Oil is Data-Weary

The early Singapore Platts window has achieved little in enlivening a market that is beginning to hunker down and accept a possible period of doldrums before the much longed for and publicised third quarter demand seeps through into fact rather than conjecture. The battle for forward predictions continues between the ‘glut’ warning IEA and the ‘tight future market’ OPEC (which my learned colleague continues to study next week) and neither serve the market well in its search for clarity. In a week in which all markets have had to curb enthusiasm due to tier one data, the Bank of Japan’s decision to leave interest rates alone comes as no surprise, but its lead on how it will continue in some bond purchases but begin to taper its balance sheet is greeted with a tired roll of the eyes from investors who just want this week over and done with.

Yesterday’s easier than expected US PPI and Initial Jobless Claims being the highest since nearly a year ago are markers of faith in interest rate cut belief, but for oil bad news is bad news and the PPI register of -0.2% versus a +0.1% forecast brings a certain demand worry. Aiding and abetting a reluctance to participate was yesterday’s admission by Russia that its May oil production exceeded its OPEC+ quota and no matter how many times it promises to make up for poor compliance at a future date, the market just sees more oil and an agreement that might just possibly unravel if somebody pulls at the threads too hard. One can never dismiss conflict stories from the Middle East, particularly those involving Israel and any Iranian proxy, but the battles on contested borders are humdrum to a deafened market and as horrific and sad as the events may be, they have lost the gaze of oil watchers. This week is likely to exit with a whimper rather than a bang.

Procrastinate, stick, repeat

“Will no one rid me of this turbulent priest?”, so said the English King Henry II on the interfering Archbishop of Canterbury, Thomas Becket. One wonders if this is how most of the oil market’s fraternity thinks about interest rates every other month when they get to take all the copy and suck out all the enthusiasm time and again as the Federal Reserve, in particular, tries to bring to heel inflation and its accoutrements. Having been promised by analysts and bankers alike that we could expect six cuts in 2024, it now appears, and according to the hallowed ‘Dot Plot’ that we are likely to experience a miserly single reduction. The art of kicking the can down the street makes a ‘Pele’ out of Jerome Powell, but the poor chap can only work with the pitch and ball he is provided with and to continue in football parlance the defence against rate reductions such as employment and personal behaviour, have ‘parked the bus’.

All markets can be accused of short-termism not only in consumption of news but also in memory. Oil prices this year have fallen foul of FED interest rate wrangles over our calendar so far, for the undoubted foaming fomo (fear of missing out) that is the constant wingman to this market’s psyche, has led to rather uncomfortable inflection points. Indeed, there does seem to be something of a pattern forming over and around this year’s FOMC rate decisions. Scrolling back to the behaviour of M1 WTI futures after meetings of the Federal Reserve we see the following price action. On and after the January 31 decision; a five-day, $3.82/barrel move lower with a technical dive in markers such as stochastic and momentum. After the March 20 decision; a three-day, $2.56/barrel move lower with similar technical reactions. And finally, after the May 1 decision; a three-day, $3.59/barrel dip leading to negative momentum and notable downward change in stochastic.

Therefore, should oil participants be in close contact with interest rates every day and price exposure accordingly, and how could that be achieved? Long-term investors and institutions will have pricing against US Treasury Yields in the mix because of how the yield will also represent any movement in the US Dollar. The trouble being is that the volatility of yields particularly say the 10-year kind is enormous, management would be akin to trading options on the Volatility Index and oil length is rarely proved to be long-term to such degree. The obvious question as well is why on earth would one be considering daily interest rates if the Strait of Hormuz closed or a category 5 hurricane barrels along the US Gulf Coast swamping oil infrastructure? Frankly the bi-monthly interest rate decisions from the FED are probably about as much as oil participants can take and why they have an outsized influence when their settings are announced.

We have been speculating among ourselves that because of the invincibility of the AI positioning within stock markets, oil in our recent history has actually felt more keenly the fallout from fiscal headlines. The above then is a little evidence in support of that notion and why our market just cannot get away from being collateral damage when Jerome Powell wheels out his standard catchphrases and inanities. Because of another bout of inertia from the FED Wednesday night, should we then expect another marked fall in prices? Probably not one of any size, the long only positions of late means that the market at present is not overly committed to bullishness. But at the very least the reasons to stay a long hand in the sight of ‘higher for longer’ will likely dent the default tendency of oil, well, possibly until this episode of interest rate correction is forgotten and the next one comes along in repetitious cycle.

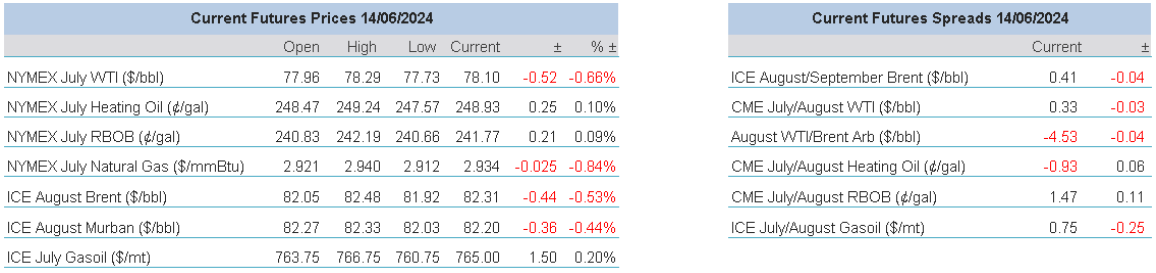

Overnight Pricing

© 2024 PVM Oil Associates Ltd

14 Jun 2024