Questionable Price Support

Last year was characterized by a healthy dose of reluctance to react to seemingly positive developments as every attempt to push prices higher brought out willing sellers. Yesterday’s performance mirrored this attitude. A variety of price-supportive factors pushed oil prices to peaks not seen since last October. This move north was predominantly led by the CME Heating Oil and the ICE Gasoil contracts because colder weather and falling temperatures encourage demand to grow for distillates. In coming weeks drawdowns in distillate inventories cannot be ruled out in the northern hemisphere. Confusion and contradicting reporting about re-thinking punitive US tariffs by the incoming Trump administration sent the dollar lower also aiding oil’s fortunes in the early part of yesterday’s session. The increase in Saudi official selling prices to Asia next month and the possible introduction of further US sanctions on Russia also played part in the jump.

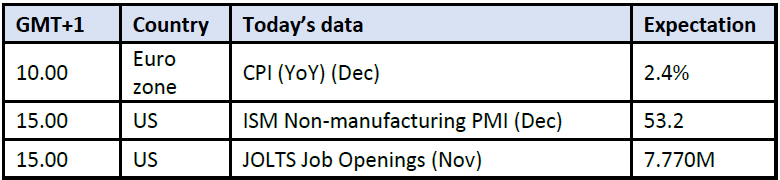

A reality check of very tangible economic headwinds then came as Germany is seemingly unable to rein in inflation, the eurozone composite PMI in December stayed under the critical 50 level and US factory orders declined in November. A data tsunami on the US labour market and the service and manufacturing sectors due out later this week will provide a fresh health check of the US economy. Whilst renewed strength cannot be ruled out in the immediate future should freezing temperatures persist, the sudden change in sentiment yesterday afternoon insinuates that a protracted rally will be difficult to sustain without fundamental changes in economic prospects or the global oil balance.

Wars, the Trump Presidency and Loosening Oil Balance

Predicting the future is always an arduous task, more so now than 5-10 years ago. One needs to recognize that the future is not shaped by one big thing, but reality emerges from the interactions of many agents and forces, including luck. The result, therefore, could easily be unpredictable and unexpected. Attempting to envisage the major driving forces of 2025 is easy but assessing their effects is difficult. What seems certain is that the new year will be impacted by acrimonious global politics and wars, an ambiguous global economy mainly because of the incoming old/new US president and a looser oil balance than in 2024 despite global oil demand growing faster than last year.

It has become obvious in the past few years that the US global dominance has diminished and the battle for influence will continue in 2025. With the Trump presidency fast approaching, economic wars between the US and its adversaries and allies alike will most plausibly be re-ignited as discussed below. Very real military wars, such as the Ukrainian conflict and the Israel-Palestine tension, on the other hand, might move closer to being resolved with the help of the incoming US president. De-escalation is more plausible in the Near East as Israel is edging ever so closer to its ultimate target of obliterating Hamas and Hezbollah. Of course, the million-dollar question is the fate of Iran. Israel feels emboldened and if it decides to destroy Iran’s nuclear capabilities, with the blessing of the US, Iranian retaliatory measures will be inevitable with the potential closure of the Strait of Hormuz. It is the less likely scenario, consequently, our view is that no oil price support will be forthcoming from the region.

Donald Trump pledged to end the Ukrainian crisis in 24 hours. Whilst the promise was nothing more than campaign charade, with his help a peace deal between the warring parties could actually be envisioned. It might come in the form of Ukraine agreeing to give up its already occupied land in return for security guarantees from Europe and the US. The promise of NATO accession, even if it is far in the future, will be met with strenuous Russian resistance and might be a tall order. Without it, however, any peace deal would be more like capitulation. In any case, the pre-2022 status quo in energy trading between Russia and its former partners will not be re-established.

The four major cornerstones of the Trump presidency will be taxes, deregulation, migration, and trade. He promised to ‘end inflation and make America affordable again’. His economic policies might achieve the opposite result. His plans to extend tax cuts enacted in 2017 and lower corporation tax are designed to support the domestic economy but financing it could prove more than tricky. Cracking down on illegal immigration might drive up wages and lead to inflationary pressure. His deregulation efforts spread from cryptocurrencies to the banking sector and oil exploration. Short-term impacts might be positive as compliance costs are reduced but the long-term implications, in the form of environmental damages and financial instability, will be hurtful.

Donald Trump’s trade tariffs will also probably do more economic harm than good. He threatens to impose a 60% on Chinese goods and 20% on any other countries, including its neighbours, Mexico, and Canada, which runs a trade surplus with the US. This protectionist measure is aimed at promoting domestic manufacturers, however, just like during his first presidency, consumer prices will rise, and it is the American consumer that will ultimately pay for these tariffs. The US stock market could continue to march higher in the first half of 2025 but start retreating later as inflation rises again.

The diverging views of global oil demand will prevail throughout the year. OPEC puts 2025 demand at 105.28 mbpd whilst the IEA at 103.85 mbpd. This gap of 1.43 mbpd compares with the difference of 1.05 mbpd for 2024. Although oil consumption will reach another record high in 2025, the increase in non-OPEC+ supply will be more than able to match this growth. Demand for OPEC+ oil should fall year-on-year. Even if the producer alliance sticks with its current output level and does not start to re-add barrels to the market, worldwide oil stocks are set to build implying a Brent price below the $79.86/bbl average seen in 2024. Hence the view that rallies towards the $80/bbl mark are seen as selling opportunities.

Overnight Pricing

07 Jan 2025