Products soar, gas prices are bullish company

The reference to the Superman comics when traders utter ‘its ripping its shirt off’ is used too much and becomes watered down, but at present it is fairly apposite for the products market. The US Inventory Report revealed a week-on-week reduction in Gasoline stocks of 2.661 million barrels and a reduction in Distillate of 1.76 million. However, what really catches the eye is the change in the 5-year average. Gasoline is -12.872 million or -5.6%, but Distillate is even more reduced at -21.872 million barrels or -15.4%. Heating Oil, accompanied by Gas Oil are now attaining levels not seen since January of this year and if RBOB breaches the yearly high of 299.36c/gal set last week it will be working through numbers not seen since August 2022.

Refiners appear not to be catching up at present and with that in mind those that see extra tightness coming from the refinery turnaround season are keen to fulfil any lingering exposure before an even greater, or at least a perceived, shrink in available refined fuel. Also, waiting in the wings of worry is the forthcoming hurricane season which if chronologically aligns with refiner switching, will have quite the upward affect. With this in mind Reuters interestingly report on a plan by US refiners to up the ante on throughput. The year average has seen plants running at 90%, but refiners are expect to ramp up to 95% defying the problems caused by distillation and cracking in high temperatures. EIA shows run rates last week at 93.8% utilisation and stands in evidence that refiners are willing to run higher in potentially dangerous climate conditions.

Adding to the bullish mix is the recent issues faced by European importers of LNG. The Eurozone is still in the process of weening itself from Russian natural gas and as large as some of the term deals secured by the likes of Germany might be, there still remains a possibility of a shortfall and a reversion to having to buy at spot as seen in 2022. Dutch TTF closed at Eur31.066 MWh on Tuesday, but rallied 30% yesterday to finish just below 40MWh after reaching a high of 43. The main cause is a strike by Australian LNG workers. Australia is now the highest exporter of LNG, beating Qatar and the US, but with production issues and compromised gas fields, European buyers are fearful of security in supply and have resorted to tank filling from the cash market before the onset of winter. Adding to LNG tightness is the extension of the force majeure declared in Nigeria during October last year as fields continue to struggle to regain production after heavy flooding.

At present it does not appear that there is anything untoward in the energy sector to upset this rally. Commentators and traders alike are much concentrated on fundamentals rather than what might be ailing the wider macro-economic suite. The poor state of China’s manufacturing, its property sector and some stubborn world inflation stand out as issues that the oil fraternity chooses to ignore at present. It will be interesting to see if that is still the case if there is a higher rating in the US CPI/inflation data due out later today.

|

GMT +1 |

Country |

Today’s data |

Expectation |

|

13.30 |

US |

CPI YoY (July) |

4.8% |

|

13.30 |

US |

Inflation Rate YoY (July) |

3.3% |

|

13.30 |

US |

Initial Jobless Claims |

230k |

|

13.30 |

US |

Continuing Jobless Claims |

1.71m |

Oil complicates Central Banks’ thinking

Recently, the European Central Bank’s chief economist Philip Lane was quoted on Bloomberg as saying, ‘[…] the recent rapid fall in energy prices will bring down costs across the economy as well, so that inflation should come down quite a lot later this year.’ One wonders if Mr Lane might be changing his view after the continued rally in oil prices particularly those of inflation harbingers gasoline and diesel.

Taking France as an example, Gasoline (Euro 95) forecourt prices currently stand around Eur1.90/litre up from a low this year in July of Eur1.79. Diesel is Eur1.81/litre, up from a low this year in May of Eur1.66. Therefore, Gasoline is up some 6% from the low and Diesel up 9% in those periods, which is admittedly a touch arbitrary, but only as much as the above curious view on oil prices. The troubles that refiners of the world have in keeping up with seasonal demand are well documented, be they from a heavy driving period or low distillate inventories, they are only likely to be made worse during turnarounds. If one accepts that France is a fair representation of Europe as a whole, then the bloc’s accumulative acceleration in refined fuel prices run at odds with the ECB’s 2% inflation target and its crowd-pleasing muttering that the hiking cycle in interest rates is coming to an end.

Indeed, the outlook for Europe’s long-term inflation has been increasing of late. The 5-year European inflation swap rate is pricing at 2.665% and according to Bloomberg analysis indicates an average increase in prices of 2.67% from 2028 to 2033. With the current Euro area inflation rate at 5.3% as of July, the path to the hallowed ECB 2% target looks as if it will be long travelled one.

Platts S&P Global have just released their OPEC+ assessment, finding the group’s crude oil production dropping to a near two-year low due mainly to Saudi Arabia’s voluntary cut and issues with production in Nigeria and Kazakhstan. There is uniformity in the reduction of production within the various OPEC groupings surveyed. Crude from the OPEC 10 members was -930,000 barrels per day in July from June; with OPEC+ -980,000 barrels per day, thus highlighting the importance of the Saudi self-sacrifice. This is hot on the foot of the EIA’s small adjustment higher of 2H global demand but a stop-and-read-again $7/barrel increase in call from July’s prediction. While not exactly inflationary per se, the idea of a tightening crude market will only add more psychological pressure to products and by default inflation.

In fairness oil prices have been lower and inflation has decreased from the highs of over 10% experienced in the Eurozone. But that has all changed with the downward oil move inverting and if logically accompanied by inflation, the recent ground swell in opinion that rate hikes within Europe are at their zenith, might just prove to be premature. The next ECB rate decision is due on September 14 which if greeted by a continuance in this oil rally, will potentially see a nexus unfavourable to soft landing doves. Oil is currently sashaying away from the troubles of the macro-economic world, enjoying commodity micro-drivers based around inventory. This is all aided by the recent spike in natural gas prices as LNG imports into Europe are threatened. But this dance is still threatened by the interest rate black swan and as pointed out by many before, significant increases in oil prices will bring significant counter measures from Central Bankers making oil a possible master of its own downfall.

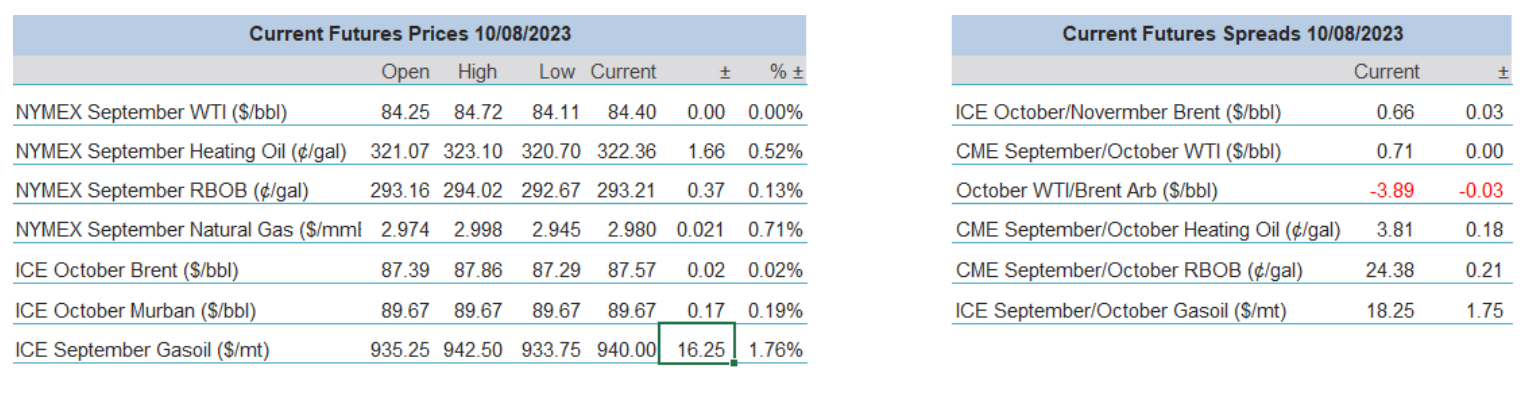

Overnight Pricing

10 Aug 2023