Oil Prices Propped By New Developments In Old Stories

The current bullish winds of sentiment that are driving oil prices nicely along seem set to continue as the world yet again experiences notional 'what ifs' as conflict arenas deliver not only continued weaponry exchange but also antagonistic rhetoric. The Ukraine's President, Volodymyr Zelenskiy's brag yesterday on increasing ability to hit Russia's oil infrastructure solicited a response from Russia that dialled up attention. Dmitry Peskov, a Kremlin spokesman, while referring to US donated systems said, “Of course, the involvement of the United States of America in hostilities, direct involvement in hostilities that result in the death of Russian civilians, this, of course, cannot but have consequences." What they might be is anyone's guess and thus the tick up in worry. Russia is feeling particularly put upon at present after yesterday's EU decision to increase sanctions aimed at the lucrative LNG market and although analysts believe that the monetary value will be of little consequence, it still does not detract from the idea of an embattled Russia in some way resorting to lashing out.

Just a few thousand miles south, Israel goes about its business of ignoring world opinion and continues with operations in Southern Gaza. Outcries over yet another incident involving the deaths of Red Cross workers on Friday and volunteers at a food distribution centre yesterday have hardly subsided as Israel this morning steps up attacks in and around Rafah. According to Al Jazeera this morning, IDF targeted the home of a senior Hamas official killing 10 and tanks have pushed further into the city. As this plays out and peace seems farther away than ever, Houthi attacks on shipping seem to have increased. In an alliance with Islamic Resistance in Iraq strikes on four vessels in Israel's port of Haifa have been claimed in missile attacks with a bulk carrier and tanker receiving fire yesterday in the Red Sea and Indian Ocean. Oil markets have so far been immune to the fallout of the Gaza invasion. However, at a time when there is an expectation of higher-to-be numbers in oil prices, such a sweeping under the carpet of the wider considerations of the conflict is starting to run out of space. Coupled with some ugly developments in Ukraine/Russia, those that are arguing for another charge in oil prices can probably rely on geopolitical issues to run as very decent wingmen.

Investors might just vote with their feet

The growing popularity of a summer kicker for oil prices is very much taking hold and those that have persisted in expressing a friendly outlook to the market have once again wrested the narrative from the doom mongers. Gasoline and Jet Fuel may very well end up on a tear, or alternatively, distillates may very well pour cold water on bullish moves, but what might just be the biggest influence in any sort of fluctuations from investment/trading markets is politics which this year come armed with elections. Along with a myriad of other diarists, we have held the view that the biggest risk to investors this year is what not only comes out as decisions from the ballot box, but also from the processes and the campaigning leading up to when our fellow beings put an ‘X’ next to a chosen candidate. Our thoughts were geared to elections in India, the UK and of course mainly the US but this revolving ball of celestial confusion will never let one sit on laurels and has introduced another level of voting intrigue.

With the gaining of 30 seats by so-called right-wing parties in the recent European Parliament elections, the French President has felt compelled to call a national election in a bid to unmuddy perception and demonstrate that he continues in having a clear mandate. However, this action has left those that are experts in calling results squirming in their seats and markets plotting flow charts that an AI software developer would be proud of. France is so very important on the world stage. A founding member of both NATO and the EU, any emulation of a right-wing swing will put both of these memberships in doubt as they are subject to much scepticism from the likes of ‘National Rally’, the party led by Marie Le Pen. The world’s security will take a backward step and so will investors. Having the seventh biggest economy in the world, France is already under scrutiny from its outsized debt burden, which under a new populist rule will become even greater if election promises are adhered to by Le Pen. These include cutting Value Added Tax (VAT), lowering the retirement age while increasing pension payments and specifically against EU rules, encouraging shoppers to ‘Buy French’. According to the IMF, France’s budget deficit is just shy of 5%, predicted to be the same in 2025, is higher than all other EU members and above the 3% threshold required by the Union. On the ‘left’ of the equation, the ‘New Popular Front’ have promised freezes to energy and foodstuff prices and a bump in the minimum wage. Either way, the strain on the public purse is there to see which is why French bonds have the same risk as those of Portugal and why the ratings agency Standard and Poors recently downgraded France’s debt from AA to AA-.

Markets as a rule care not whether a left leaning or right leaning government wins an election. As long as free markets (almost deserves a tongue-in-cheek) remain largely left alone and there remains at least a base case of policy continuity. A-la-mode political speak does not allow for concord, well at least publicly. Adversaries are set against each other like rabid dogs that dance to the tune of the soundbite rather than the substance. These stylized, rehearsed and some might say orchestrated encounters never offer meat for markets to sink teeth into, just morsels to scrap over and come up with some meaning. This is why anxiety levels increase along with reluctance to participate. Will a surprising election result in France lead to direct oil price moves? No. Not even the likely shelving of green energy expenditure, which has a connotative bullish outcome for oil prices, will be a reason for a troubling of the highs of this year. However, a regressive investing attitude and likely hunting of safer havens can only lead to abandonment of riskier instruments and possibly flight to an already prowling US Dollar. Populist outcomes in India and Mexico or as in France, a probable populist inspired governmental stalemate, will continue to serve market confidence illy. How on earth the drama unfolds and what it means in the US might find better pricing on the tables of Las Vegas. Maybe this week’s presidential debate will give us some clues, or not. This world campaigning period, which includes the UK, is a massive suppressant to markets. The actual election results markets can deal with, the uncertainty beforehand they hate.

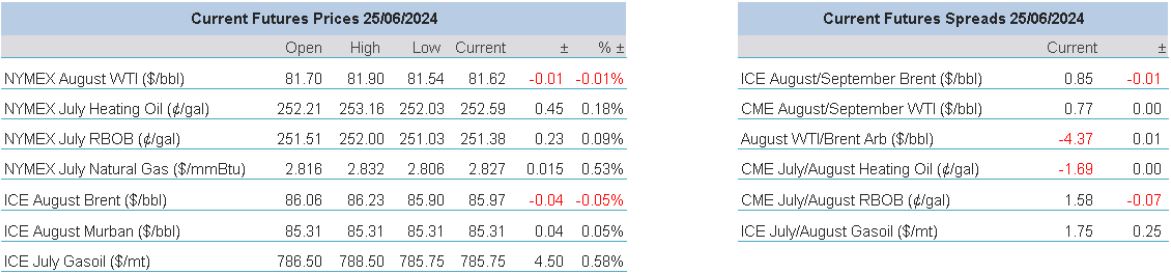

Overnight Pricing

© 2024 PVM Oil Associates Ltd

25 Jun 2024