Oil Unwinding from Middle East, Equities Winding up to Wyoming

Yesterday's turbulent price moves in the oil complex point to not only a thinned trading populace but one that is seeing faith drain from those that have remained loyal to the bullish cause. Crude futures have now lost around 5% of value in 3-trading sessions. Overnight, and adding more insult to injury was the API inventory data. After 7 weeks of draws in Crude, last week's being countered by the EIA build, an increase of 0.3mb was reported against an expectation of a 2.7mb draw. Even with Distillate and Gasoline reducing stock by 2.2 and 1mb respectively, the Crude number outweighs in significance because the strength in the US Crude market has been without doubt the main prop to bullish thinking and how such a lofty backwardation has endured, up until now.

Oil is also in the process of shaking off conflict premium due to some limited success by the United States in bringing Israel to the Gaza ceasefire table. Yet the bridging deal is still seen as one-sided by Hamas and while Israel reserves the right to attack after hostages are released, it is very premature to think that the conflict is in the first steps to resolution. If then a rumoured prerequisite of Iran not attacking Israel is a Gaza ceasefire, then oil participants guilty of over-egging prices higher on Middle East premium, are now starting to be guilty of dismissing escalation unduly.

China continues to curse oil prices, and the daily musing of the many and varied media tell of an economy that just cannot get going. In the latest bout of offering a plaster to staunch a severed artery, the government is set to allow local authorities to buy up unsold properties in a bid to place a floor under house prices. Hardly a representation of demand and one that commodity watchers will be wary of until such time that a true release on government purse strings is witnessed. Another blow for China sentiment is the news overnight of the US's mighty shopkeeper Walmart Inc. selling its stake in the e-commerce JD.com after eight years. A mixture of declining returns and a wish to concentrate on its own branding in China is blamed, but whatever is true, the sale has prompted a scurry away from tech stocks and why the Hang Seng and onshore bourses traded very much lower this morning before recovering.

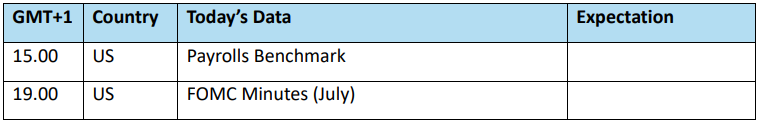

As for the wider equity and bond world, much is still on hold and awaiting the Jackson Hole Symposium. The biggest victim of notions of 'soft landing' and FED interest rate cuts is the US Dollar. This is represented by the Dollar Index (DXY) that at the start of the month was trading 104.42 but today stands at 101.47. Reverting back to an oil gaze this move should have been an aid to price as seen in how Gold is making historic highs, but such is the mood of the black stuff. One ought to keep an eye on the US Payrolls Benchmark at 15.00GMT. The Bureau of Labor Statistics releases its data today with some analysts predicting a downward revision of half-a-million jobs for the 12 months leading up to March 2024. Such a reading would bring even greater urgency in calls for the FED to start easing policy in a more aggressive manner. This evening will see the FOMC minutes published, but it is doubtful that a retrospective gaze back to what was a dull FED meeting will be relevant bearing in mind the news and market moves experienced since then.

Nothing is more important than convenience

The hitherto recent energy relationship between China and Russia in which both get to thumb their noses at the US and the West, is not always one that operates in fraternal happiness. Being able to score points against a western alliance is not something that is openly sought but is a welcome side effect on the current monetary partnership that the two nations benefit from. President Putin was at pains to herald the ‘iron-clad partnership’ after this year’s visit to China, but in truth the relationship is still something of a marriage of convenience, despite the protestations of the Russian leader when waxing lyrical on the ‘no limits partnership’. The Association of Southeast Asian Nations (ASEAN) has China as its greatest trading partner, and the US, Japan, Australia and India also have China way up on its list of theirs. Therefore, context is an issue, from China’s point of view Russia is an opportunity to acquire cheap energy, and from Russia’s, income from China is the fallback monetary generator after losing Europe as its biggest customer.

Admittedly, China’s attitude to Russian oil and energy in this current state of sanction has emboldened other countries to pursue what might have been difficult trade paths against a US diplomatic frown, such as South Africa, India and Turkey. However, the US has been somewhat duplicitous along with Europe as there can be little doubt the sanctions are enforced when it does not impinge on either the supply security of Europeans or the price of oil as the US battles inflation and an oil-sensitive populace during the election year. Yet the West is probably more united than it has been for quite some time in condemnation of Russia’s war on Ukraine. It is also showing unity in opposition to China’s burgeoning trade gap, everywhere. Therefore, the 4000km of border shared by Russia/China is not the only thing they have in common.

Other relational partnerships bring anxiety to China. Russia has found easy listening from Vietnam and India, countries that are wary of China. Vietnam boasts close economic ties with China, but tensions continue to ramp up over disputed territory of the archipelagos of both the Spratly and Paracel Islands in the South China Sea. The previously fought over Sino-Indian border areas of Aksai Chin, Arunachal Pradesh and the general Himalayan region look never to be resolved and China also fears the rise of India’s economic power. Any improving Russian status with either country will be viewed as competitive rather than tripartite. For Russia’s part, the rise and rise of China’s economy and influence brings fear of encroachment in strategic interests. Russia’s international fall from grace and the idea of being a weaker partner is an anathema as President Putin longs to bring Russia back to the great power days of the Soviet Union.

The current threat to cordiality between the neighbours centres around the ‘The Power of Siberia 2’ natural gas pipeline connection that is to be built across Mongolia. On Friday, as reported in the South China Morning Post, Mongolia omitted the pipeline from its plan of action that stretches through to 2028. Speculatively, the land locked Asian nation might fear secondary sanction action from the West. But other drivers are influencing the decision, so the SCMP goes on to ponder. The gas communication is overseen by China’s CNPC and Russia’s Gazprom and there appears to be a difference in pricing expectation. With international relationships in mind, Beijing will fear any influence that Moscow might bring into Mongolia with the pipeline allowing a trojan horse of further diplomatic relationship and influence. Russia needs an outlet for its gas, China the security of energy supply and Mongolia, the investment. If the status quo of world alignment remains and the Moscow/Beijing affair does in fact turn into the ‘no limits’ relationship, the pipeline will no doubt be built, but not before time is served in the gaining of trust.

Such are the minutiae of international relationships, their history and parochial sensitivities, to list them all would read into next week considering the wonders that are China and Russia and how they have rubbed along for millennia. ‘Necessity is the mother of invention’, so the proverb goes. Therefore, this current alignment will continue only in economic convenience that at present outweighs geographic and strategic concern, just.

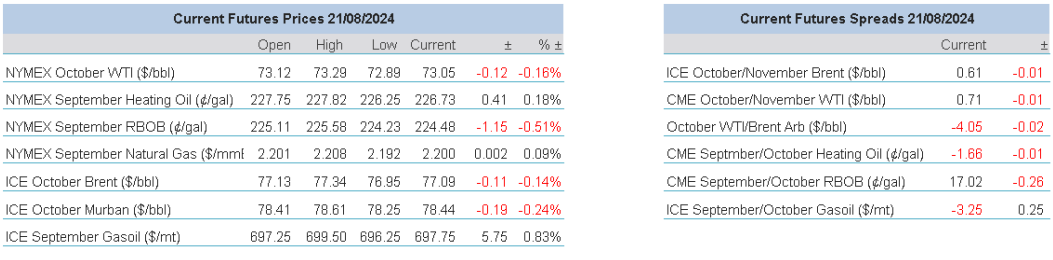

Overnight Pricing

21 Aug 2024