OPEC Just Made it Harder

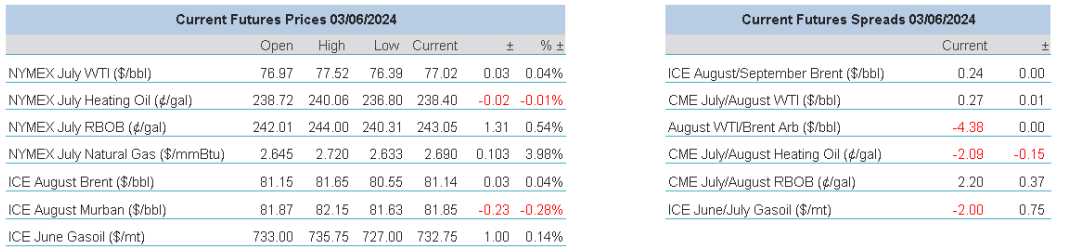

It is rather unsurprising to see how net longs in WTI, even though increased last week, continue to be at lowly levels. Last week’s performance in the oil complex, although not exactly disastrous, did not inspire confidence and there were, and are, too many drivers to keep full-blown commitment to oil length side-lined. The five main futures contracts finished negatively with the following progress; WTI -$0.73/barrel (-0.94%), Brent -$0.50/barrel (-0.61%), Heating Oil -5.00c/gal (-2.07%), RBOB -5.82c/gal (-2.34%) and Gasoil -$7.25/tonne (-0.98%). Bounced around by the ‘what ifs’ of the wider suite and its tussle with interest rate speculation, oil also found a restrictive impending OPEC decision that pervaded all thought.

Yesterday, the answer came from the cartel that has not really given rise to bulls in hurrying up any strategies that might be under contemplation. The face-value announcement of keeping official cuts all the way through 2025 in normal circumstance might have had a hubbub of chattering from our fraternity, but it comes with a worrying caveat. The ‘voluntary’ cuts that are supposed to amount to 2.2 million barrels, initiated in June of last year and have been continually extended, once again find prolonged existence into the third quarter of this year. However, they will then be ‘phased out’ in stages over a 12-month period. What is also concerning is that the UAE has again managed to secure another hike in its production quota by 300kbpd. If one were to cast a cynical and bearish eye over this mish-mash of a meeting, and taking the possible UAE increased production, as of October the market could theoretically see an additional 2.5mbpd of OPEC oil.

Because of the roll into the third quarter of the voluntary cuts, the prospect of a deficit in the normally tight part of the year will keep the market from being too gung-ho in being bearish. Despite the obvious misses by the likes of Russia and Iraq in maintaining discipline, the group has achieved a sort of unity that deserves respect and there cannot be a member that does not realise what will happen to oil prices if such conformity suddenly disappeared. The rest of the week in oil circles will be taken up by digestion of what has been agreed (if that is what one can call it), but from a first look basis, it just appears as if another layer of unease has been added to price prediction.

The continuing case for the Dollar

Eurostat, the statistical office of the European Union, on Friday released its May 2024 inflation flash at 2.6% which has stubbornly increased from the April reading of 2.4%. This is likely to cause some grinding of teeth in the upper echelons of those that wield the power to change interest rates at the European Central Bank. Indeed, the now four-month high in inflation is largely sponsored by the two-largest economies in Germany and France where the individual marks read 2.8% from previous 2.4% and 2.7% from previous 2.4% respectively. Given that the data is not exactly playing ball, can it be supposed that the ECB will delay the rate cut due this Thursday? The 2% inflation target of the world’s central bankers is akin to the famous Lewis Carrol nonsense poem, ‘The Hunting of the Snark’, where a ragtag of humanity (including, and fittingly, a banker) hunt for something that is mythical and might just not exist. The ECB does not appear as fleet of foot as other regions’ controllers of monetary policy and hate deviance from set plans. The other consideration is the loud screaming from many other members that are not enduring similar inflation woes and worries of France and Germany but where the biggest threat lies in continued high and growth-crushing rates. Most commentators then believe that the ECB’s plan to ease for the first time in three years will play out. Markets it would seem agree. Despite sticky prices, a 25-basis point cut from the record 4% high to 3.75% is now being fully priced-in.

Across the proverbial pond, ‘Snark’ hunting is proving to be even more of an elusive exercise. There is now a developing argument among commentators and statisticians that the Federal Reserve will not cut interest rates at all this year. Jerome Powell’s epitaph, may it be for many, many years hence, is likely to read ‘higher for longer’. The Fed, under his guidance is a data-dependent conformist, and while we can all thank the US for being the economy that saved the world from a full-blown capitulation to recession if not depression, it is proving something of a headache to those that endeavour to manage it. As ratified by the recent CPI reading and the Fed-favoured PCE data on Friday, inflation is irrefutably a beast that just will not be tranquilized. Along with high prices, the economy remains steadfastly resilient and the employment market strong which are again markers that often find reference when Powell or any of his cohorts speak on prospective changes to monetary policy. As of COB Friday, easing of interest rates on the FedWatch tool are 54.8% in September and 85% in December which have been the most mentioned for ever-hopefuls and are of course at the end of quarters. Yet all months that have enjoyed such predictions in the year so far have behaved similarly to expiring options and endure time-decay as they approach on the calendar. The political pressure on the Fed must be enormous in front of the Presidential Election, but if the Fed, led by the stickler Jerome Powell behaves true to form, then those that see a year devoid of interest rate relief might just have shown prescience.

It therefore looks very much as if the US Dollar is about to get another leg up on the Euro. On Friday the governor of the Bank of Italy accepted that going forward there will be a currency risk but alluded to the Fed’s current policy being enough to curb global demand and therefore inflation in the Eurozone. It is an interesting take on what will be something of a gamble should, as expected, the ECB announces the start of interest rate easing this week. The US Dollar and the Euro are the largest of all currency traded pairs and are often referred to as ‘the majors’ and the effect of the Euro within the US Dollar Index (DXY) is frankly huge. There are six currencies in the basket of the index and are made up thus: Euro 57.6%, JPY 13.6%, GBP 11.9%, CAD 9.1% and CHF 3.6%. The Bank of England is very much knocking on the door of interest rate cuts, and although nothing as important to currency setting as the Euro, markets can very much concern themselves with prices that will be subject to a swaggering US Dollar. Adding to the greenback’s pomp is the recent poor showing of bond sales. Government debt, a burgeoning trade deficit give rise to more interest in yields than in treasuries. Because the Fed is no longer in the market to add to its book, much of the underwriting for issuances is gone. This all leads to a circular, continuative and prospective course higher for the US Dollar and increasing concern for its deleterious influence on not only risk but on dollar-priced commodities.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

03 Jun 2024