Oil remains steady, China frustrates and will a wind blow

It appears that markets’ fixation with all that is China this week is not about to go away any time soon. Despite China officials yesterday going on a charm campaign, the 1-year Loan Prime Rate (LPR) was left unchanged this morning in line with this week’s Medium-Lending Facility (MLF). This is hardly the stuff of stimulus that the charm had intimated at and not what investors are looking for. There has been a tweaking of cross-border financing designed to free investment capital and this morning Chinese authorities announce that they will be addressing restrictive mortgage practices aimed at large cities. Whether or not this will be enough to bolster the downtrodden property market remains to be seen, but market reaction for the moment suggests that talk and tweaking are not enough.

Staying with China and an interesting foil to such economic woe is the state of crude imports. Oil from Russia, according to a Reuters survey, hit an all-time high in June and totalled 2.56-million bpd. This probably comes as no surprise bearing in mind how discounted Russian crude has been, but the survey shows much increased imports from elsewhere, leading to an idea that as Russian crude nudges along the $60 sanction price cap, China is looking at alternative delivery. The month-on-month increases are Russia +21.6%, Saudi Arabia +12.6%, Malaysia +132.8%, followed in volume by Iraq, UAE, Brazil, Oman and the US. Despite recent trade tension the increase from the United States is an eye-popping 96.9%. Debatable, but two take away notions arise from this data; China is happy to continue in feeding a thirsty refinery sector and that US Crude is available at market wherever in the world it is needed.

Yesterday’s US EIA oil stock report proved something of a disappointment for those that were looking for inspiration. Although inventories at Cushing reduced by 2.9 million barrels, the most for 2-years, overall crude stocks only drew by 708,000 barrels, way below the expected 2.5 million and with crude production unchanged at 12.3 million barrels, those with an idea of a tightening crude situation in the US will have to wait a little longer. Gasoline showed a seasonal draw, with an increased 99,000 barrels in demand, but that was the highlight.

|

GMT +1 |

Country |

Today’s data |

Expectation |

|

13.30 |

USA |

Initial Jobless Claims |

242K |

|

|

Continuing Jobless Claims |

1.729M |

|

|

15.00 |

EUR |

EU Consumer Confidence Flash |

-16 |

Keep an eye on the weather

In recent weeks, the World Meteorological Organisation warned that El Nino, the Pacific Ocean based weather pattern has returned. Named for a Peruvian fisherman in the 17th century, El Nino is ordinarily declared when equatorial waters of the Pacific Ocean rise by over 0.5 Degrees Celsius for at least 3-months. According to the National Ocean Service, episodes of El Nino typically last 9 to 12-months, but can sometimes last for years. El Nino events occur every two to seven years, on average, but they do not occur on a regular schedule.

What triggers El Nino, is not yet fully comprehended but monitoring allows for partial understanding. As Pacific trade winds blow East to West, warmer waters move toward Australia and Asia allowing cooler water or ‘upwelling’ to rise from the deep keeping the ocean cooled. During El Nino, trade winds disappear and sometimes reverse, resulting in higher sea temperatures that pool and start to move toward the Americas and thus changing recognised weather patterns. The size of the Pacific Ocean dictates that affected areas are global. El Nino interferes with circulation within the atmosphere as oscillation occurs leading to alteration of the jet streams. Normally dry regions of the Americas can be swamped with torrential rains; during the 1997 winter, huge landslides were seen in both California and Peru with drought across Australia and many areas of South-East Asia. Typically in El Nino seasons, Indian monsoon precipitation decreases, Eastern Africa becomes wetter, Southern Africa drier and winters in Northern Europe colder. According to the WMO during decade-long cycles the warmest years are those that experience El Nino episodes. 2016 was the record hottest year during an El Nino period.

Commodity markets around the world are bracing themselves for a period of uncertainty in pricing as the weather is set to disrupt not only direct production but how goods make their way to market. It could be argued that drought had already set in, nevertheless some already blame the low levels of the Panama Canal on El Nino. The vital Atlantic/Pacific conduit’s traffic is very much under threat. The Panama Canal Authority is forecasting a July 31 water level of 78.2 feet (23.86 meters), beating the previous all-time low of 78.3 feet reached in May 2016 and far below the five-year average of 84.9 feet for July. The draft limit for the larger vessels is now 44 feet, down from the normal 50 feet, if water levels hit 78.2 feet as the canal authority predicts, the maximum draft will decline to 43 feet, reducing cargo capacity.

Taking the example of the Panama Canal around the world, it is easy to see how commodity prices including oil will be sharply affected by low levels in navigable waterways. We have the recent example of the Rhine levels and how Gasoil and Heating Oil prices climbed dramatically while out of so-called season. Failed crops and freight issues might just lead to another bout of inflation, whether from sparsity of commodity or from ‘bottleneck inflation’ which seems to have only just disappeared after COVID-19 and the Ukraine invasion. It is probably fair to assume that agricultural and soft commodities will initially bear the brunt of any upward pressure, but foodstuffs and oil do enjoy correlation albeit not always for the same reasons. Apart from the Brent high of 2008, the S&P Agriculture and Livestock Index and Brent price comparison charts sees them never tracking very far apart.

Oil watchers will ponder on agriculturals and softs and whether soaring prices elevate oil in kind or will a restrictive bout of inflation and shipping issues decrease foodstuff demand and depress the global economy. For oil itself, demand should come for distillate if colder winters are felt. Then there is the notion of lower water levels that rely heavily on hydro-electricity generation and whether winds will be too strong or disappear for turbines which if both occur will rekindle the idea of ‘fuel switching’. The hurricane season in the US Gulf is likely to see greater activity; crude pipelines may come under threat from wildfires during drought as recently seen in Alberta, Canada. Elsewhere possible flood damage might impinge on infrastructure. But these examples would add to inflationary pressures that larger economies have fought so hard to defeat. El Nino brings another layer of intrigue to an already enthralling market and will make weather forecasters of us all before it blows its last.

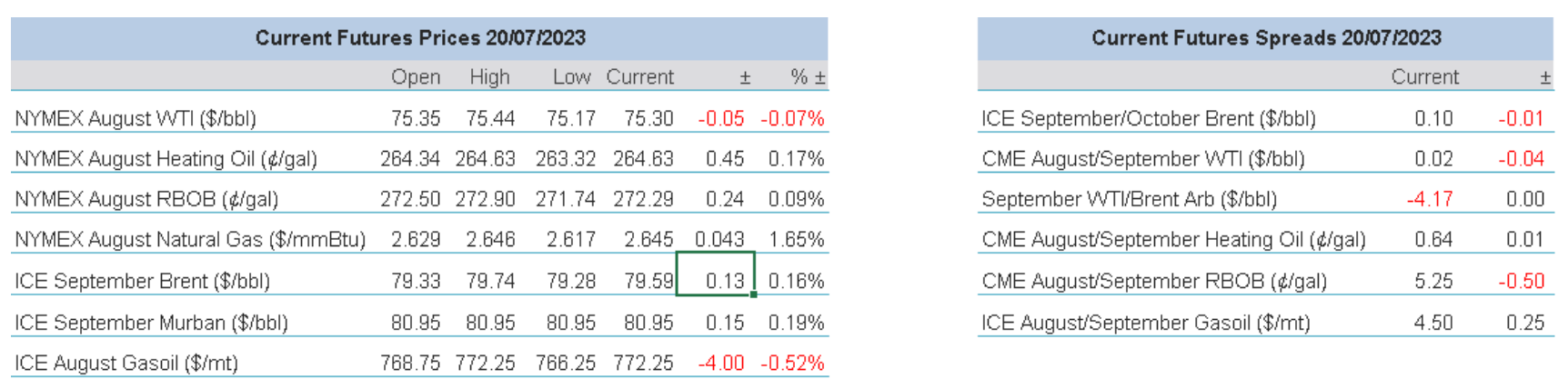

Overnight Pricing

20 Jul 2023