Perceived tightening and actual outage

It is difficult to remove ourselves from the inflation and interest rate stories as they continue to haunt investment markets in the background be they for better or worse. The very tepid US PPI of -0.1% has again given rise to speculation of both disinflation and that the Federal Reserve will only raise interest rates by one more time this year. Indeed, the CME FEDwatch tool has adjusted pricing to the extent that there is only a 20% chance of another rise after the expected 25-basis point increase at the July 25-26 meeting. Where this is important for risk assets including oil, is it has inspired a complete flounder by the US Dollar. Today the Dollar Index sits below 100 and is trading at 15- month lows, adding another layer of bullish rhetoric as we near the end of the week having gained nearly $4/barrel on both WTI and Brent.

Production issues are again harrying would-be bulls into action, possibly earlier than desired. The news that Libya’s El Feel oil field production had halted due to protestors entering the project, started an upcycle of price which found extra accelerative as protestors expanded their grievances to Sharara, possibly losing some 70,000 bpd from the former and 300,000 bpd from the latter. Adding even more metal to these production outages came from Nigeria, where the Forcados terminal was shut in due to a leak with a possible loss of some 225,000 bpd.

The Libyan situation is unpredictable. We have in the past seen protests/strikes akin to an on/off switch as the situation sometimes changed on an almost daily basis. However, last year a prolonged shutdown period saw the African country’s production shrink from over a 1-million bpd to under 700,000 bpd. In a market that at present is in thrall of a ‘tightening’ narrative, anymore outages as seen in Nigeria and Libya will push the oil price to levels that not even the most ardent bull would have predicted for the second half of the year. This concept of ‘tightening’ was very much taken up by both the IEA and OPEC in their monthly reports.

|

GMT+1 |

Country |

Today’s data calendar |

Exp |

|

13.20 |

IND |

Balance of Trade |

|

|

10:00 |

USA |

University of Michigan Consumer Sentiment |

65.5 |

|

18.00 |

USA |

Baker Hughes Oil Rig Count (Previous 540) |

|

Different ways of getting there, but tightening is the answer.

It has always been a noble endeavour when trying to predict oil fluctuations based on the state of demand, be it actual or perceived. It becomes an even harder task when those with agency within the industry and those that command large readerships offer variance in how they see the state of what might inspire demand or dampen it. The International Energy Agency released its Oil Market Report a few hours before OPEC’s Monthly Oil Market Report, while both were preceded by the Energy Information Administration offering both alignment and divergence. As far as the take on global demand is concerned, these three most influential reads listed the balance of 2023 forecast demand in millions of barrels as follows: the EIA with Q3 at 101.75, Q4 at 101.83 giving a 2023 total of 101.15 million barrels per day; the IEA with Q3 at 103.10, Q4 at 103.30 giving a 2023 total of 102.08 million barrels per day; lastly OPEC with Q3 at 101.95, Q4 at 103.21 giving a 2023 total of 102.21 million barrels per day. For the sake of brevity, the previous quarters are not listed here but it is fair to say that the reports revert to type in that the EIA does seem to be always more conservative than the IEA and OPEC. This becomes even clearer when looking at the year-on-year changes to global demand predictions. In the EIA, IEA and OPEC order they are +1.75mbpd, +2.18mpbd and +2.44mpd from 2022 to 2023.

This then examples that the IEA and OPEC appear to be of similar mind when assessing demand, or does it? Both have revised down their 2H 2023 demand forecasts, but the revision is much keener from the IEA. The France-based agency trimmed 250,000 bpd whereas OPEC is meagre in comparison by cutting only 60,000 bpd. The notable adjustment by the IEA is explained on the basis that global demand will not grow as fast as previously expected this year because many of the major industrialised nations are harbouring economies that are stuttering, as evidenced in the poor batch of global manufacturing PMIs that have recently been published. Another data discord is the increased non-OPEC supply; the IEA has it at increasing by 50,000 bpd which is in sharp contrast to OPEC’s prediction of a decrease of 230,000 bpd.

However, accord arrives from their views on the size of the call on 2H 2023 OPEC crude; the IEA at 30.15 mbpd and OPEC at 30.39 mbpd. With OPEC June 2023 output at 28.19 mbpd and the Saudi voluntary 1 mbpd cut probably not yet registering, these forecasts foretell of inventory drain. Admittedly, the self-sacrifice shown by Saudi might well be taken advantage of by the likes of Iran and the US and let us not forget that the EIA 2H 2023 call on OPEC is much lower at 28.31, but for all the differences listed those that have held the view of a tightening market at the back end of 2023 might feel that vindication is nigh if these data bear fruit.

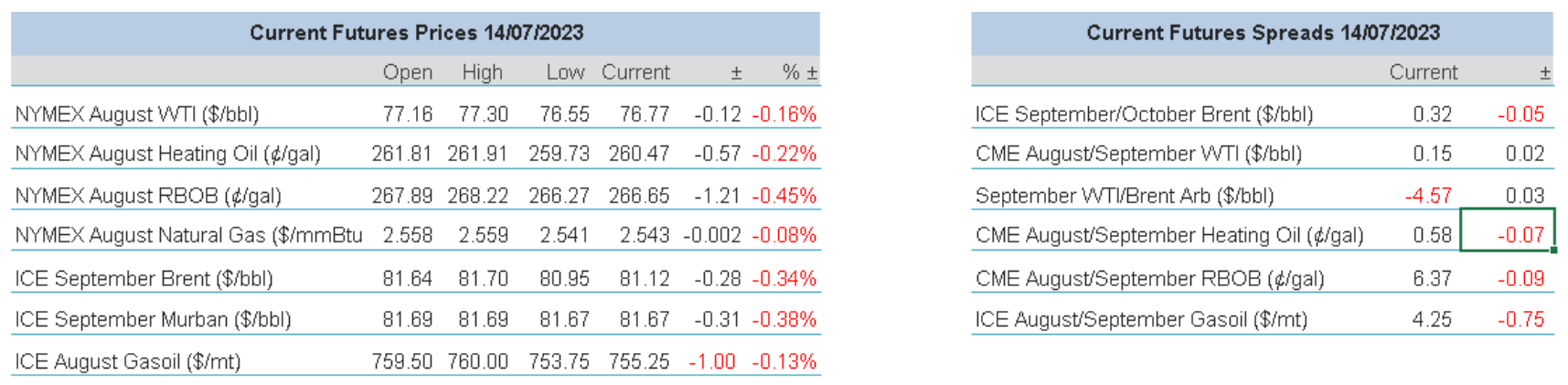

Overnight Pricing

14 Jul 2023