Oil Surrounded and Quiet

Yesterday turned into something of a non-event for oil prices as commodities and the wider suite hunker down in the face of data and politics at the week's end. What added to the mix of reasons to be careful were the rather insipid data from the US EIA Inventory Report. Looking for draws in the important summer Gasoline market and with it a reflected show of WTI use, the actual readings were nothing short of disappointing for bulls that look for a continued tightening brought about by seasonal demand. Gasoline stocks rose 2.7 million barrels on the week against a call of a 1 million draw. It does not necessarily follow that such a build directly affects Crude stocks, but in this case, refinery runs were adapted lower by 233kbpd and utilization 1.3% lower at 92.2%. This then was a major contributor to why Crude inventory built by 3.6 million barrels and confounded bulls by being so much worse that the expected 2.9-million-barrel draw.

If it were not for the steady and incremental ratcheting up of geopolitical risk in the Middle East, oil prices might have found themselves on the back end of a much more negative day. Israel's continued action in Gaza and now developing engagement with Hezbollah in the North is causing disquiet yet again and that discomfiture appears to be spreading. Turkey have entered the diplomatic talking space by condemning Israel's plans to expand the war. Calling Benjamin Netanyahu "mentally ill", Turkish President Recep Tayyip Erdogan did not hold back in not only accusing Israel's behaviour, but also worryingly drew in its allies. “Israel, which devastated Gaza, is now setting its sights on Lebanon, as we see,” Erdogan said in a televised address to his fellow party members in the Turkish Parliament. “We see that while Western powers speak differently on camera, behind the scenes they are patting Israel on the back and even supporting it", as reported by Al-Monitor. Such language can only mean that after years of normalisation between Turkey and Israel, once again the old lines of embedded enmity may just be being redrawn.

Such developments and alignments between Houthis and Iran backed organisations in Iraq bring back notions of conflict spread. Israel's actions are finding a common cause for disgruntled factions to unite behind and easy prey for politicians to act tough from lecterns. The question for oil participants is the longevity of this blip higher in international intrigue. Faced with an unpredictable US Presidential debate this evening, US PCE inflation tomorrow and elections in Iran and France, inciteful language and sporadic missile attacks are likely to add to the market's progress conundrum rather than give a clear path.

France is indeed worth another look

The geopolitical situation is in a fascinating place at present and it is not all about wars and conflicts. As we touched on earlier in the week, there could very well be a stifling of investor vigour as France goes to the polls this weekend and what the fallout for markets should be as of much note, if not more, than instances of missile attacks in and around the Red Sea. Could much of the unwillingness be due to the end of the second quarter and first half of this year? Undoubtedly. However, when such ‘repositioning’ or repricing normally occurs it is not done so in a climate of political intrigue. The point being is that if one were to hold heavy European exposure which was due to either expire or rolled forward by the close of business on Friday, surely the very real prospect of an upset to the incumbent in the Elysee Palace would mean an exit stage left for many Europhile investors.

Some of the plate-spinning policies from both the right and the left of Monsieur Macron’s competitors are frankly scaring bond markets and the belief in a unified Europe and its common currency. One only has to harken back to the 49 days in office of the former Prime Minister of the UK, Liz Truss and her infamous and disastrous ‘mini budget’. Who knows if it was brave and innovative, but failure to disclose how $45 billion in tax cuts and energy subsidies were to be paid for, and an ignorance of debt saw the government almost pitted against the independent Bank of England which had to ride to the rescue of a collapsing Sterling and bond markets. The damage inflicted on confidence in the UK’s economy was arguably worse and some might say the aftereffects can be felt even today.

The echo of unfunded promises rings true in the current French political farrago. As was seen in the UK, Marine Le Pen’s National Rally party have pledged to bring VAT down on energy from 20% to 5% among others without adequate information on funding. Some argue that the policies of the left-wing alliance, New Popular Front (NFP), might be even worse with blowout pay rises for civil servants, a retirement age cut from 64 to 60 all paid for by a hike in taxes on corporations and individual wealth. Whatever political leanings one might hold, agreement can be found in the negative affects either departure from fiscal prudence will, and is already producing. The fallout from the UK’s financial meltdown was contained because of its independence. France’s possible fallout will not be so singular being both integrated and an integral part of Europe’s financial system.

Pricing to French risk can be found in French/German 10-year government bonds. There is now a 72-basis point premium or 0.72% yield if one prefers, up 23-basis points inside of one month. The differential to the German bond means France is now higher than Belgium, on a par with Portugal with only Italy higher. Within the rules of the EU, the Excessive Deficit Procedure obliges Member States to avoid excessive deficits in their national budgets. As France has fallen foul of the procedure the ECB cannot bring to bear its Transmission Protection Instrument to protects France’s sovereign credit risk. Doldrums have pestered the French economy for some while now which is reflected in recent PMI readings. Manufacturing, Services and Composite are all under 50 and are deemed in contraction while growth over the last decade has been slovenly. Little wonder then a downgrade in ratings has had to be endured.

The common currency has not escaped the worry around this election either. Admittedly, the first one cent loss from 1.09 versus the US Dollar came from the European election results, but the rest of the journey down to 1.07 is all about fear surrounding historical Gaul. If either of the fiscally expansionist opposition gains power, then there is about to be shiver sent through the Union that will probably be more of a financial threat to it than Brexit. Even with, as many are starting to think, a stalemate, France is about to be hamstrung in so many ways which can have little other than a viral negativity across the continent. This is unlikely to be an end to the great European project or its shared moola, and the ECB will probably come up with a plan to bailout France. But what the world awaits is how much it will all cost, how European citizens will pay for it and how many backward steps will confidence take?

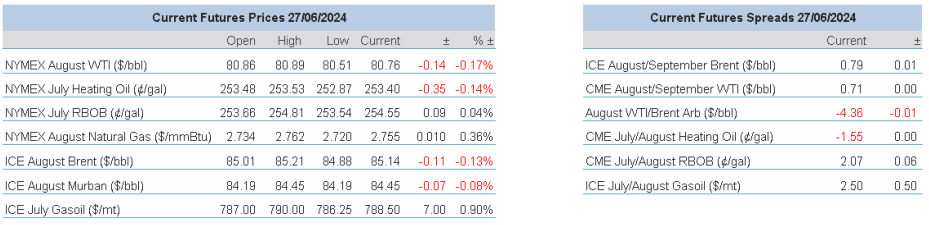

Overnight Pricing

© 2024 PVM Oil Associates Ltd

27 Jun 2024