Onward, upward but with care

The oil complex had a particularly good week and bulls would have been greatly pleased with the progress made. The front month of all the major contracts; WTI +$3.51/bbl (+4.55%), Brent +$3.92/bbl (+4.84%), Heating Oil +21.29c/gal (+7.75%), RBOB +15.40c/gal (+5.50%) and Gasoil +$79.00/tonne (+9.94%) made great gains allowing an increase in bullish positions (as of July 25), particularly RBOB with total speculative longs at 89,278 lots which is the highest in nearly 2-years. Products led the way and net longs in Heating oil increased to 24,792 and to 55,208 in ICE Gasoil which is a 6-month high. Adding momentum to this increased long exposure were the taking out of some key technical resistances. This was not just the 200-day moving averages but that Brent, Heating Oil and Gas oil are now trading above their 50% retracement numbers of established highs and lows of 2023.

Bulls are unlikely to run out of influences this week as it would appear the current news flows will read well for this rally. There seems little fear that Saudi Arabia will have any change of heart and will go ahead and roll their 1-million barrels per day cut into September. Goldman Sachs, who have never relinquished the most bullish crown, are back today and espousing a tightening market situation. A forthright view has the investment bank estimating that July crude demand will be 102.8 million barrels per day leading to a 1.8 million barrels per day deficit for the second half of the year due in the main to the efforts of OPEC+, which of course means Saudi.

Chronologically, we are deep into the gasoline season and every refiner hiccup, inventory build or draw will have a poring over from the great and the good. Stock levels will become the new currency of oil news to which something JP Morgan attests to by saying inventory will be more important for oil than the influence of the US dollar. There is bull-twitch in the market’s antenna, something which Saudi will most definitely look to aggravate with a roll in their production cut and while the product suite continues to show tightness, oil will again enjoy a beginning of the month firmness that it has done for the last 3 cycles before global economic news comes to keep it in check.

|

GMT +1 |

Country |

Today’s data |

Expectation |

|

10.00 |

Eurozone |

CPI Flash YoY |

5.4% |

|

10.00 |

Eurozone |

GDP QoQ (Q2) Flash |

0.2% |

|

10.00 |

Eurozone |

GDP YoY (Q2) Flash |

0.5% |

European engine stutters

According to Genscape, crude inventories in ARA rose 3.5 million barrels in the week ending 21 July to 60.6 million. This storage total has only been higher in 2016 and 2018 in the last 10-years when reaching just over 65 million barrels.

‘Weak macroeconomic performance and ongoing tensions continue to impact economic and manufacturing activity in (Europe),’ OPEC said in its recent report. This follows year-on-year manufacturing contractions in OECD Europe for five consecutive months, with oil demand now expected to average 13.46 million bpd in 2023 from 13.51 million bpd in 2022. In June the OECD said of Germany, ‘the economy is projected to stagnate in 2023’. GDP growth will be subdued in 2023 as high inflation reduces real incomes and savings and holds back private consumption. In 2002 German oil consumption was 2.7 million barrels per day, in 2012; 2.3 million barrels per day. During the pandemic of 2020; 2.049 and 2021; 2.042, with only a slight recovery to 2.08 million barrels per day for 2022.

On Friday, Germany posted a preliminary GDP quarter-on-quarter Q2 figure at unchanged, coming in slightly lower than the expected +0.1% and now has to answer charges of stagnation. The strength of the German economy has been under scrutiny for quite some time and has now endured nearly a year-long manufacturing swoon. Indeed, the previous Monday saw the publication of the HBOC Manufacturing Purchasing Mangers Index, which was forecast to show sharp contraction at 41 but actually came in even worse at 38.8. With Services PMI retreating to 52, this gave a 48.3 reading for the Composite PMI completing the picture of a derisory state that the Germany economy is currently suffering. According to Hamburg Commercial Bank’s commentary, ‘a lack of incoming new work saw firms make further inroads into their backlogs of work during July’. The pace of employment growth across the German private sector slowed sharply in July. The overall rate of job creation was the jointweakest in almost two-and-a-half years.

Unfortunately, the news does not get any better from an inflation point of view. The European Central Bank, arguably cheered on by the Bundesbank, has let loose a campaign of interest rate rises that while bringing Germany’s inflation rate down from 8.8% in October and November of 2022 to 6.1% in May, June’s reading of 6.38% is causing considerable worry and consternation, not only domestically, but from other Eurozone members. The Euro area inflation rate comparably came from 10.6% Oct22 to 6.1 May23 and fell to 5.5% in June completely in contrast to the belligerent price rises of Germany. The ECB continues to feel the wrath of members whose inflation rates are considerably lower, but ignored (according to recent Portugal grumblings) as the ECB’s hawkish stance really has only one beneficiary. Expanding the comparison shows of the G10 countries (and including China as a plus one), only Italy at 6.4%, the United Kingdom at 7.9% and Sweden at 9.3% fare worse.

The term deals being seen and sought in LNG imports from places such as UAE, this week’s 15-year deal with Qatar and a similar 20-year deal under negotiation with the US should not indicate fuel switch and or extra energy demand. It is Russian gas replacement. Germany’s oil usage is down and likely not to recover while the outlined preceding economic troubles harries the economy. Gasoline consumption was 454,000 barrels per day in 2022, it was 495,000 in 2019. 35 million tonnes of diesel were domestically used in 2022, it was 38 million tonnes in 2019. China is not the only country to continue in struggling for industrial, economic and social growth after the pandemic. There is an ongoing seasonal worldwide charge in gasoline, there will be a similar one in distillate.

However, of the 4 largest economies of the world, the plight of two of them in China and Germany ought to give pause for thought against a straight-line oil unified complex rally based on economic activity. The high feedstock storage as reported by Genscape in ARA is another and while the argument is two-sided in that refiners are just not capable of running enough crude, it still doesn’t mean that reduced distillation during turnarounds provoking further crude builds will not be a suppressant, particularly in a world of unreliable macro-economic drivers such as those currently experienced by the likes of Germany.

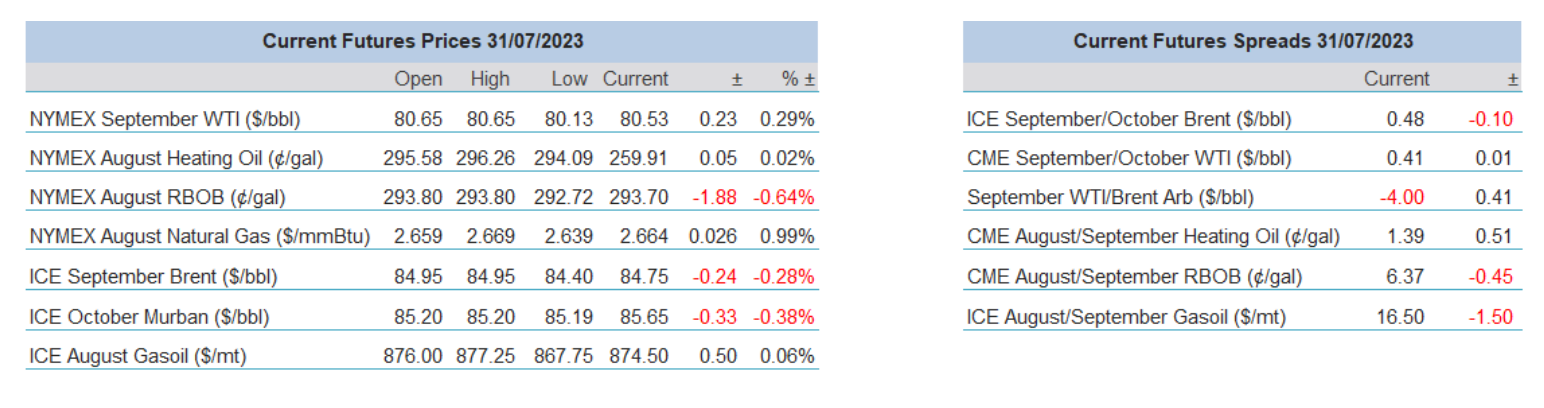

Overnight Pricing

31 Jul 2023