Oil Regains Conflict Fear Premium

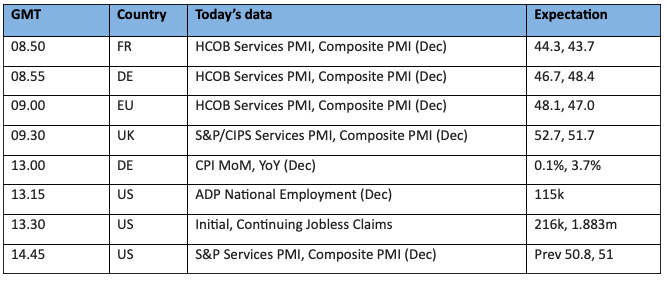

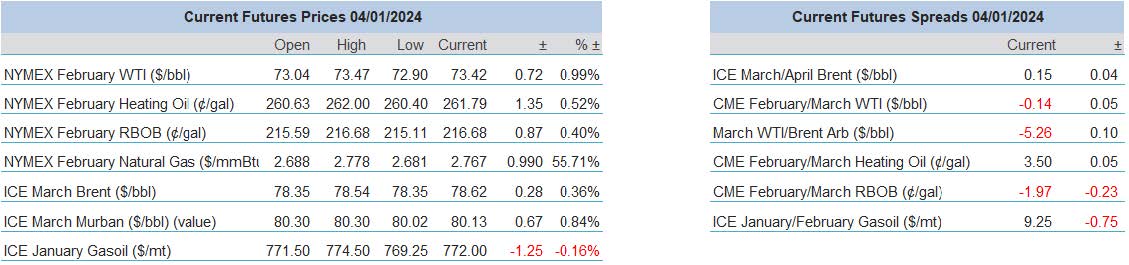

Outside pressures have been the bane of oil price trading in contemporary times, and having fallen foul of moves in the big brother markets recently, oil regained composure with some micro-drivers of its own. Whatever Red Sea risk premium that had been priced into oil seemed to be in dissipation, until that is Israel's killing of a Hamas commander and the awful bombing in Iran being bound into a package and delivered as conspiracy throughout the Iranian proxy allies, fanning the flames of a fear in conflict spread. Libya, an annual shoo-in for force majeure, obliged the cynicism as protestors entered the Sharara Field area and proceeded to halt the estimated 270kbpd it contributes to Libya's national 1.2mbpd production. Despite extraordinary builds in API data for products, Gasoline +6.9mb and Distillate +6.7mb, it is likely that oil watchers will concentrate on the 7.4mb draw in Crude inventory because of Libya and the rekindled war premium. Another boon for this current leg up comes in the form of the Chinese Caixin Services (52.9) and Composite (52.6) PMIs coming in higher than the previous readings and establishing numbers of expansion. We await many more global PMI readings today and whether or not the APIs match up to the EIA data, but much of the next market moves will be driven by data from the US.

There is something of a cooling in the United States as the ISM Manufacturing PMI came in at 47.4, and although higher than the predicted 47.1, activity is someway short of expansion. Added to this was a reduction in JOLTs job openings at 8.79m versus an 8.85 call which is the first of the instalments of employment data continuing today with ADP employment and jobless claims and the very much eyed Non-Farm Payrolls tomorrow. The job sector is such a catalyst for forward thinking from fast money investors who have suffered a blow to confidence at the start of the year due to a taming in expectation of lower interest rates. This counter to recent thought culture was made all the more real as the minutes for the FOMC meeting in December were released in which FED members in the main saw current policy peaking but want rates to remain high for some time, and although there was no specific mention of what might happen in March, the month in which the first cut had been primed by dovish bets, the intentional obfuscation allows doubt for a cut delivery.

The New Year will not stop macro considerations

There is a collective guilty verdict on those of us who might think that this is the year that we will get to concentrate on being pursued by fundamental oil drivers and geopolitical events that will actually be of relevance to the flows of global oil. That verdict came down in a large hammer over the last couple of days as the premium that was garnered from Yemeni Houthi’s firing missiles and drones at anything that came in their crosshairs, and Iran’s dispatching of a warship to the Red Sea was made moot in one fell swoop by the connivings of the wider suite.

As mentioned previously and covered extensively on wires across the media, speculators have been so far ahead of themselves in some sort of monetary easing bias that markets, before the New Year, had priced in 150-basis points cut by the FED in 2024 despite its (FOMC) own ‘dot plot’ alluding to a 75-point reduction. The ensuing rally during the fourth quarter in bourses is self-explanatory given that easier interest rates allow for not only greater investment, but the freeing up of monies that might have been sectored for interest rate payments instead. However, fickleness stalks not just the corridors of oil pricing but also in the grand penthouses of the wider suite tools, and expectant investors intent on picking up in 2024 where they left off in 2023, found a conspiracy of events that had the twitchier of them scrambling for an exit, particularly those of a dollar-sensitive nature.

Those that follow technical analysis will be interested to know how the US Dollar Index (DXY), travelling from ~107.00 at the end of September to ~100.00 at the end of December, and using the 14-day relative strength index, shows the greenback going from overbought (70) to oversold (30), the importance of which being that a state of ‘oversold’ has only existed 5-times in the last 2-years. Not all can be blamed on a technical bounce, happenstance played its part as pricing for Dec24 100-basis points cut on the CME FedWatch tool fell by 10% showing an uncertainty in lower interest rate calls that has not been seen for a while. US Dollar bears take note, but a bearish tendency is entirely understandable given that the state of the US peers’ economies and their likely inability to match the rate of US monetary easing be it 75, 100 or 150-basis points.

The largest contributors to the decent stock market performance of 2023, especially Q4, lies squarely at the door of technology companies. No matter one’s view on A.I., the pursuit of it and the ever-increasing productivity it has shown in trials has been a boon for Microsoft, Apple, Google et cetera to name but a few. However, tech companies are debt reliant, even more so are smaller capitalised chip and part makers, therefore any turn of events in interest rates, the US Dollar, or even analyst recommendations will have an outsized ripple effect. At the close of business on Tuesday, Apple shares had hit a 7-week low after the investment arm of Barclays Bank, concerned with demand for the world’s most valuable company’s devices, downgraded its outlook for Apple, being tantamount to a ‘sell’ which then spooked a market already being harried by interest rate doubt and a resurgent dollar, the oil market did not dismiss the Red Sea premium, it just became collateral damage.

At the beginning of each New Year, there is an assumption that new flows, and by flows we mean money, will enter markets be it through fund allocations and reweighting, or even debt as bond markets will see new issuances. Whether or not these are magnified by an easing of credit conditions only posterity will tell, but greater exposure means greater influence and for those that thought oil might escape the proclivity of the wider suite to run roughshod over commodity-centric thinking should be very quickly disabused of the notion judging by the first full day of the trading year.

Overnight Pricing

© 2023 PVM Oil Associates Ltd

04 Jan 2024