One-Track Thinking

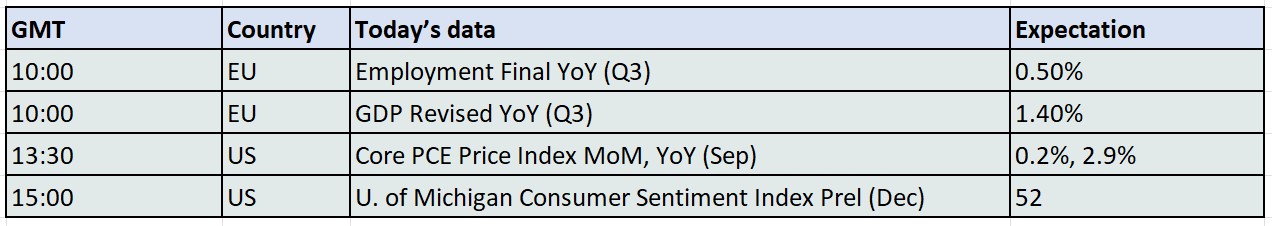

The current pathway to market enlightenment is a narrow road of tracking interest rates. With such shared and crowded focus, foreign exchange, equity and commodity markets start to ball up in a defensive but positive stance. One can never keep a good stock market down in modern climes and even with tepid global manufacturing (as discussed below), buoyant bourses take heart in either good or bad news. The expectation of a Federal Reserve rate cut next week is all but nailed on, according to pricing probability mechanisms. Still the hunger for market-indicating clues is not sated which will be heightened again today when the Fed’s favoured measure of inflation, Personal Consumption Expenditure will be released. What adds to the intrigue is the data provided will be from September due to the recent US government shutdown. Logically, the next data sets ought to be awaited on for a compare and contrast assessment, but since when do markets of late show patience or fiduciary practice? If the year-on-year PCE reading is within tolerance of 2.8 percent and 2.9 percent for the Core measure, validation and buying will ensue no matter that the data is two-months old.

Whatever corner Japan has boxed itself into over interest rates versus a stimulus-wanting government, or this morning’s Indian repo rate cut that will fire its economy onward, or even the European Central Bank’s rate decision on the 18th of December, nothing could be more tier-1 than the outcome of next week’s FOMC decision. The fallout victim is the US Dollar. Its demise over the last week is now starting to register as supportive for commodities and with the Ukraine peace negotiations being no more than people around the table introducing themselves, a breakthrough has no chance of emerging. With these price-holding influences propping oil at present, the success of Ukraine’s drone incursions on Russian oil infrastructure will keep most from seeking a bearish position into the weekend.

Manufacturing PMIs are MIA:

Our fraternity, while not holding its breath because of news fatigue, has not seen fit to be about a bullish slant given the snail’s pace in the Ukraine war negotiations. With Donald Trump’s proclivity in giving Vladimir Putin the benefit of the doubt, any type of stringent enforcement of sanctions does not appear on any sort of card any time soon. A well enough rehearsed argument, particularly on these papers of late. But what is also standing in the way of bulls are continuing reports of decreasing, or at best stagnant, levels of economic activity across the globe, particularly in manufacturing.

China’s National Bureau of Statistics published November’s Manufacturing PMI over the weekend and although there was a betterment of 0.2 pips over October’s six-month low of 49.0, it is still a run of eight-straight readings of contraction. An uncertain global outlook, coupled with the tariff tryst Beijing enjoys with Washington has led to persistent weakness in demand with output then stagnating and employment being sluggish at best. More alarming was the NBS Non-Manufacturing PMI figure of 49.5 for November. There has not been a contraction reading since the ending of the dark days of the disastrous ‘zero-Covid’ policy in December 2022. The poor property market is nothing new but remains a millstone to consumer sentiment and, with it, lower spending. The fiscal support so advertised by the government has been piecemeal and designed to save the GDP target of 5 percent rather than bring relief to an underwhelmed populace, therefore, momentum wanes. Indeed, and to give an overall insight, the private RatingDog China General Composite PMI fell to 51.2 in November from the 51.8 reading in October and reads as the lowest level since July.

Such sluggishness in industrials is seen closer to home. The S&P Hamburg Commercial Bank Eurozone Manufacturing PMI fell from 50.0 in October to 49.6 in November. The HCOB report accompanying the reading told of renewed demand-side weakness with activity now being at a five-month low. As for employment, jobs were lost at the highest rate since April reflecting the state of factories and a decline in both new and export orders. The largest economies of France and Germany saw nine-month low readings of 47.8 and 48.2 respectively. As with so many cases when assessing PMIs, the downtrodden manufacturing sector is often cushioned by the state of Services PMIs. Ordinarily the very negative industrial outlook would attract greater concern, but HCOB Services PMI November final reading of 53.6, revised higher from the 53.1 flash shows keener activity than that of October and its 53.0 measure. Sales and growth improved along with business confidence which show a market contrast from manufacturing from the two main protagonists, France and Germany having 51.4 and 53.1 which is the highest for France in over a year and consists of three-straight months of expansion for Germany. There is a warning coming from future orders as the backlog of current service business shrank and no matter what area of PMIs looked at for the Eurozone, one is never far away from a dose of tariff terror.

The manufacturing malaise is global and continues at pace within the United States. The Institute for Supply Management Manufacturing PMI for the US fell to 48.2 in November 2025. It has not been in expansion above 50.0 for nine-straight months now and is at its lowest ebb since July. Some 58 percent of the sector’s GDP contracted in November with only computing, electronic products and food being the pick of industries showing growth. All else including clothing, wood, pulp, textiles, metal products, furniture with all manner of mineral, fossil fuel and transportation among other areas slumping. Order backlogs and employment fell. Keeping with our earlier observation, the Services PMI in ISM serves to dull the severity of the industrial woes. Even though there was a negative deviation expectation of 52.1 in November from 52.4 from the previous month, expansion eked out a climb to 52.6 and the highest nine-month reading. The backlog of business orders is at the highest since the beginning of the year and suggests future health, however, with jobs still reducing and deliveries being slowed by the US government shutdown it is not all plane sailing. Again, disruption in the continuing changeable tariffs situation and with it, customs and excise hold ups, the complicated state of international trade is still not done with its effects on American businesses.

While delinquent manufacturing from the three largest centres of commerce is not entirely a new phenomenon, its continued pall of concern hangs on any ideas of industrial and manufacturing demand for oil. Global citizens within service sectors might very well drive a few more miles or take a few more flights, or use more power in computing, but without the thirst of heavy industry and manufacturing, a goodly part of oil usage will continue to be missing from our balance puzzle. Russian oil may or may not be freewheeling back onto our trade routes, the question is whether there is enough demand in the globe’s industrialised manufacturing to help absorb it?

Overnight Pricing

05 Dec 2025