Products still leading, King Dollar to stay

Last week saw the complex ending in good form and has now notched up 4-week gains. On the week they individually finished, WTI +$1.65/bbl, Brent +$1.12/bbl, Heating Oil +14.78c/gal, RBOB +15.81c/gal, +$39/ton. Compared with products WTI and Brent had a more stately move higher, being subject to greater immediate macro-economic worries and the flip of refiner turnarounds that are bullying the derivatives higher.

Friday’s news that US refineries running at 94.3% of capacity, 2.2% above the 10-year average, are still unable to create product builds and that European distillate is 7% and Singapore 27% below their 10 year averages is added to by news of a fast-tightening gasoline market in Asia. Concern that refiner outages in Japan in India will see an increaseof gasoline deficit August to September and that there will be lower exports from China because of stock building in front of Golden Week in the autumn, has seen RBOB futures rally to within striking distance of its 2023 high of 289.43c/gal.

Even though crude demand should in theory reduce because of seasonal turnarounds, there is a greater interest in bringing WTI into Asia. Its discount to Dubai, the now expensive landing Saudi crude and according to Refintiv, the freight cost of a VLCC from the US to China being at a 2-month low are making the US crude attractive. WTI into Asia flows might get as high as 1.9 million bpd for August (FGE), shy of the Kpler record of 2.2 million bpd, but impressive enough to keep bull’s interested.

The oil market is not without warning. International Energy Agency’s Executive Director Fatih Birol said to today that the IEA might revise its demand call because of China and the market is readying for today’s manufacturing Purchasing Managers Index data from across the globe, which have already been found wanting in Australia, UK and Europe. However, oil’s complex is charting well and product led. Even if a lull in demand for crudes occurs while refiners endure their seasonal spin, it can be argued that on return refiners will have to play catch up on product and create a greater pull on crude stocks that bulls are hoping for.

That is of course if the guardians of the economic galaxy who meet at the Bank of Japan, the European Central Bank and the Federal Reserve this week, do not throw hawkish spanners into the works.

|

GMT +1 |

Country |

Today’s data |

Expectation |

|

14.45 |

USA |

S&P Manufacturing PMI |

46.4 |

|

|

|

S&P Services PMI |

54.1 |

|

|

|

S&P Composite PMI |

53.2 Prev |

The US Dollar, here to stay

Without delving deeply into a well-worn and debated historical path, the agreement that the US Dollar would be pegged to the price of gold and that other countries’ money would thence be valued against the dollar, seemed logical in that at the heart of financial transactions, there would be a tangible asset allowing for stable relationships in foreign exchange. In hindsight, inevitably the United States gold inventory was not enough to cover the size of currency in circulation and this form of gold standard was abandoned.

The US Dollar, already established as the currency of trade, defaulted into the universal standard of value. Thus, economists bestowed upon it the ‘global reserve currency’ and so it has remained for some 80-years.

Contemporary geopolitics and the rise of the cryptocurrency market are now bringing real threats to the all-powerful dollar. The obvious backlash, and calls for other currency use, comes from Russia as it scrambles to find alternative payment and currency transfer substitution following the array of restrictive financial measures deployed in sanctions. China, always a malcontent to anything US dominated, is settling its oil exposure to Russia in various ways including crypto and has recently traded with Brazil in Real and Yuan. Syria, Iran and North Korea all feel the heavy hand of sanctions as the easiest way for punitive actions to be enforced is by linking national, corporate or personal prohibition to the dollar.

Weaponizing the ‘global reserve currency’ in this way has seen nervousness and a greater inclination to ponder alternatives from nations who not only feel this is an abuse but are now questioning exposure to a currency that they have no control over. During April’s visit to China, President Lula of Brazil was quoted as saying, “Every night I ask myself why all countries have to base their trade on the dollar […], who was it that decided that the dollar was the currency after the disappearance of the gold standard?” Even though everyday Americans can claim no benefit from the global use of their money, they are cossetted from inflationary foreign exchange pressures and when negotiating international deals, they do so with ‘home’ currency advantage, another gall for the likes of President Lula.

Research from Bloomberg shows Mexico, Saudi Arabia, Canada, Australia, Brazil, Japan and South Africa all have over 30% of their corporate debt issued in US Dollars. The recent debt-ceiling farrago would surely have caused consternation even among the professional risk takers that oversee this exposure. What it must feel like in nation states exposed daily to the dollar and by default, the shenanigans of political Tomfoolery on Capitol Hill are anybody’s guess, but it is a gift for those that champion alternatives.

According to the IMF the dollar’s share of international reserves fell from 73% in 2001 to 58% at the end of 2022. ‘Dedollarization’ has in some ways already happened. However, JP Morgan argues that there has been transfer into sovereign wealth fund portfolios and the decline has been offset. Finding alternatives will prove extremely difficult.

The Euro now accounts for just over 20% of reserves but is becoming less attractive because of the fractious nature of its sovereign components. As much as China pushes for trading in Yuan, its currency only makes up some 2.5% of international reserves and is just not liquid enough. Some champion crypto, but its recent dramatic fall from grace, its association with rum dealings and a lack of transparency means it is likely to only ever be the reserve currency when humans can travel to Mars in a few days. Therefore, with flippancy aside, it does not appear that anything will be able to usurp the all-powerful greenback for some time to come.

King Dollar is here to stay, at least for the foreseeable future, and why this week’s FOMC and its decisions remains the most important of all the Central Banks meetings, even though any subsequent currency shift will likely antagonise the greenback’s detractors and their calls for something else.

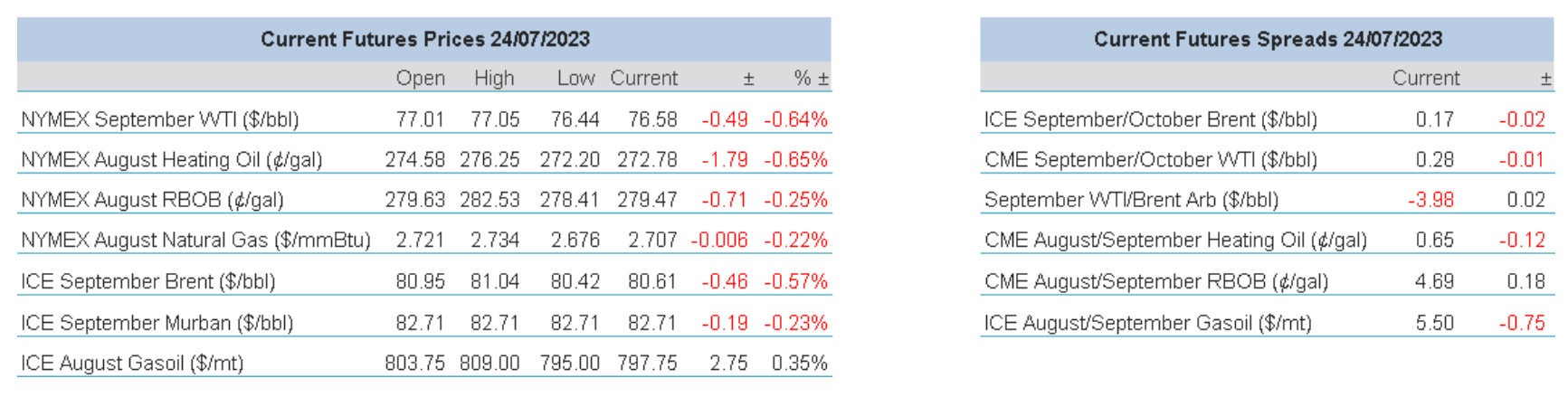

Overnight Pricing

24 Jul 2023