Products show the way, India will have its say

There is still plenty within the macro-suite to carry on knocking oil off its stride. This is not just something that haunts bulls, howsoever ones sees fit to approach the market there is an economic counter waiting to pounce. The wider suite today is concerned with some markers from the United States. The lower initial jobless claims gives credence to those that still believe the employment market is still running too hot. Inflation is always in mind and investors looking for some sort of relief in the near future from the Federal Reserve will have 10-year breakeven inflation rising 2-basis points within a day to confound them. To put this in context, 10-year breakeven is a daily marker and these moves are not unusual, although such an increase has not happened for a week. The macro picture is sugared with the second worst day of the year for Nasdaq after poor Netflix and Tesla results and iced with an improving US Dollar.

However, and at last, oil enjoys some boosting factors that at present seem to be avoiding the hampering wider suite. Today in China, the National Development and Reform Commission (NDRC) announced impending support for both the electronics industry and automobile consumption. The announcement remains short on detail but notions of China buying more cars gives rise in hope for oil investor bulls.

The products markets are starting to find a lot more attention and Gasoline futures has recently caught the eye. But hot on its heels and not to be outdone, distillate and its components Heating Oil and Diesel are also gaining recognition from investors. Reuters data shows that even with US refineries running at 94.3% of capacity, 2.2% above the 10-year average, distillate stocks are still 15% lower than the 10-year average and gasoline 5%. In Europe distillate is 7% below and in Singapore 27% below.

Products are setting a strong tone and there is little doubt that longs are entering with the turnaround season in mind. Bulls will be hoping that between now and then, refined fuels will keep their sheen and able to avoid macro trap doors such as any hawkish stances from the avalanche of Central Banks meetings next week.

|

GMT +1 |

Country |

Today’s data |

Expectation |

|

18.00 |

USA |

Baker Hughes Oil Rig Count (Previous 537) |

India, not to be ignored

India is now the fifth largest economy in the world according to the International Monetary Fund. With a population now matching China’s of 1.4 billion and growing, the IMF predicts by 2050 India will rank third in the world for GDP per capita purchasing power, PWC go one better and predict second.

The association of poverty is becoming less valid and although rural communities are still playing catch-up in terms of poverty reduction, catch-up they are achieving. NITI Aayog, the public policy think-tank of the Government of India recently released its National Multidimensional Poverty Index. The MPI takes into account deprivation in health and nutrition, education and standard of living. Multidimensional poor declined 9.89% from 24.85% in 2015-2016 to 14.96% in 2019-2021. Interestingly, for urban areas 8.65% to 5.27%, but the decline is much more pronounced and impressive in rural areas falling from 32.59% to 19.28%.

As welcoming as this report reads, running counter to the idea of India on full steam ahead are some sticky growth data. Real GDP reached dizzying heights of just over 10% in 2010 but has never been able to cling on to that sort of growth. At the start of the pandemic, GDP registered in negative territory and although a recovery since saw a 9% reading in 2021, growth has levelled out at or around 6% which is where the IMF predicts it to stay until 2028. China’s GDP per capita purchasing power is 28% of US levels, whereas India’s is 11%, but of the largest emerging economies it places second behind China.

Even with some contemporary mixed growth data, India’s crude imports are up 0.5% year-on-year for June with an increase to 19.5 million tons versus 19.4 million, but because of the sharp fall in oil prices it has enjoyed a 36.7% reduction in its import bill. There seems little complacency in this reduction of cost. Securing future supply is now imperative as India’s relationship with Russia is now proving something of a headache.

Along with China, India is now facing a Russian crude price that is breaching the $60 sanction price cap. With discounts, India, since the introduction of the price cap, had been enjoying cheap Russian crude which has aided economic recovery after COVID-19. It has also not been shy in alternative payment which has won favour with Moscow. Whether or not this has enabled increased discount or was enforced by the Bank of India after international concerns were aired when a term deal with Rosneft came to light, is speculative. However, payments have not only been made in US Dollars, but in UAE Dirhams and Chinese Yuan, something that the international community, that are signed up to Russian sanctions, are unlikely to tolerate if used again to circumvent the price cap.

Russia supplied about 42% of crude oil, April to June data shows. The Middle East 41%. India is now in the process of trying to secure extra alternative supply from the Middle East in an attempt to stave off having to trade at the spot market with all the travails that brings including inflated prices. It might be afforded time as summer approaches. The hotter weather normally hails a period of lower demand for oil products because of lower mobility and construction. However, if a reduction in Russian flows proves to be true or disqualified because of sanctions and the voluntary cut by Saudi Arabia begins to bite, a thirsty India might add another prop for those signed up to the concept of a tightening market.

India’s influence on the oil price and energy in whatever future form, is something that will need to be considered ad infinitum. Compared with its oil buying rival China, India’s economy has somewhat of a long-term financial stutter. But assuming the conservative GDP growth continues and GDP per head tracks it, the ever-increasing population reaching 1.67 billion by 2050 according to UN forecasts and reduced poverty levels will mean that India will be an increasing source of energy demand for decades to come.

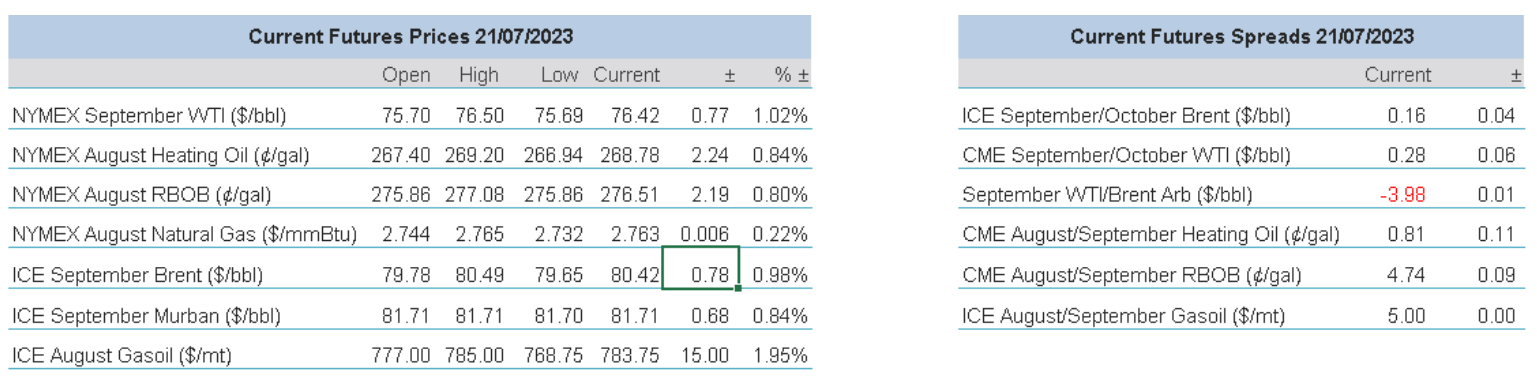

Overnight Pricing

21 Jul 2023