Oil Prepares For a Big Day and Big Weekend

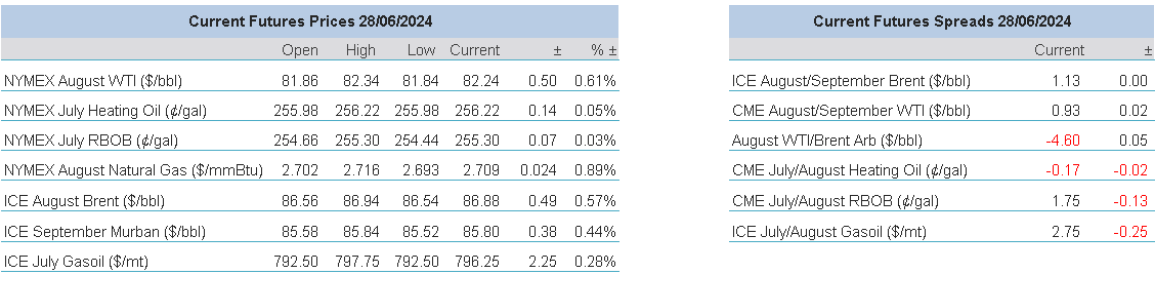

As most markets draw in breath at the end of both the second quarter and first half of the year oil remains true to its current form of expansionism on prices. There is little doubt that the current increasing backwardation in M1/M2 Brent futures at expiry is having most of the positive influence across the complex, for North Sea markers in nearby CFD's and dated versus front line, while remaining steady, have not advanced much at all this week. The idea of a tightening market remains very much the remit of futures at present and is where much of the anxiety of what might just happen in the Middle East is represented. Intent has been shown by the metaphorical shrugging of shoulders at what were poor US Inventories and even a rampant US Dollar causes little dampening of the current sentiment. Whether or not some of this unravels after the expiry and weekend is the million-dollar question, but with the Iranian election today, as covered below, the market is right in being oxymoronic defensively-positive.

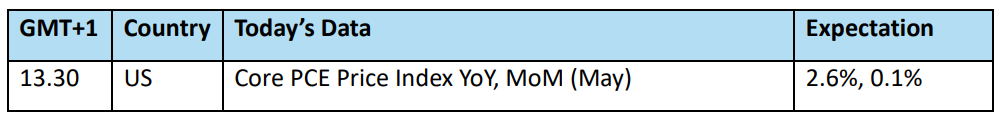

Accelerators and deflators to mood are available in abundance today. Expiries in Brent, Heating Oil and RBOB will bring their own kind of magic, but the wider suite will be hanging on the Core PCE data due today at 13.30BST. There will be some warming up in inflation chatter as European economies publish their own readings and because of the start of polling in the French elections this weekend, they might just have little bit more bearing than usual. Kickers to the oil price and those that hold bullish intention are also served by the continued issues with the weather in Ecuador that by some analysts' measurement is taking out 100kbpd of production. There is also a build of systems in the Gulf of Mexico and while forecasters judge that it might be more of an issue for Mexico rather than the US, the idea of an approaching hurricane season adds another touch of seasoning to this, if not bubbling, warming pot.

What’s at stake in today’s Iranian Election?

The Shortly after the Iranian President Ebrahim Raisi was killed in a helicopter crash on May 20 the battle for succession began in earnest. The late president was considered to be a hardliner and also the potential successor to the country’s Supreme leader Ayatollah Ali Khamenei. The changing of the guard comes at a time when dissent about the economy grows within the Persian Gulf nation, when the country’s deepening alliance with Russia, its indirect involvement in the Israel-Hamas conflict and the continuous pressure about its nuclear programme makes it one of the geopolitical hotspots. The outcome of today’s election could have an impact on domestic and Middle East politics but, notwithstanding the ban on Iranian crude oil exports, which is still in place, at least on paper, not so much on the global oil balance.

The late president replaced Hassan Rouhani, the pragmatist who was dethroned in 2021. During Raisi’s reign all branches of power were brought under the control of hardliners. His popularity considerably suffered due to his failure to lay down the foundations of economic prosperity and because of the clerical rule he strongly advocated. The civil unrest, which followed the death of Jina Mahsa Amini in police custody in September 2022 for wearing her hijab ‘improperly’, is still fresh in memory.

The result of the election will plausibly have a significant influence on the succession of the Supreme Leader, who is 85-year-old. The turnout, nonetheless, is expected to be traditionally low as the economic and political crises engulfing Iran should force many voters to stay at home, which, in turn, would favour hardliners.

The outcome will have a tangible impact on Iran’s relationship with the West and consequently on sanctions. Curiously, as oil prices rose after Russia’s invasion of Ukraine so did Iranian oil production and exports. According to the latest figures from secondary sources, as reported by OPEC, Iran’s May output level reached 3.22 mbpd, the highest monthly reading since November 2018 and its crude oil exports broke above 1.6 mbpd. The increase is partly down to sophisticated sanction evasion, but it is also a tacit nod from the US and a sign of intentional lax enforcement. Other economic boycotts, however, have successfully precipitated persistent economic crisis leading to civil disobedience and popular dissatisfaction. The election will also shape the conflict between Israel and Iran, will have an impact on Yemen’s civil war and the new president will be put right into the middle of the power struggle between the Shia clerical establishment and the powerful Islamic Revolutionary Guard Corps.

Six candidates have thrown their hats into the ring, but the election will plausibly be decided amongst two of them. These contenders are Mohammed Bagher Ghalibaf and Saeed Jalili. Both of them are conservatives. Ghalibaf is a former mayor of Tehran and is related to the Supreme leader through his wife. He is part of the establishment and is favoured by the Revolutionary Guards. Jalili was the chief nuclear negotiator under Mahmoud Ahmadinejad and is deemed to be unconditionally loyal to the Supreme leader. Ghalibaf is widely expected to continue Raisi’s policies, but Jalili is to maintain a very hard line with the West and tackle domestic issues with vigour and oppression.

The fact that the moderate former president Hassan Rouhani was barred from seeking re-election to the country’s assembly is the unmistakable sign that ideology, which includes funding militia groups across the region, will trump economic concerns, despite campaign promises to revive lost fortunes. Consumer prices rise 40% on an annualized basis, the World Bank sees the economy growing less than 3.2% for the next three years, the local currency keeps depreciating, unemployment is close to 8% and purchasing power is seemingly in a terminal decline. The only silver lining is the energy sector as production and exports are on the ascent. Whilst anti-Western policies and self-reliance will remain the major policy path, the incoming leadership will be acutely aware of the importance of export revenues in keeping the country afloat. For this reason, direct confrontation with Israel will probably be avoided, but if Donald Trump is re-elected, Iranian crude oil exports might come under renewed scrutiny from the US administration.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

28 Jun 2024