Oil is Currently Bearish but Confusing

As we touched on in yesterday’s report the ability for management in large corporations to pick long paths of stability is shrinking on a daily basis. If the US President has the stock market in mind, it is nothing compared with the heads of companies, who, unlike Mr Trump are not guaranteed their seats for the next 4 years. We have already heard some quibbles from the top dogs of industry. The CEO of Ford described threatened or implemented tariffs as causing “chaos” for car makers. Rather brave in a world of vindictiveness, and one that will not be repeated by oil giant chiefs because The Donald is a full-blown advocate of fossil fuels. However, the oil market is trading under a spectre of unease. As the great and the good gather in Houston for CERAWeek, there have been expressions of doubt and frustration toward future planning in terms of investment and indeed, that of price. Not all misgivings can be laid at the door of the White House, for some issues were extraneous to tariffs, but in reality, can only be made worse by them.

The CEO of Gunvor in a mixed media interview seemed to err on the side of scepticism on the future of prices and demand. To loosely paraphrase his view, demand for oil in 2025 does indeed exist, but it is largely outweighed by the prospect of increasing supply. A basic economic warning that is backed up by a rightly pointed problem in the size of available spare capacity. With such an existence of easily accessed production increase he wondered if the bringing back of such a small amount of oil from OPEC was wise. Suffice to say it is valid point because the benefit of 138kb is paltry in terms of petrodollar income, but much larger in psychological affect and can only showcase the spare capacity of the group which is estimated to be up to 5-million barrels per day.

It must be allowed in approbation the term ‘climate change’ and use it to describe the trading practices between former solid partners. The US/Canadian relationship seems in every level at an all-time low. Recently and recorded on Bloomberg, the Canadian Association of Petroleum Producers (CAPP) said, “We must now recognize the relationship with our closest friend, ally and trading partner has fundamentally changed [and] act with urgency to focus on the Canadian national interest.” One wonders if such rhetoric is an adoption of Trump-like language rather than an impending change to the massive energy business that the North Americans share. Even though there will be an expansion in pipeline accessibility for LNG exports from the British Columbia coast, with lower oil prices envisaged, it must be economically questionable whether such pipeage could extend for the black stuff which already has a route west through the Trans Mountain pipeline. Indeed, and again reported on Bloomberg, Enbridge are swatting away tariffs as ephemeral and are investing heavily into the status quo, as finding a 3.2mbpd customer elsewhere is impossible. Enbridge reported a state of ‘apportionment’ of late, where pipeline capacity is delinquent to customers volume to ship. Clients in this case are willing to carry on shipping despite the tariff threat and maybe at a 10% levy they can make the baseline work.

It does not matter how pro-oil Mr Trump might be, companies can only care through the prism of profit. Where the point of profitability for US drillers lies is debatable, but as WTI zeroes in on $60/barrel given the global supply/demand imbalance, profit margins become tighter. The buried $40 and $50 assets have already been mined and with secondary drilling and fracking underway, costs are increased despite savings from modern innovation and AI. The US oil industry is offered a parachute by the current US government from promised SPR buying which should allow for a future bid to be relied upon. But even the DoE is commercial and will scale its buying to suit the needs of its populace and military rather than to fully underwrite the US oil fraternity. Lastly, oil prices can only ever be firm if there is product demand. US refiners are running at a slower pace because of recent turnarounds, but unless the state of Gasoline and Heating Oil prices change, run rates will remain low to protect refinery margin. As the calendar enters the gap between Distillate and Gasoline demand scrutiny will increase. Gasoline nearly always comes to the seasonal rescue, but oil company bosses and those that manage risk can hardly rely on it given the numbing nature of tariff fear on demand be it emotionally or fundamentally so.

Oil prices are arriving at a point probably earlier than the US President envisaged. Loitering at these levels or lower will not only see refiners scaling down, the same will eventually be seen by crude producers, be they US, OPEC aligned and non-aligned. The ensuing rally will be so inflationary as to be frightening and will knife all the White House aims. All this is clearly speculative, it is not something to write strategy upon. Yet, some of this will be the concern of oil executives and hence the flow charts of possibility faced by the oil fraternity’s hierarchy and why anxiety will continue to build.

And the confusion goes on

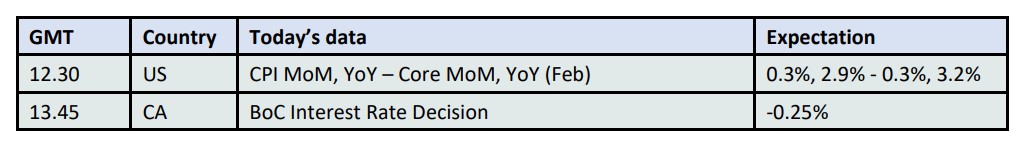

This morning oil prices are seeing some relief again after yesterday fishing the depths of the year-to-date lows only to find a nearing of an oversold status. Aiding something of technical bounce is the cutting by the EIA of its surplus forecasts for 2025 and 2026. Reducing the overhang from 500kbpd to 100kbpd this year and from 1mbpd to 500kbpd for the next, the administration’s cause for adjustment lies with the sanctions currently and proposed by the US on Venezuela and Iran. World demand was left unchanged at 104.1 in 2025 and raised for 2026 by 100kbpd to 105.3mbpd. Oil participants will await what OPEC and the IEA have as an alternative or aligning view before making any conclusion, but any friendliness to the cutting of a glut seen by the EIA is muted by its prediction of US production continuing to increase into 2026 toward 13.75mbpd. Another build in the API Crude inventory of 4.2mb also caps enthusiasm along with the geopolitical melee.

In Baseball parlance, taking a swing at these markets can only result in foul balls. Ontario’s climb down of an electricity surcharge for exports into the US was greeted with reciprocal backoff from the White House walking back a 50% tariff on Canadian metals, although the global 25% charge on Aluminium and Steel came into effect. The world awaits a response from Russia as a ceasefire proposal was thrashed out between Ukraine and the US. Volodymyr Zelensky’s must feel relief from the arm up his back and his reward will be to see Russia prod and prevaricate on peace as he predicted. How this lopsided peace process pans out is no basis for risk profile until it is fully signed sealed and delivered. Something which we suspect will only be an irritant to the immediacy of the US President’s attention.

Overnight Pricing

12 Mar 2025