Politics are Unable to Scupper a Feel-Good Market

There is no deleterious effect of a sweeping Labour Party win in the UK General Elections and arguably the size of the new government's majority means more of a secure political footing than that of what is happening in Europe. The runoff in France is likely to conclude with a 'cohabitation' and a hamstrung executive that will likely cause more consternation for a debt-ridden economy. Staying with politics and turning a gaze across the proverbial pond, a "I'm not going anywhere" President Biden is about to endure an interview with ABC television, aired tomorrow, in which any sort of stumble might see greater calls for him to step down, infighting within the Democrat Party and a door left ajar for a prowling Donald Trump.

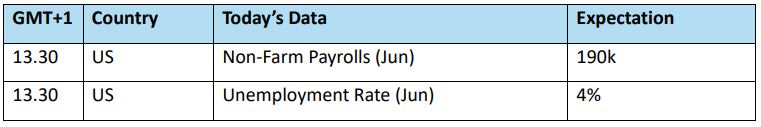

Given that politics have not impeded the current robustness of markets, stock indices, led as always be the technology sector remain very much bid into the weekend. Japan's Nikkei 225 pushed towards its record high before drifting, underpinned by Wall Street and the weakness that continues in the Yen. In evidence that AI-inspired success remains, Samsung announced profits for the second quarter of over $7 billion which is fifteen times over that of one year ago as the demand for semi-conductors and microchips soars. This then is the backdrop for oil to operate in, and while its many upward drivers remain relevant, the friendly climes of the wider suite can only be supportive. The only thing on the agenda that might upset proceedings, in what will remain a US-thinned environment, is the Non-Farm Payrolls due at 13.30BST and expected to register an increase of 190,000 jobs.

There is much for bulls to be happy with, but will it last?

There is little to doubt the voracity of the current rally in oil prices and the idea of Brent making a $90 handle has gone from wishful thinking to de rigeur. Leaving conflict geopolitical issues aside, those that have kept faith that the driving season would eventually come are glowing in prescience and the many calls of a much better path for bulls in the third quarter at present seem to hold true. As always it is to the United States that bulls need to doff their caps, as the most successful economy once again is the source of positive influence. The EIA’s US Inventory Report on Wednesday brought data to the bullish suspicion and if it were not for the US holiday and that investor tourism remains in love and concentrated with tech stocks, oil might have fared a little better.

Refinery runs punched up slightly, but this did not stop both Gasoline and Distillate stocks to draw by 2.214 and 1.535 million barrels respectively. The 12.157-million-barrel reduction in Crude stocks does smell of something rogue that might be a correction, but it will have little effect on the 5-year average being undershot by 13.539 million barrels. The products also have averages that run delinquent to their own long-term means, and while stocks ought to trim in a poorer refiner margin world and more costly financing of tanking due to interest rates, it will be interesting to see whether the lowly current holdings in Distillate will give a winter kicker when we get to the fourth quarter.

Keeping to the beat of product demand and seasonality in the Northern Hemisphere, Jet Fuel continues to find increasing demand. According to data from Bloomberg and using aircraft scheduling, Jet Fuel use will increase 2% week-on-week to 7.1 million barrels per day. It seems that oil demand and stock levels are colluding to aid a market seeking higher ground and this might just be aided by climate. Data available from ‘Copernicus’, the Climate Change Service to the European Union, reveals that May23 to April24 global-temperature average was the highest on record and with sea temperatures around the world offering higher month-on-month values, Hurricane Beryl is indeed a precursor to a very active storm season in and around the Gulf of Mexico. If US oil inventories remain relatively short and the North Sea basket experiences tightness coinciding with a storm barrelling into the likes of Corpus Christi, the third quarter might just see some rather elevated oil prices.

So, is this a bullshot then? Shall we light the blue touch paper and stand back? Conceding to all the above, there are some things that give concern to oil demand beyond the contemporaneous drivers. Firstly, it seems to have gone unnoticed how bad the global Purchasing Manager’s Index data have been this week. To list them in Manufacturing, Services and Composite order some of the larger economies posted thus: Japan 50.0, 49.4, 49.7; France 45.4, 49.6, 48.8; Germany 43.5, 53.1, 50.4; EU 45.8, 52.8, 50.9; UK 50.9, 52.1, 52.3 and the US 48.5, 48.8 with no US ISM Composite PMI. The UK and EU Services apart, the PMIs make for alarming signals if one were to look for economic health as a positive long-term reason for oil demand. Europe remains in stagnation, the political flux it finds itself in will need more than just one cut from the ECB to get industry going. As for the US, it is all well and good greeting ‘bad news as good’, if one is on the lookout for a trigger that might make a reluctant FED take at least paring knife to interest rates. But contraction in Manufacturing and Services is a real jar to any idea of oil demand beyond seasonality.

What of China? The PMIs were of a mixed instance. The National Bureau of Statistics (NBS) readings were 50.5 for Non-Manufacturing and General categories, but 49.5 for Manufacturing. Even though the private Caixin PMIs showed expansion, 51.8 for Manufacturing, 51.2 for Services and 52.8 for the Composite, nothing smacked of an economy going gangbusters. FGE speculate that China’s crude imports in the third and fourth quarters will only match current levels of 11 million barrels per day at best and there is some contention from other analysts who suspect the number might be closer to 10 million in July. Despite all the talk of stimulus and grandstanding of 5% GDP growth target, China’s efforts are inept at exacting itself from the malaise that has taken hold in subsequence due to the disastrous zero-COVID policy. The continuing ruination of confidence at the hands of the property sector and current higher crude prices might mean China will lean on its considerable SPR if it ever gets any demand fired up in the second half of this year. Bloomberg calculate that China uses one in every six barrels of oil consumed in the world, whether it retains the status quo will make for interesting tracking. We remain as keen as most in calling the market to have a very decent summer. However, beyond the short-term, demand becomes occluded as are market predictions.

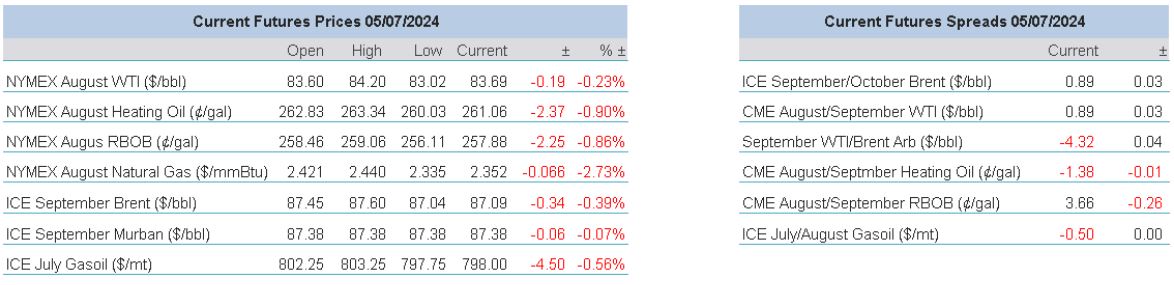

Overnight Pricing

© 2024 PVM Oil Associates Ltd

05 Jul 2024