Oil Pushed and Pulled, but Overshadowed by Wider Macro Concerns

A rather muted opening greets oil prices after Middle East tension is back on the menu due to a reported Hezbollah attack from Lebanon that killed children playing on a football pitch in Israeli-occupied Golan Heights. Our market, in some ways sadly, is becoming immune to such atrocities and what might befall the region in notional conflagration, even with increased aggressive language from the likes of Turkey threatening to intervene with supplies of weapons and support for Palestinians. Such rhetoric is matched by Israel with among other comments suggesting the moment of all-out war with its northern neighbour cannot be ruled out. What one might think as at least vaguely bullish should be pushed on alternatively by a recovery in world bourses, but the oil futures complex finished in such a sullen state last week that momentum to the upside will be hard won at present.

In numbers, M1 futures finished last week in the following manner. WTI -$2.97/barrel (-3.71%), Brent -$1.50/barrel (-1.82%), Heating Oil +0.06c/gallon (+0.02%), RBOB +1.01c/gallon (+0.41%) and Gasoil -$18.25/tonne (-2.42%). Confidence was severely dented by risk off in the wider suite but the state of China's industry worried prices lower and even a another draw down in US Crude oil stocks was not enough to temper the bout of current anxiety in oil prices. For this morning's fresh considerations, news again serves up equalizers. According to Reuters, in Nigeria Dangote refinery is re-offering crude barrels to the market as it undergoes technical issues and elsewhere Ukraine have claimed success in hitting a Russian oil depot in the Kursk region.

Oil will be watching how Brent's front contract will expire this week and if decent showing from a backwardated finish is enough to inspire a flat price renaissance. However, it will be to the wider macro-suite that most of the main drivers will emanate. Oddly, the market will cheer on the ability of the BoJ to raise rates indicating resilience to an economic recovery and hopefully more success in weaning the economy from the bloated stimulus it has gorged on for years. On the flip side, and probably more important, will be the rate decision that comes from the US FOMC on Wednesday which is touched on below. Playing wingman will be the UK BoE decision on Thursday and although the UK is expecting a pickup in the economy, there is likely to be a cautious approach as seen in most decisions before. Oil participants might just have to watch this week's race from behind the relay having passed over no baton of influence at all.

Maybe not in the Olympics, but we should all cheer the USA

It would appear that from whatever corner one might attack the investment suites, none have been immune to the influence be it good or bad, of the Forsyte Saga-like volumes surrounding the plight of US interest rates. One might even argue, with fair cause, that the rolling, continued besottedness seen in AI driven technology stocks has been always kept alive by the notion of a US Federal Reserve on the cusp of a cut. Intriguing then for the last few months, most commentators, analysts and importantly the CME FedWatch pricing tool have congregated around the prediction of only two cuts to come in in 2024. With both being called to be totally not much greater than 25-basis points each, the highfalutin calls of cuts of 150-basis points seen at the beginning of the year are but a twinkle in the eye. There have been so many instances of data in the American economy coming in too hot for the FED to draw down rates that they are too many too list. Last week’s data showed GDP grew an annualised 2.8% against a consensus call of 2% and the Core PCE price index came in at 2.6% which is 0.1% higher than the year-on-year forecast. Often in recent times these two readings would have interest rate positioning scuttling risk appetite but have fallen at a sensitive juncture in the US economy and interest rate pricing has stayed relatively unchanged.

Such ambivalence is partly brought about by how the market has started to reprice itself. Did the data of Thursday and Friday aid the sell-off seen started by lower-than-expected standings from Tesla and Alphabet? Absolutely. Yet there has been preceding caution developing as depicted by descriptions of technical rotation from mega-caps into small-caps within bourses. Fancy language for how the market is questioning whether the likes of Nvidia, Apple, Google and their like can continue to outstrip the other constituents that make up stock market indices. By the close of play on Friday, some of the confidence had re-appeared and bourses rallied hard, but recent movements and an increasing awareness of too many eggs in one basket will be a doubt to cause continued discomfiture. Markets, when left alone, generally price themselves back to value technically and this just might be part of the phenomena, rather than a prelude to a crash.

However, markets might just be pondering fundamentals in other markers that must change the FED’s myopic stance on interest rates being the only fight worth winning. In recent months, there has been something of levelling in the labour market. Job openings have reduced and although still at a something like a 50-year low, the unemployment rate has pipped up to 4.1%. Unemployment is notorious for holding trends and quoting a WTW Consulting survey, the WSJ reveals vacancies have fallen from a record two per unemployed worker in early 2022 to a more normal 1.2 now. Annual wage growth has fallen from 5.9% in March 2022, to 3.9% in June, and is set to fall further next year. Indeed, in the recent S&P Global Flash US Manufacturing PMI output was seen falling into contraction at 49.5 for the first time in six-months. Business activity has nudged ahead slightly, but S&P’s overview said positive news was further marred by employment growing at a slower rate, and business confidence in the outlook falling for a second month. Falls in new orders, production and inventories contributed to the decline in the PMI.

We plan to touch on the PMIs, economic battles and interest rate decisions of the other global centres of commerce later in the week, but none are more important than that of good old Uncle Sam. Its economy has been a panacea for all the financial ill that the rest of the world has thrown up post-COVID, post-Ukraine. Rightly, every nuance of data sets, every market movement in correlation is pored over and every word of language deployed by a FED member will be given such analytical endeavour only surpassed by code breakers. The world needs a United States to continue in economic growth, a falter would be serious for all. Even if the FOMC decision on Wednesday is that of an unchanged one, what will be signposted going forward into September is now becoming make or break. Another delay will come with consequences, none that are good. Economists surveyed by The Wall Street Journal on average put the probability of recession in the coming year at 28%, not high, but higher than normal. “If that risk becomes reality, even a few months’ delay will have mattered”, it went on to opine. Let us hope Jerome Powell’s merry (ahem) band of brothers are watching and listening.

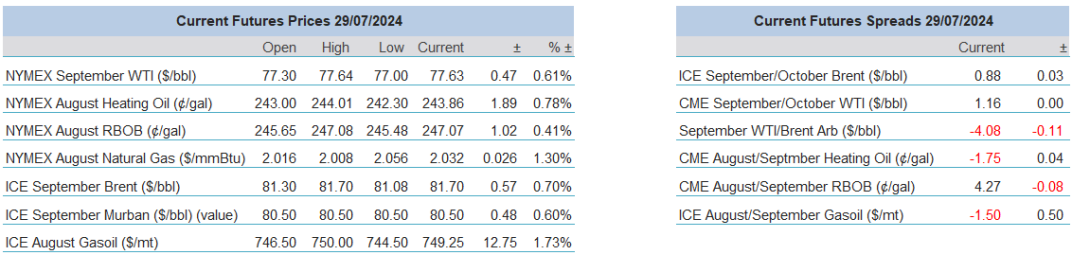

Overnight Pricing

© 2024 PVM Oil Associates Ltd

29 Jul 2024