OPEC+ Mouths the Market Higher

OPEC+ members set about a charm offensive yesterday with the big guns of the pact deployed in a show of unison. If tension exists between Saudi Arabia and Russia over the latter’s admitted non-compliance to voluntary cuts, it did not show as Russia’s Alexander Novak commented that the weekend’s decision “is positive for the oil market and helps stabilise it.” Saudi’s Abdulaziz bin Salman spoke on the how the mechanics of the agreement are not new and alluded to flexibility in being able to pause and reverse as the case may be. The growing power of the UAE within the DoC is observed as it made up the triumvirate talking things up. However, the newbie deserves a touch of sarcastic swipe, for markets just love a politician that tells it, “sometimes the market doesn’t understand decisions, it takes time to analyse”. Thank you for your enlightenment Mr. Suhail Al Mazrouei. Levity aside, the talking head intervention showed decent success as it was very well timed with oil prices in the midst of throwing off an oversold status and welcoming some friendly developments in the macroeconomic world.

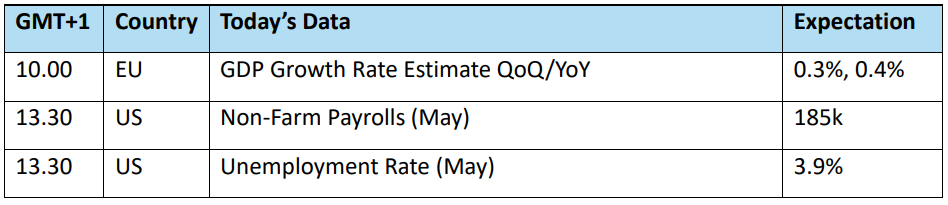

Fresh on the tail of the Bank of Canada’s lead in cutting interest rates by 25-basis points on Wednesday, the European Central Bank duly obliged all expectations and repeated the reduction. The two cuts themselves are relief markers rather than harbingers of the great easing that markets are so looking forward to. Neither will instil any hurry from the Federal Reserve to bring about interest rate change. Indeed, pricing is still centred around 2 cuts for 2024 and both coming at the end of quarters in September and December. However, it was enough cheer to keep hopes alive and when coupled with US Jobless Claims and Challenger Job Cuts that might suggest a contained Non-Farm Payrolls reading today, traditional investment suites had a steady day. There is little reaction so far this morning on China’s trade data. Exports handsomely beat expectation, 7.6% increase versus a 6% call but worryingly for oil, overall imports were again down and well under the 4.2% call at 1.8%. Oil imports oblige the data by falling 8.7% year-on-year from 12.11mbpd to 11.06mbpd. Our day again will be governed by the wider suite and how employment data will fit in with the current interest rate obsession.

Welcome to the shop of oil market influences, where the shelves are full

In the current state of world divergence from globalisation and expected behaviours there are always comparable replications within markets. As yesterday’s report touched on, our market in terms of price prediction is a mess. However, and because it does seem at present that we are adorned with a lack of cohesion in market drivers, there is, as they say, more than one way to skin a cat. Taking a multi-focal attitude can lead to charges of being flighty, but opinions abound within the subset of what makes up the charter of market influence and to dismiss any out of hand is to miss just what might be important; as ephemeral as they may just be. Labelling moves as ‘overreaction’ in some ways is a disservice, particularly if one has been caught on the wrong side of a move and covered a long or a short. Since when does prudence in risk management equal being overreactive? This is in reference to those that believe that the OPEC+ announcement of a possible redemption in the 2.2mbpd voluntary cuts last Sunday has been unduly and harshly dealt with by oil prices. After all, the cuts from April 2023 are still in place until the end of 2025, those members that have exceeded limits will show acts of compensation and there is a new transparency with quota/discipline assessment being determined by third parties. However, the market smells more oil around and prices suitably deflated. Similarly, after the world smelled war when Israel and Iran decided to give us a firework display, would it be an overreaction to not be at least defensively long? Hindsight is a wonderous thing.

This week’s leg lower was not an overreaction to OPEC+, it was just unfortunate happenstance. The US ISM Manufacturing PMI was frankly awful, if one were to use it as a measure for oil demand, and it printed at a time when the market was vulnerable during digestion of a change in the oil cartel’s production management. Demand scenarios can change, and rather quickly. Conflict and war even more so. Yet there has been one consistent nag to those that remain earnestly optimistic for oil prices. Interest rates. Admittedly, and at times of investment tourism excess, wishful thinking and subsequent pricing has seen some bold positive action from oil prices. But as a generalisation rates have been a prophylactic to bullish thinking and have been the anchor for oil, and no matter what geopolitical or fundamental force comes upon it, it remains steadfast in pouring out negativity on price advances, and adding to those that would sink them. Quantifying and or qualifying the $15/barrel fall in Brent over the last six weeks solely to the influence of interest rates is disingenuous, but when was the last time that our fraternity could string a least a few days together without having to consider the complexities of rates, and how ‘higher for longer’ keeps throwing cold custard on bullish notions?

Correlations come and go, but there are some that remain stalwarts in the lexicons of markets. Oil has an outsized effect on inflation and thereby on interest rates. There is never really a good time for high oil prices in the eyes of the central bankers. This conundrum has had a profound effect particularly in the United States where the Federal Reserve has been at pains to contain a free-spending American populace and very sticky inflation. Yet, while taming behavioural traits, higher interest rates have arguable tamed oil prices. ‘Things’ cost more to heat, more to ship and because of finance, more to store. One of the reasons the world is working its oil circles from a low stock level is due to the cost incurred when keeping oil in tank or on ship. Has the Gaza conflict, and the ‘overreactive’ call for triple-digit crude help stay hand of the Fed? We do not have a direct line to Jerome Powell, but it cannot be an unreasonable muse. The ECB’s interest rate cut is something of gamble, but the diminishing influence of the European economy means it will be as a whisper to oil consideration. Not so in the US, where prevarication, if indeed oil is in the mix of motivators, will be made so much keener by the US Dollar’s influence. We were posed the question by an old oil hand the other day, “when did it become a thing, that to trade oil you need to look at the US CPI?” Rates are part of the oil prediction mess and will always be a consideration after the many years of hiding at zero. There really are so many things to ponder in this market. The full quote from American humourist, Seba Smith is quite apposite. ‘There are more ways than one to skin a cat, so are there more ways than one of digging for money’.

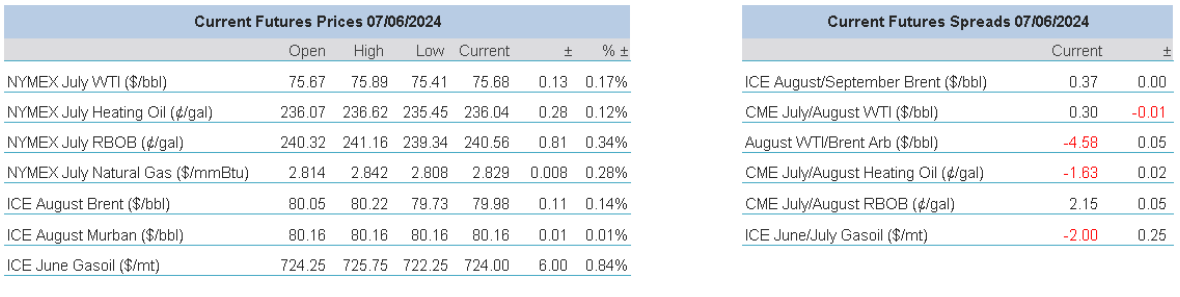

Overnight Pricing

© 2024 PVM Oil Associates Ltd

07 Jun 2024