One Last Piece of Macro-data

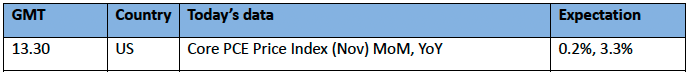

There is one last piece of market data to consider today before we all get about our rituals of eating food that will take a million steps per day to walk off, let alone ten thousand, and pretending to really like the nylon socks with sheep on that your elderly aunt has gifted you. The US Core Personal Consumption Expenditure Index (PCE) is the favoured measure of inflation for the US Federal Reserve, it is due at 13.30GMT and expected to register at the following levels for November, 3.3% year-on-year and 0.2% month-on-month. The wider investment suite is attaching great importance to these readings because the forward pricing of interest rate cuts has gone beyond the 'dot plot' of the FOMC for a possible 75-basis points cut in 2024 and has started to price in 150-basis points. Higher than expected personal prices paid might just see an outsize downward reaction to such pricing particularly in paper-thin liquidity, but a register in accordance with expectation or under, will likely see the stock market 'Santa Rally' hold with US bourses again making ever-new highs.

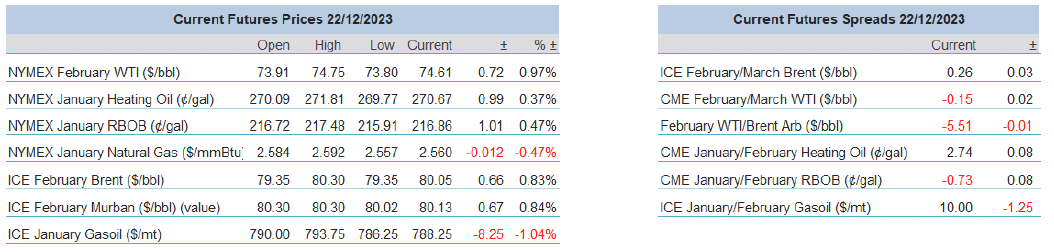

It is interesting to see how oil prices have greeted the news of Angola's retreat from OPEC membership citing the cartel no longer serves the country's needs. This course of action has been rather predictable because of Angola's attitude at the last OPEC meeting, nonetheless it brings into mind percolating divisions that might beset unity going forward, yet the market is no mood to adhere to this bearish news, as was the case yesterday with US inventory builds, and the defensive rally continues. With an early Platt's window and sparsely occupied desks, those that are exposed to oil price moves over the elongated holiday period are likely to be covered from the long side for there does not seem to be any sign that the issues of the Red Sea are abating and geopolitical notions of some sort of hostility spread give diverted or halted cargoes a bullish advantage that outweighs any negative drivers.

Operation Prosperity Guardian is currently lost at sea

The shipping issues facing the world caused by the Houthi drone and missile attacks on freighters in the Red Sea have been something of a slow burner in terms of reaction, the daily attacks have been increasing since late November and has frankly been ignored up until this week. Freight majors Hapag-Lloyd, Maersk and Evergreen to name a few gave warning on pauses in shipping through the Europe/Asia/Africa seaway which were brought more sharply to the fore when the equivalent oil major, BP, announced on Monday it would halt oil cargoes that navigate one of the world’s busiest conduits that lays claim to 12% of global trade including 30% of container traffic, although estimates have that only 8% of oil transportation uses the route.

Still, 8% day in and day out, is not to be sniffed at, especially if this turns out to be a protracted affair. On March 24, 2021, the 200,000-tonne container ship, Ever Given, blocked the Suez Canal when it went aground causing M1 Brent futures to rally nearly $4/barrel on that day alone, nearly $5 in the 6 days it took to refloat the stricken ship and reversed a corrective down move that the Brent price was at the time experiencing. Admittedly, Brent was in an uptrend and a 6-day blockage cannot in all justification be argued as cause of the continued rally, but it does have some similarities to the price action this week because the ensuing price rise after the BP announcement has taken away the vulnerability that dogged would-be buyers’ psyches. Keeping opinion on Brent, the recent up-move has contributors including a technical bounce from the 200-week moving average, expiry driven buying from position limits and of course short-covering, but the shipping diversions have been more than mere fodder for those that have harboured ideas that oil is oversold.

The longevity of impact on prices is completely dependent on the length of time that shipping companies continue to steer clear of the area. What has exaggerated such impact is the lack of clarity on how, where and when the so-called naval coalition will turn up and swat away incoming from Yemen. In defence of this lack of action is that just turning up with big hardware armed to the teeth with anti-missile technology is not as easy as it seems. Rules of engagement must be set, the limit of powers and how much this new task force may interfere with a maritime fraternity that will be very unwelcoming of extra scrutiny. The other trouble pointed out by many observes is the distinct absence of Saudi Arabia among the list of the naval cohort, which of course brings again its own geopolitical speculation that the Kingdom is not in the mood to upset Iran at present for fear of another proxy war spread.

Direct pauses to supply are not the only reason oil prices will be moved by the Red Sea situation, freight rates and insurance costs are increasing and not just because of pseudo-war premiums. Vessels that are diverted, say, Asia to Europe around the Cape of Good Hope will take 12 to 20 days longer, according to Hellenic, meaning longer duration for insurance cover and higher risk. Referring back to the amount only being 8% of the world’s oil flow, at first thought one might think it doesn’t matter, but shipping cost rises rarely stay in parochial waters meaning routes around the globe are likely to see higher numbers. Smaller crude carriers are used to negotiate the Suez and Panama canals, but if both of these shortcuts are unnavigable (the Panama is restricted due to drought), VLCCs and larger vessels become more appealing because of their ability to move greater volume with smaller frequency of journey. Fixing larger carriers will become more expensive because of demand, and although there might still be plenty of oil in the world, it could just be in the wrong places. The influence of what is happening in the Red Sea and wider ramifications is utterly dependent on how long the Houthi attacks go on unanswered, currently the market is in the mood to believe that it will be longer than first thought and that it is prudent to have defensive length.

All that remains for Tamas and I, on behalf of PVM, is to wish you a joyous Christmas and a healthy and prosperous New Year. We shall return on Wednesday, 3rd of January.

Overnight Pricing

© 2023 PVM Oil Associates Ltd

22 Dec 2023