Possible OPEC+ Supply Increase and Iran in the Foreground

The weekly closing prices do not tell the story of last week’s events. Our market had to contend with the refreshed monthly oil balance reports, all of which envisage a year-on-year increase in global oil stocks to varying degrees. A huge weekly build in US crude oil inventories, possibly a consequence of the January polar vortex, also caught attention. The diplomatic tug-of-war between the US and Iran has not resulted in military action so far; nonetheless, fears of supply disruption have helped keep oil prices stable. The next round of talks is scheduled for tomorrow in Geneva amid rising tensions. The US has sent a second aircraft carrier to the region, and its military, US officials told Reuters, is preparing for a weeks-long campaign against the Persian Gulf OPEC member.

It is this resilience that may have tempted OPEC to float the idea of resuming its efforts to regain a further share of global supply. If the purpose of the announcement was to test the market’s reaction, words might translate into action during the April discussions, although such a move would contradict the group’s monthly update, which foresees falling demand for its oil in the second quarter. Both WTI and Brent edged slightly lower last week.

For the oil fraternity, Iran is what US interest rates are for equity investors. Last week’s data releases further blurred an already ambiguous picture. Solid US job figures, both monthly nonfarm payrolls and weekly jobless claims, would not warrant an immediate reduction in borrowing costs. On the other hand, headline inflation ticked lower, and the core reading came in as expected, although the 2% target remains a distant prospect. In the forthcoming clash between interest rate doves and hawks, it is obvious which side the US President stands on, given the gigantic debt pile his government must service.

Significant Oversupply After 2026? Implausible.

The futures curve contains a wealth of information. Conventional wisdom holds that a backwardated structure implies tightness, as buyers are prepared to pay a premium to secure supply. Contango is the opposite, suggesting ample availability of black gold. In extreme cases, the market self-corrects. A steep backwardation makes it profitable to sell oil out of storage and replace it at a later date. A wide contango offers an arbitrage opportunity, whereby buying crude oil now and selling it later ensures a risk-free gain.

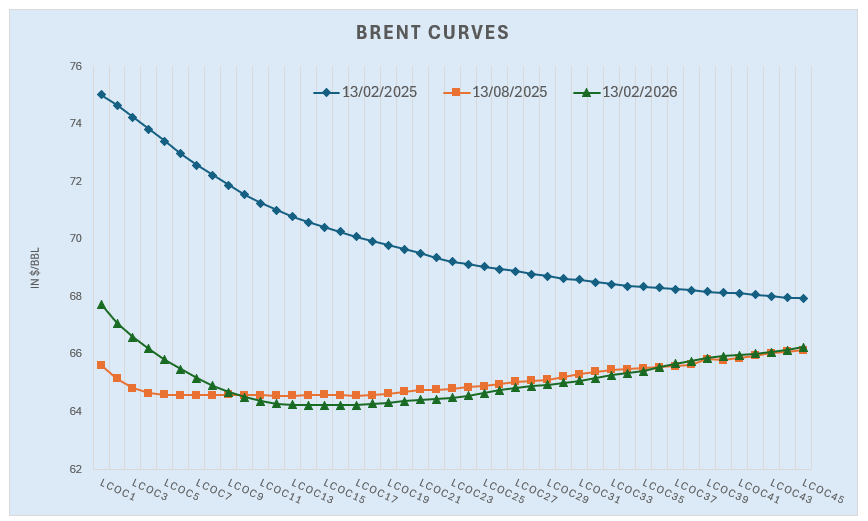

Taking the widely accepted definition of the futures curve at face value, and as illustrated in the chart below, the following conclusion can be drawn. A year ago, the market was unconditionally bullish, as the Brent curve was in backwardation four years out. Sentiment shifted somewhat six months later. The short-dated premium flipped into a discount after 12 months. The current structure is similar to that of last August, with backwardation turning into contango after 16 months. In other words, the optimism observed last February all the way down the curve has been replaced by expectations of a well-supplied global market and a loose oil balance one to one and a half years further out.

When uncertainty and unpredictability are the zeitgeist of the present, nothing, including conventional wisdom, is set in stone. One might argue that the contango further down the curve reflects these unknowns and that its extent merely mirrors the cost of storing, insuring, and financing one barrel of oil for one month. A contrarian would assert that the contango does not imply a balanced market or excess supply further out, but quite the opposite. Longer-dated contracts may be getting more expensive because supply will not be able to satisfy expanding demand in the future.

The overlap between the August 2025 and the current Brent curve is a particularly intriguing phenomenon. It lays bare the fact that market participants consistently reassess their views and remain positive on the near-term outlook, which is less cumbersome to evaluate than supply and demand one or two years from now. Take the Brent M15/M21 spread on August 13, 2025, which was the Dec26/June27 spread at the time. It showed a contango of 17 cents per barrel. The same spread last Friday, now the M9/M15 price differential, was in backwardation by 45 cents per barrel. Perceptions have changed, and for the December 2026–June 2027 period, the backwardated curve suggests some degree of supply deficit.

Will this constant reassessment prevail, and will the front end remain in backwardation? Several factors point in that direction. Although oil supply is expected to outweigh demand this year and next, this approach can and should be viewed as rudimentary. After all, as pointed out by Energy Intelligence, a significant portion of theoretically available oil is effectively unavailable, as sanctioned Russian and Iranian cargoes remain afloat, struggling to attract buyers.

More importantly, the shift in how climate change is being addressed may tighten the oil balance in the coming years. Simply put, when the transition from fossil fuels to renewables was expected to progress uninterruptedly prior to the COVID-19 crisis, investment in exploration and production was scaled back meaningfully. While producers are now attempting to make amends and are increasing their E&P capex, roughly 5%, or 5 mbpd, of existing supply must be replenished annually due to natural decline rates.

The changing attitude in the battle against global warming is also having a profound impact on consumption. Just last week, for example, the US President revoked the Obama-era “endangerment finding,” which had classified a range of greenhouse gases as a threat to public health. Rolling back current emission standards could lead to ever-slower EV uptake and higher gasoline consumption. When increased demand for electricity generation from data centres is added to the equation, it is not far-fetched to conclude that global oil supply may be overestimated and that dependence on fossil fuels, and oil in particular, will persist and even grow. There is a strong case to be made that front-end backwardation will prove persistent, supporting outright prices beyond 2026.

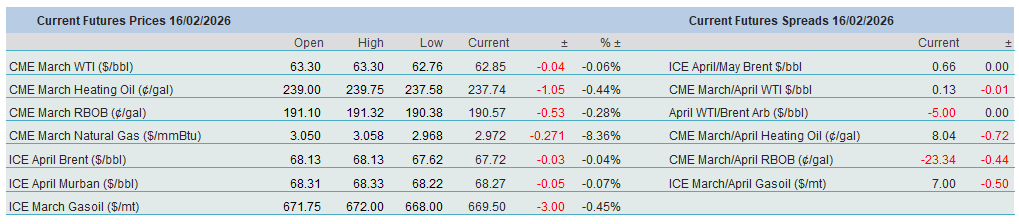

Overnight Pricing

16 Feb 2026