Prices Reset with Quiet Geopols and Another Pivot Pushback

Oil prices took yesterday as day of correction which was inspired by a lack of any further conflict news from the world's clash points as markets had to settle on what was bothering the macro world. The bets of interest rate pivots were dealt a blow by the Reserve Bank of Australia minutes in which the governing board had actually considered a rate hike, and as the RBA is in the mix of probable policy accord with other central banks, investors yet again felt a hiccup in pivot prediction as to when the most important central bank of all, the FED, might alter course. Pricing is being pushed back again from May to June and in an interesting poll by Reuters, economists in the main predict that the cut might come even later in the year. US investors returning from holiday took a cue to ease exposure, particularly as today sees not only the FED minutes but the much awaited and darling of investors NVIDIA results.

Chinese bourses have found a surprising rally this morning and although the cut to the 5-year Loan Prime Rate yesterday at last showed some intent from the PBoC/government in adding action to promise but as a standalone action as a positive, it failed. What has aided investor revival is another clampdown on Quant fund trading and its supposed exaggeration on volatility, however, what it really represents is another way of stopping short selling. Another leg to the rally comes from a Bloomberg piece, state media reported that banks have approved equivalent $17 billion loans to the 'white list' so far since January giving an upside nudge to property stock values. This is likely to be an ephemeral rally, for the piecemeal way in which so-called stimulus is being introduced appears to be defensive as it lacks a cohesive plan giving confidence to any ideas that there will be a change in the fortunes of China. Oil participants love bullish China stories, but by the way they voted with their feet yesterday, the risk-off tone and correction would not be stayed as M2 WTI fell $1.42/bbl, but more importantly, and discussed below, M1 Heating Oil fell again by another 7.51c/gal.

GMT | Country | Data | Expectation |

15.00 | EU | Consumer Confidence Flash (Feb) | -15.6 |

19.00 | US | FOMC Minutes |

|

Despite refining issues the middle of the barrel cannot get away from NatGas

Seasonality at this time of year ought to offer at least a smidgen of a rally in distillate, especially when one considers the crimping of Russian Gasoil due to the drone attacks by Ukraine on refineries around the Baltic coast. Imports into Europe from India have been reduced due to the Red Sea issues and the US is, on a weekly basis, adding to product reduction with the lowest refinery utilization rates since the COVID era of 2020. The lack of throughput in the US refiner sector means that it cannot service India-light European demand and, according to Petroleum Intelligence Weekly using Kpler data, US Diesel loadings have dropped this month by 90kbpd to 250kbpd and gives data meat to the Russian problems citing Energy Intelligence who see exports of ULSD from the start of the year to February 13 at 555kbpd, which is nearly 25% lower than the 2023 average.

However, ‘seasonality’, should not just mean a cycle of annual events, at this time of year it should come with something akin to a winter. Last month saw a record temperature high in Washington DC of 80 degrees Fahrenheit and the US is well on the way in having the warmest winter on record with data starting in the 1950s. The European Commission sponsored Copernicus Climate Change Service (C3S), in a February 8 report, noted that January 2024 was the warmest January on record globally, with an average ERA5 surface air temperature of 13.14°C, 0.70°C above the 1991-2020 average for January and 0.12°C above the temperature of the previous warmest January, in 2020. C3S went on to report that global mean temperature for the past twelve months (Feb 2023 – Jan 2024) is the highest on record, at 0.64°C above the 1991-2020 average and 1.52°C above the 1850-1900 pre-industrial average.

Without stirring sensibilities, whether it is El Nino or climate change producing such warm weather, there is still enough in the low availability of distillate to have some upward bearing on oil prices, but there is a large puzzle piece of fuel sitting as a counterweight to such expectations. The warm weather has had an outsized influence on the prices of Natural Gas, and it is to this usual winter warmer that most of the blame lies on why the middle of the oil barrel lacks a bid. It was only in October 2023 that Dutch TTF prices were soaring as the LNG strike in Australia pushed global gas prices higher. March 2024 TTF was trading at Eur58 MW/h on October 13, but has since fallen 60% to Eur24 MW/h as of yesterday. Similarly, but more profoundly, across the pond M1 Henry Hub futures fell to $1.58 MMBtu, and aside from COVID times, is the lowest since its inception in 1990.

Europe, as argued in many quarters, would find moving away from its addiction to cheap Russian gas a long and laborious process, but has proved rather malleable in finding other sources which in the main involves LNG imports. The Financial Times quotes EU data showing Russia’s share of gas imports into Europe dropped from more than 40% in 2021 to 8% last year and with other markets unable to create such dynamic custom, Russian prices have continued to fall since peaking at the start of the invasion into Ukraine with a surplus of supply. In surplus is where gas inventories find themselves in the US, gas stocks have recently been over 2,500 billion cubic feet, the highest since 2016 and even a consistent shuttering of gas rigs which has seen 30 rigs idled in one year, production has increased due to greater rig efficiency as seen in oil rigs, and according to the FT, hit a record 105 Bcf/day in December.

The C3S 6-week forecast for Europe shows temperatures will remain mild and combining the 1-month and 3-month forecasts from the US National Weather Service, the outlook seems comparably benign. If time shows these predictions as proven, it will mean more pressure on gas markets and with such a copious and cheap burner available for heating and power generation there is little reason other than to believe that gas prices will be a hinderance for any upward progression in distillate derivative oils for some time yet.

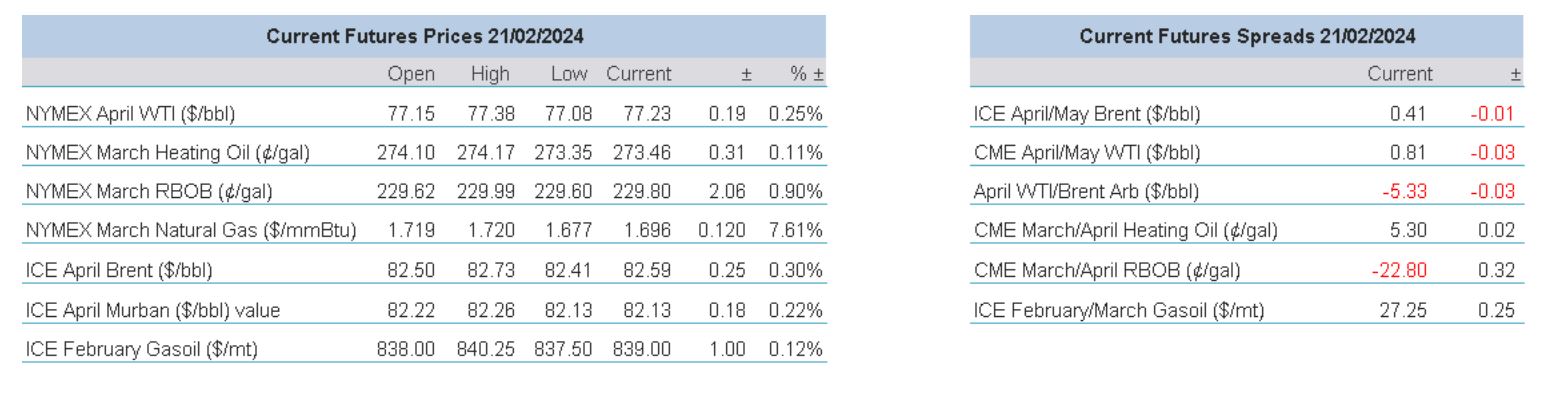

Overnight Pricing

© 2024 PVM Oil Associates Ltd

21 Feb 2024