Nvidia and Francine to the Rescue

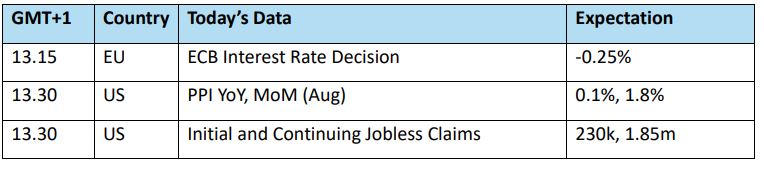

A gust of hope blows through the wider suites, and it is to do with computer systems, rather than those of the weather variety. The news late in the trading day that the US government is contemplating sales of advanced microchips from Nvidia to Saudi Arabia has the investment tourists cock-a-hoop again and they pile back into the AI darling. The tech company's shares have rallied 8% overnight and how its fortune is the bellwether for bourse prices is a now well-practised commentary. This has proved an antidote to the very poor performance seen on Wall Street yesterday after the US CPI posted a cooling +2.5% August year-on-year and +0.2% month-on-month readings. In terms of influence for interest rate decisions this is a very passive rate and pricing for a double decker 50-basis points decision by the FED next week has all but disappeared with a 25-pip increase nailed-on. Because of the Nvidia interest, the S&P 500 is 1.0% higher and has made back all the losses endured yesterday and those since last week. The impending rate decision from the ECB later today is unlikely to have much of an effect due to the probable 25-basis point cut being baked in. It will be the commentary afterward that markets will look to and if there are more cuts contemplated before the turn of the year. With the European economy in such dire straits, it is hard to see how the ECB will not at least allude to such a notion because anything else will harm an already beleaguered financial backdrop.

Retuning to winds, Hurricane Francine made landfall and moves inland in dissipation. However, its aftermath is not yet truly known with much of the oil businesses of Louisiana shuttered. Estimates are that 40% of oil production has been halted in the US Gulf and depending on staff returns and restarts, effects might last as long as two weeks. The weather-related bounce and relief rally counter the poor US Inventory Report yesterday and continued negative global demand stories. The EIA reported builds of 833kb in Crude, 2.31mb in Gasoline and 2.31 in Distillate. Worryingly refinery runs eased again and implied demand fell in all three major sectors. The US has obviously been the stalwart of demand, and such data might have had a more deleterious outcome if it were not for the weather system. However, having thus far seen a very quiet hurricane period, the US National Hurricane Centre is tracking 4 more possible storm systems, therefore, more disruptions should not be yet dismissed.

China’s worries find similarity beyond oil

The looming presence of China casts a shadow over the world’s trade at present and while the amalgam of stories points to an economy in decline some of the reasoning behind commodity imports are never truly a one-way understanding, but because of the Southeast Asian’s appetites, any reduction in demand brings negative appraisement. This is because China boasts an impressive history of international trade, but modern China is a nation state business and not a PLC driven by a shareholder bottom line. Strategy and long-term thinking are paths that it deems more important than a fast buck, and what China is armed with most of all is adaptability and a massive infrastructure to out manufacture most economies on the planet. Yet for all the above forbearance, being a massive part of the intricacies of international trade cannot stop its current performance from being summarily judged.

When taking into account GDP growth since 1990 its performance has been nothing less than incredible and up until the pandemic had averaged towards 10% which is made all the more impressive when compared with the United States that has rarely skirmished anywhere near 5% during the same period. With such lofty readings, the health of GDP growth for China is given almost reverential status as seen in the Third Plenum of the Chinese Communist Party, and while the current target of 5% seems paltry compared with past years, it is nonetheless emphatically defended and broadcasted to all that will listen. It is a measure of pride, of economic growth, of power and size but mostly because of it being the reason that 800 million people have been lifted from poverty. After an impressive first quarter, 2024, 5.3% GDP growth reading, all seemed well but with ensuing broad-based economic weakness culminating from domestic demand, GDP growth soon scurried down to 4.7% year-on-year for the second quarter. With successive house price index, retail sales, foreign direct investment, CPI and PPI all falling and manufacturing PMIs in contraction, a slew of banks are now downgrading their calls for China’s GDP in 2024 to a range of 4.6 to 4.8%.

Directly linking quarterly GDPs to current dips in commodity demand is something of a stretch, but as China is so often judged by the health of its trade then in some ways it is apposite. Looking beyond oil for the moment and into the world of metals, there are of late some worrying indicators of demand. China’s importance in iron ore cannot be overstated, it is the destination for 75% of the global seaborne market. Customs report imports in the January to August period of this year are up 5.2% against the same period of 2023. However, a turn is underway with a fall in August of 1.4% or 101.39Mmt against July’s 102.81Mmt and 106.42Mmt for August of last year. Some analysts see the commodity gobbler consuming over 50% of global refined copper, but without delving too deeply, August also saw a negative shift. Imports dropped for the third consecutive month with both unwrought and copper products down to 415,000 tonnes from the previous year’s 473,000 tonnes. The two main metal stuffs for building and manufacturing suffer at the hands of a beleaguered domestic market. Which is why, according to Reuters, China shipped abroad 9.5Mmt of steel products in August, up 21.33% from July and 14.73% from a year before. In June it also pushed out 158,000 tonnes of refined copper giving a first half total of 302,000 tonnes, higher than any full year since 2019.

China continues to try to export its way out of an economic slump. At present it really has very little choice if it wants to get anywhere near the targeted 5% GDP growth that it seems so resolved in achieving. There is also the possibility that it is ‘making hay while the sun shines’. The smell of tariffs and trade wars are in the air as the world seems intent on abandoning free trade. China’s oversized trade surpluses are in the sights of not just the United States but also the European Union and any increased ‘dumping’ of the likes of steel and copper will antagonize trading partners. It is hard to see how China can alter behaviour, bearing in mind the vastness of its industrial infrastructure that it has so heavily invested in. Here is the rub. If at a time in the future it can no longer freely export as it likes, those spitting, hissing and fiery machines will lose import appetite. If it continues to ignore its domestic malaise with the half-hearted stimuli seen so far this year, then local consumption will continue to decrease, savings increase, and deflation continue and become cyclical. Whatever commodity is used as an example, the size of effect from China is massive. At present the walls appear to be closing in on Asia’s economic dragon which is why the world is besotted by what goes in and what comes out of the world’s industrial multi-furnace.

Overnight Pricing

12 Sep 2024