OPEC+ Test the Waters of Demand

After the onslaught of data and news last week, yesterday’s considerations seemed sedate by comparison. The trading day was not without heft though, particularly for our market. The return of the 547kbpd balance of OPEC’s 2.2mbpd oil production cuts was not unexpected, but it sat heavy in a market where the out-of-season strength in Distillate has diminished and where the Gasoline market is not turning out to be the summer bastion of support. In the EIA inventory report last week, four-week implied demand average registered at under 9mb. It is a general conception within oil circles that a strong Gasoline market must see the EIA metric well over 9mb to give any indication of health. Indeed, according to GasBuddy, the one-month average retail price in the USA is currently $3.16/gallon, the same as the three-month average and the two-year mean. To allow perspective on the relative cheapness, a year ago Americans were paying just over $3.50/gallon.

Oil prices have been swayed by the incessant noise from the White House on how it intends secondary tariffs on those that lift Russian oil exports. This was again repeated yesterday as the US President took India to task over Delhi’s oil relationship with Moscow, something of which we touch on below. However, judging by the price reaction it looks as if oil market participants, including us, are at least dubious on how Donald Trump would risk higher oil prices which would be the inevitable outcome of penalising Russian energy customers. What then flew over oil market consciousness and opened its bomb bay doors onto bulls were reports that OPEC+, at their September meeting, could consider unwinding another 1.65mbpd cuts brought forward from 2026. The veracity of such noise cannot be confirmed, but OPEC+ like all political operatives often leak information to gauge market reaction. Their answer is unfolding.

Thanks for the lesson, India will do what India wants

Deglobalisation is upon us, the length of its endurance and effects are frankly incalculable at present. Free traders of the world will point to historical times and when hunkered behind national borders, the world becomes prone to exaggerated political influence, jingoism and global armed conflict. We may not be in a state of world war, but so much of the criteria is already met, even before the barriers of trade are fully lowered. The goings-on in Ukraine and the Middle East can hardly be described as border skirmishes. Financial stress is never far away, even in the exceptionalism of the United States and given the right amount of agitation, creeping inflation and a declining workspace seems such tension is all but self-perpetuating.

The founding of Make America Great Again is understandable. Lifetime jobs in one-industry towns are a thing of the past and Americans, along with every other population of every other country have been at the mercy of multinationals and their industrial ability to migrate where the cheapest workforce is. Abetted by the tax regimes of nations willing to flout certain geographical trading bloc’s rules, a favourite brand might find itself being constructed either side of the globe within five years. Arguments well-rehearsed and well debated, but the pushback represented by the current US Administration will no doubt find copycats. After all, whatever happens in the US has more than just a chance of emulation elsewhere.

How very different diplomatic ties between India and the US now seem. Long gone is the “Howdy Modi!” mass rally held for the Indian Prime Minister in Houston during 2019. The antagonistic language now deployed by President Trump towards the sub-continent’s powerhouse is causing shockwaves through both the Indian diplomatic and business communities. “India has been taking advantage of the US for far too long,” and with an introduction of an across-the-board tariff of 25%, Washington has created an opening for Narendra Modi’s detractors and opposition to deride any personal sway the Indian leader thought he had with the mercurial Donald. Upsetting India’s hardliners is also Trump’s insistence that he helped broker a peace deal in Kashmir which represents a double attack to the country’s national dignity. In fact, a triple attack if one believes the US might go ahead with an extra 10% tariff of those in the BRICS alliance and countries that align.

At the end of May, the Economic Times of India reported businesses recalibrating their trade strategies in the face of global uncertainty, with 87% pivoting their focus toward domestic markets to prioritise local customer needs and ensure stability, according to HSBC’s Global Trade Pulse Survey at the time. The reasoning is all-too familiarly obvious. Shifting sands in geopolitics, unwelcome fluctuations in global markets beyond the control of India’s businesses and worrisome supply chains means that Indians must concentrate on markets giving solid data and trackable progress. The answer lies in by turning the focus inward. Given that these observations were made before the latest fallout between Washington and Delhi, this new tendency can only now see acceleration.

If there is a new attitude from India, in which it perpetuates a state of self-interest, the influence of secondary oil sanctions from the US must over time dwindle. Who is Uncle Sam to tell a nation of a billion souls where to buy its oil from? Particularly a so-called ally who is now treating it as some sort of pariah. Skirting the US Dollar in oil transactions is proving a tricky affair, and until such time alternative monetary settlements can be worked out, India’s coming to the wider market to replace the 1.7mbpd of Crude it takes in from Russia is bullish. But it now feels no need to fall in line with US thinking. If the world, led by the US is about to get more selfish, then it would appear India will have no qualms in matching parochialism. The backlash of deglobalisation, of American self-interest and an epidemic of ‘beggar thy neighbour’ is about to create something very different in India. Here is the rub. If the US and its Western allies, whoever might be left after Trump eventually goes, have any diplomatic capital in keeping a rein on India when it expresses indignation in Kashmir, it might just have been blown up. We started this study with a warning on how introspective nations have historically behaved in times of stress. Imagine then the danger to world peace if India and Pakistan face off as is their habitual, animosity release without a care for international opinion or influence? Forget what it means for oil prices and worry on what would be in the payloads of a missile exchange between eighty-year-old archenemies.

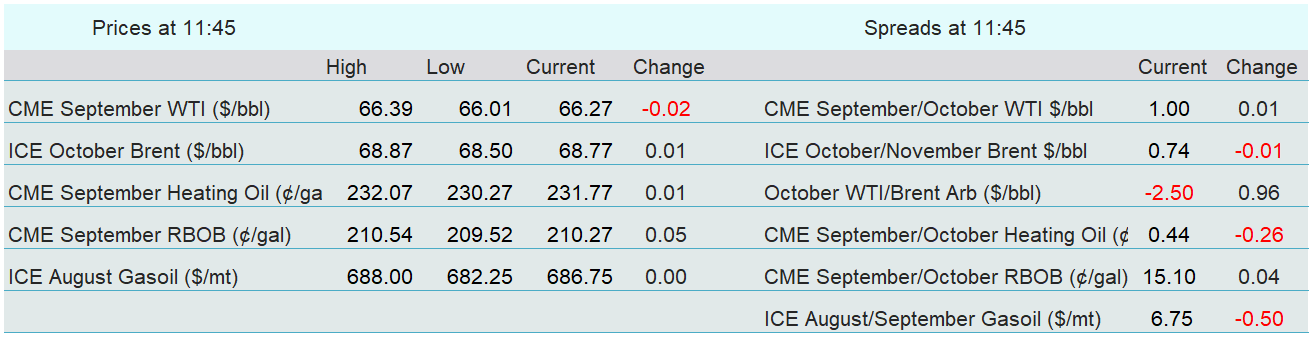

Overnight Pricing

05 Aug 2025