consumption dropped 9 mbpd predominantly driven by OECD nations but China’s demand remained resilient (although it retreated from 2021 to 2022).

Then something changed post-pandemic. The management of the health crisis by the political elite had a profound impact on growth. Strict lockdown rules crippled the economy which has not been able to fully recover from the malaise even after restrictions were lifted at the end of 2022. Last year the country’s growth rate was a dismal 5% and the expansion will be even slower in 2024 and 2025 -4.16% and 4.12% respectively- if the latest IMF estimates from last October are to be taken at face value.

In this slowing and precarious environment Chinese consumers prefer saving to spending. The retail sector is undergoing a significant shift, and this will affect corporate performance. The high-growth era is probably the thing of the past and changing consumer behaviour inevitably puts protracted pressure on the pivotal property sector, too. At the end of last year new homes prices fell by 0.3% year-on-year, according to the National Bureau of Statistics and in an oversupplied market falling sales and an indebted sector will undeniably impact this year’s growth prospects. The manufacturing PMI was below 50 last month and for most of 2023 indicating contraction in the sector. The country’s exports fell 4.6% last year, the first decline in 7 years, and imports plunged 5.5%. The labour market is also under strain and youth unemployment is so high that no official data was published in 2H 2023. (The new figures were released last Wednesday using a new methodology and showing improvement. In the words of Churchill, we only believe statistics we manipulated ourselves.)

Lack of convincing post-Covid recovery coupled with the Communist party’s explicit priority of national security at the expense of growth is conspicuous in the performance of the stock market. The Shanghai Composite Index has lost 6% of its value 2023-to-date, which includes the 5% stimulus-induced rally of the past 3 days. The MSCI All-Country Index recorded a gain of 21% during the same period.

Amidst lukewarm short-term aggregate demand, public enemy No. 1 is deflation. Consumer prices have been in deflationary territory since August and producer prices are also falling; they plummeted 2.7% last month. Policy makers, in their latest attempt to restore confidence, announced a 50 basis points cut in the amount of cash banks are mandated to hold as reserves, reportedly freeing up almost $149 billion for lending – with potentially dubious results as Chinese economic troubles are probably more of the result of confidence than credit crisis.

In the medium-term Chinese deflation could turn into inflation but for all the wrong reasons. Demand for tombstones started to exceed the need for midwives; the country’s population has declined for the second successive year in 2023. India has become the world’s most populous country. An aging population shrinks labour force and drives up prices with all the unwanted consequences on economic growth. The mutually hostile rhetoric between the western world and China adds another layer to the numerous economic problems the country needs to deal with. In light of the above snapshot, it is nothing short of puzzling to see Chinese oil demand growth making up 57% in the annual increase in of global oil consumption this year (IEA data). Unless there is an unforeseen and drastic improvement in Chinese economic performance it is not unreasonable to prognosticate downward revisions in Chinese oil consumption this year and possibly beyond. It was outlined in Wednesday’s note that sufficient oil supply could act as a break on any potential oil price rally. Stuttering Chinese economy might also turn out to be a salient impediment.

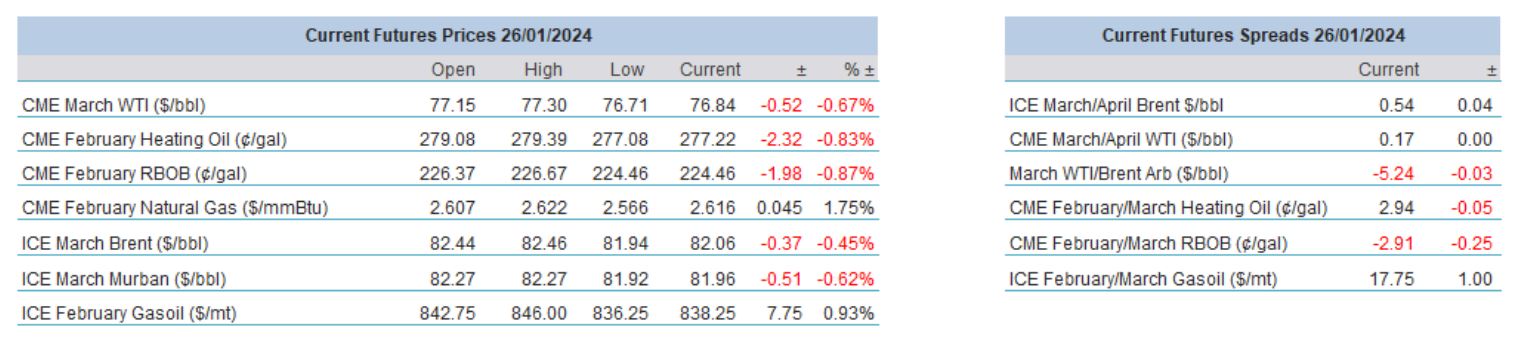

Overnight Pricing

© 2024 PVM Oil Associates Ltd

26 Jan 2024