Oil Continues to Hold its Own in a Very Busy Schedule

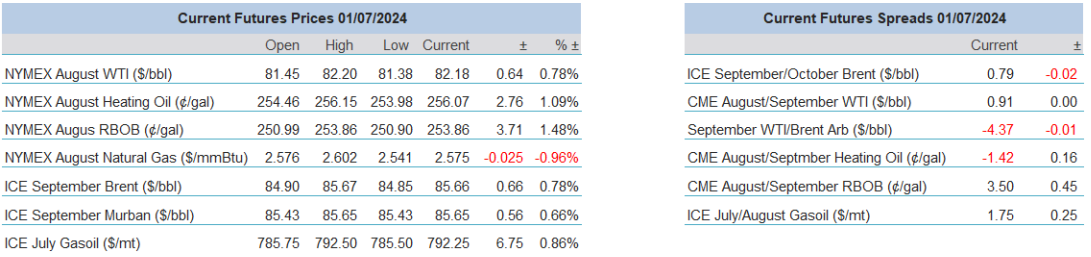

Last week the oil complex put in something of a dogged performance. Despite the setback of the US Oil Inventory figures, the oil fraternity endeavoured to hold on to the idea of impending summer demand and this was aided by worries concerning spreading hostilities between Israel and its immediate foes in both Gaza and Lebanon. WTI managed a gain of $0.81/barrel (+1.00%), Brent $1.17/barrel (+1.37%), Heating Oil 4.16c/gallon (+1.67%), Gasoil +$2.25/tonne (+0.29%), whereas RBOB actually eked out a loss of 1.22c/gallon (-0.49%) and shows the reality of a market fuelled by future nascence. Some of the trading period was influenced by expiring contracts, particularly that of Brent settling with backwardation in M1/M2 of $1.41/barrel. Those that are of a North Sea persuasion will be keenly interested in whether the follow-on spreads will emulate such dizzy heights or if the new premier contract of September is able to make up the flat price gap left behind by such a backwardated finish.

Markets in general are breathing a small sigh of relief after exit polls from France. While Marine le Pen's National Rally looks set to win the first round of the election, the process of political horse trading begins in earnest as the runoff next week will see a swathe of tactical liaisons. Markets have deemed the news as tolerable and the French CAC 40 index on futures is currently up 1.5% and the Euro has climbed a cent to 1.08 against the US Dollar. With the subsequent dip in the US Dollar Index (DXY) this morning an air of bullish bias is revealed across the suite and oil prices benefit in kind. If there is any doubt that oil enjoys decent sentiment presently it can be quashed by how the poor PMIs from China are ignored. Yesterday's publishing by the National Bureau of Statistics (NBS) showed Manufacturing PMI unchanged at 49.5, steadily in contraction and Non-Manufacturing PMI and General PMI both decreased to 50.5 from 51. Such sloth-like data is already seeing calls for more stimulus (even though the private Caixin PMI came in above expectation) but even China's overall poor showing is not enough from denting our market's grind higher or being blown along by Hurricane Beryl’s threat at the start of a very early season for such storms in the Americas.

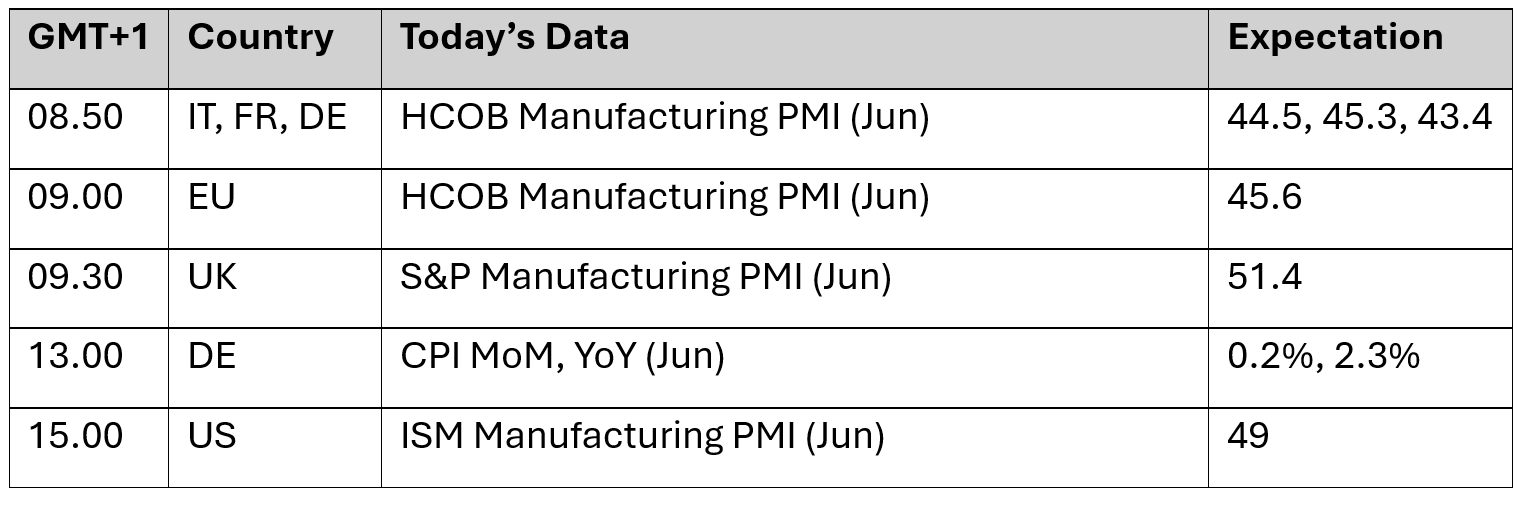

Those that wish oil were free from the wider macro-economic winds will be sorely disappointed for today will bring manufacturing PMIs from Europe and its constituents, German inflation and US ISM Manufacturing PMI. Tomorrow sees the publishing of the Eurozone's flash inflation and speeches from the heads of central banks (touched on below) at the ECB's symposium in Portugal. With service PMIs, a phalanx of US employment data and the small matter of the UK election coming across the balance of the week, the only way that our market brethren can avoid being in contact with macro drivers is to holiday in a mine.

Short-termism is the only way forward

Quite the week can be expected from the wider macroeconomic world and markets would do well to negotiate not only meetings of the great and the good in the central banking world, but also tier one data alongside growth markers that might just be hard to ignore. Leaving the French elections aside for the moment, and the reactions to the preliminary round of parliamentary elections, Europe will take centre stage. Sintra, Portugal is once again the destination for monetary chess grand masters as the likes of Federal Reserve Chair Jerome Powell and ECB President Christine Lagarde arrive for the European Central Bank’s symposium. Comments from Lagarde can be expected with minutes produced on Wednesday and whether they give credence to the current pricing of 87% for another cut in September and indeed a 38% chance for one this month. This will obviously be endeavoured to be matched and possibly married to how the US is currently pricing a 72% likelihood of its own cut in September. The US does not have the same stalled economy of the Eurozone, but it will also need something of a cooling of the labour market, therefore, once again watch out for JOLTs job openings, ADP private payrolls, the usual jobless claims and finally the Non-Farm Payrolls on Friday.

It remains fascinating that the language of bankers is focused around interest rates and growth, with all economies pitted against how the US continues on in almost invincible fashion. Truly, the American economy has been the saviour for all. Investors ooze confidence in the stock markets and the previous debated ability for a ‘soft-landing’ has changed from the conjunction of ‘if’ into one of ‘when’. There is a lined-up wall of buying and anything to do with AI has reached messianic status, which is why even in this current world of geopolitical uncertainty the S&P 500 and Nasdaq seem to be in a daily competition on making new highs and dragging the DOW and other global bourses along for a ride. Many of the Wall Street super banks are again upgrading their end of year calls for the S&P despite the massively inflated price-to-earnings ratios which typically come in times of bubble. Doomsayers are comparing AI to the dot.com era, but that has been going on for some time now without too many heeding such caution.

However, there is a runaway train of careering debt rolling through the world and one wonders if there will ever be a reckoning, or will we just see more laying of accommodative track to keep the whole thing chugging along? The world’s public debt is ballooning and because of the banking crisis, COVID and the Ukraine invasion, the go-to policy solution to any government, that is eligible, is to double down on monetary easing in whatever guise that might be. According to the Institute of International Finance, over $15 trillion was added to the global debt mountain last year, bringing the total to a new record high of $313 trillion. Not for long, global debt rose by some $1.3 trillion to another new record high of $315 trillion in Q1 2024. Moreover, after three consecutive quarters of decline, the global debt-to-GDP resumed its upward trajectory in Q1 2024.

The exceptionalism of the United States and the current forbearance to blithely watch the global debt mountain increase probably means that the tolerance to wonky balance sheets will carry on. France continues to be the model of ‘so what?’ The two opposed parties currently working out which will take over from President Macron’s beleaguered Renaissance party seem to care not by trying to outdo each other on increased spending in any way shape or form. Which brings us back to Central Banks and why the stasis in interest rates must remain if the appetite for national debt continues. Fighting inflation while allowing debt exuberance has not been a planned outcome after the major hiccups of the world’s recent disruptive events, it is just where we are. Forward one year and ask these questions. Will the debt mountain come down? No. Will inflation consistently be at the hallowed 2% so yearned for by bankers? Probably not. Will interest rates come down significantly? No. Jerome Powell has professed that each decision is manifest of current conditions. He may not be the head of the FED, but that mantra is unlikely to change. There is no measure or plan in anything long-term. It is impossible to map one. Which is why, and for the foreseeable future, every part of the moving cogs of the global economic clockwork must be considered on a daily basis, for we most certainly live in a short-term world.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

01 Jul 2024