Positive News and Positive Markets

The vote as yet needs to pass the House of Representatives and be given a Presidential signature, but the US Senate’s approval of an interim deal to reopen the US government is giving a tailwind to most risk assets. Bourses are once again trying to make the high ground, even after the news of Japan’s SoftBank selling all its Nvidia exposure. This revelation might have been a little more damaging if it were not for the stated intention by the investment bank to increase exposure to A.I., which indirectly helps Nvidia anyway. Again, it is an interesting insight into the mindset of US markets which have been deprived of official data and given what must be economic fallout from associated shutdown issues such as the air traffic control disruption. It might just be that any negative infringement on the state of employment will be a cue for the US Federal Reserve to bring in another 25-basis point interest rate cut in December. Those with such theories were given support by the ADP data showing job losses in its 4-week average measure. Back to the bad news is good news scenario one again.

Oil prices also benefited from what seems a cure to the Washington impasse. More people getting paid means more people spending money with some of that being expressed in energy demand. This comes at a time when products are leading a charge in the oil sector with refining in the spotlight due to sustained damage to facilities in Russia and how US sanctions on Lukoil and Rosneft are causing headaches to those still engaged with the oil business of Moscow. As we approach the monthly reports from the main contributors; OPEC, EIA and IEA, the latter’s Energy Outlook shows something of change of heart and will possibly give cheer to bulls or at least those that see greater longevity in oil. As seen on Reuters, the IEA now says due to government policies, oil demand will not plateau in 2030 but will instead hit 113mbpd by the middle of this century, up 13 percent on 2024 consumption.

Nice work if you can get it

If you place twelve zeroes after a ‘1’, you get to write down on paper the now potential pay package of one Elon Musk. This is not fake news, or A.I. generated click-bait, but what investors voted for in an historical Tesla shareholder meeting carried out last week. Obscene or inspirational? Take one’s pick, but it is sprinkled with the stardust afforded to anything in the tech industry these days and is making a mockery of the current warnings of a possible correction in equities. Reading beyond the headline, something alien to many these days, reveals a rather onerous set of circumstances which must mature if Mr Musk gets to scoop all those zeroes much in the same way as Sonic the Hedgehog picks up bonus rings. Not exclusive, but the deliverables before he gets hands on the $1 trillion are 20 million vehicles sales reached, 1 million Optimus robots or robotaxis sold, all enveloped by having to elevate Tesla from its current market value of $1.4 trillion to $8.5 trillion before his personal compensation is realised.

So, what has this all to do with the price of eggs, let alone anything else? Well, it is the current phenomenon to reward fame and wealth with more wealth and fame. Elon Musk is a divisive character, made flawed by his meddling in politics and social media. It is extraordinary how the would-be space man has not emulated the late, great, David Bowie and re-enacted the ‘The Man Who Fell to Earth’. His personal stock seemed to be in decline after he purchased Twitter, funded President’s Trump run at the White House while being associated with far-right political causes and being accused of making fascist-like salutes at rallies. His tenure in the department of government efficiency hardly won him friends as he led a slash and burn campaign against so-called waste, causing jitters in any job space associated with government funding. If he had alienated the left, he later gave himself an uppercut from the right with a very public falling out with his President stablemate.

Yet, despite his erratic behaviour and the recently poor standing held by Tesla in the public zeitgeist, Musk leads a band of tech magnates that have championed and cajoled capitalism into never before seen reaches. It does not matter that their wealth is so extreme as to be embarrassing, the likes of Meta’s Zuckerberg, Amazon’s Bezos, Nvidia’s Huang et al, give a face to excess and their success, rather than be frowned upon, is seen as evidence to investors that they are absolutely backing winners. Indeed, if the President elect before taking office courted such companions and they in turn turned turtle on previous Trump criticisms to obtain favour, and with the circular appreciation society running akin to how tech companies continue to invest in each other, then why would the roving investment tourists not join in?

We can all gather around the notion that at some stage equities will get a good old-fashioned sell off. But when, where and how much is as unpredictable as to how high these stellar stocks can rise. There is no exogenous danger to tech companies other than being deemed overbought and overpriced but again this is subjective. Yes, Meta is issuing bonds to finance a dive into A.I., but in the main, big tech is high in revenue, high in cash flow and high in balances being constantly fed by software subscription and incredibly durable demand. The only upsetting time for the S&P 500 was during the ‘Liberation Day’ spate of tariffs, which was registered in the CBOE VIX Volatility Index by scoring a high of 52.00. Apart from a blip higher in October when Washington’s relations with Beijing soured, the ‘worry’ index has been ticking along very stably in the high teens while month-on-month increases occur in the S&P basket. It is going to take some convincing for individual stock pickers, common ‘retail’ as huffily described on finance wires, to not receive any dip as an opportunity. It also does not matter how unsavoury a character might be viewed in some quarters, if his company says he is worth 10 to the power of 12, it will only battle harden already rich tech stock speculators and keep their roving eyes away from the likes of the downtrodden, fallow fields of oil.

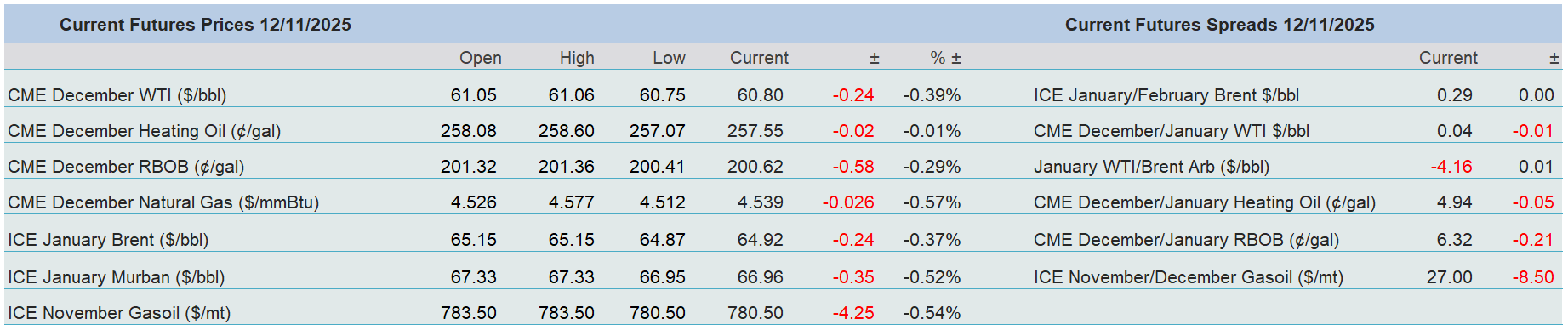

Overnight Pricing

12 Nov 2025