Rallies are from Transitory Headlines, but Sentiment has Changed

There is no point in trying to get away from the fact that last week's oil performance was anything less than terrible. M1 WTI finished down $5.88/barrel (-7.99%), Brent $7.74/barrel (-9.82%), Heating Oil 13.65c/gallon (-6.06%), RBOB 31.57c/gallon (-14.27%) and Gasoil $46.00/tonne (-6.6%). All contracts made new 2024 lows and in the case of the US products, prices were printed that have not been seen since the pandemic year of 2021. Primed with a recent spate of poor global economic indicators for manufacturing and industry and a growing numbness to all that is going on in the Middle East, the fallout was ignited by the inauspicious performance in the wider suite highlighted by the setback seen in darling Nvidia, growing unease as to what central banks were prepared to do and the idea that September would hold with the notion that it is a profit taking month. Not even a hastily backtracking by OPEC+ in delaying the reintroduction of 180kbd of production per month from voluntary cuts was enough to appease the oil price funk. Even the rapidly retreating US Dollar gave little support.

Oil prices are in a downtrend and there is a shift in sentiment and narrative. Scare bears rule the airwaves with a succession of banks downgrading their calls for not only 2025 prices but demand for the remainder of this year. China's economic woes are well recorded, including another bout of poor inflation metrics this morning, but there have been opinions on the dangers of a US recession; the very idea of which will send those of a bull bias to metaphorically 'stay hidden in the weeds'. Evidence of this comes from how net-long positions in Brent and WTI have fallen to the lowest since 2011 which is when records began. A small recovery in prices is underway this morning, inspired by hurricane warnings that might threaten the US Gulf Coast, but the wider conversation remains on where demand will come from and what OPEC+ can do. At the APPEC gathering in Singapore, and according to Reuters, S&P Global have stated during a conference that it believes OPEC and allies will increase production in 2025 with many of its members unable to resist pressure to pump, presumably from domestic economic considerations. We touch on some of the issues confronting OPEC below, but it will be theme returned to again and again over the next few months as to how the cartel will be able to respond in what looks to be a very tricky time slot for oil prices. Little support for oil is envisaged from this week's macro suite data. The US CPI is likely to show a good reading, as in a reduced rate, but will that boost the possibility for a double decker FED cut? Unlikely, and what with an encumbered ECB being able only to cut by 25-basis points this week, the writing of conservative central bankers is on the wall.

Happenstance serves cheaters well, but OPEC+ is being undermined

Kazakhstan by its own admission has been overproducing for all the year and has time and again pledged that it will compensate for doing so by reducing production. From January 2024 to July of the same year, and via data from OPEC collated by independent sources, overproduction amounted to some 699kbpd. It outlined a convening plan to redress the situation through the balance of the year, with much of it being equalized during the month of October. The program’s outstanding monthly ‘payback’ was to be 265kbpd during the first month of the fourth quarter. Convenient then that in the very same month the Asia country has announced maintenance and severe production reduction at the Kashagan oilfield. The impairment of around 450kboe/d will amply cover the promised compensation and this is despite a request for a delay due to an impending natural gas shortage.

When measured during the same period Iraq had overproduced by 1.44mbpd. Despite a spate of ‘mea culpa’ and almost monthly promises of bringing itself back into line with obligations it often hides behind the things it is not in control of. This is in reference to the semiautonomous region of Kurdistan and its continued ability to export to Syria and Turkey despite the closure of the Ceyhan pipeline. It has at last adhered to quota last month but comes at a time when it renegotiates ‘service’ contracts with foreign investors who at present are rumoured to be reluctant to continue with current flat rate deals and are insisting on profit sharing partnerships. These negotiations started when Brent was over $10/barrel higher than at present and investors are presumably playing hard ball. It is unprovable to assume that this has a direct affect, but anything that can give Iraq some credibility back within the Declaration of Cooperation by possibly delaying production is welcome in Baghdad. Yet, the Kurdistan issue will continue to haunt Iraq’s efforts to be part of team OPEC+. According to Argus, the KRG is producing 350kbpd which is three times the Iraqi government’s estimate. Confusion reigns and at present it suits Iraq.

By the measurement of S&P Global, in the first six-months of 2024 Russia produced 480kbpd over its output target rate. In that time, it has included product exports, excluded product exports, blamed data defects, supply schedules and term deals. Last week Deputy Prime Minister Alexander Novak again insisted that Russia had complied with its OPEC+ quota for August. Talking to Interfax he said, "We should have been complying. At least, data to that effect were available at the end of the month." Yet only a week before that Russia’s Statistical body Rosstat announced that it would no longer publish monthly data production of diesel fuel, fuel oil, liquefied propane and butane. This is in addition to the halting of gasoline numbers at the end of May. It will continue to produce crude numeric, but how the market can trust the fidelity of the feedstock figures must be impinged by a lack of product data.

None of this comes as much of a surprise. The idea of cheating within OPEC+ has become endemic and the oil world shrugs its shoulders at hitherto repeating promises of compliance from the usual suspects. The agreement of a holstering of the 180kbpd per month cut reversal was a small but limited gesture of unity. The reaction of oil prices speaks volumes in how it was received. The market smells trouble within the cartel and the misrepresentation has finally come home to roost. There are so many things to consider for OPEC’s kingpin Saudi Arabia, the author of the current cut regime and de facto leader. In the world of football, when a team is doing poorly, and the manager is blamed it is often warbled by so-called pundits that ‘they have lost the dressing room’. Whether or not this is true of Saudi Arabia remains to be seen, but with such an unruly and parochial group of players one does indeed wonder how long this status quo can last.

Overnight Pricing

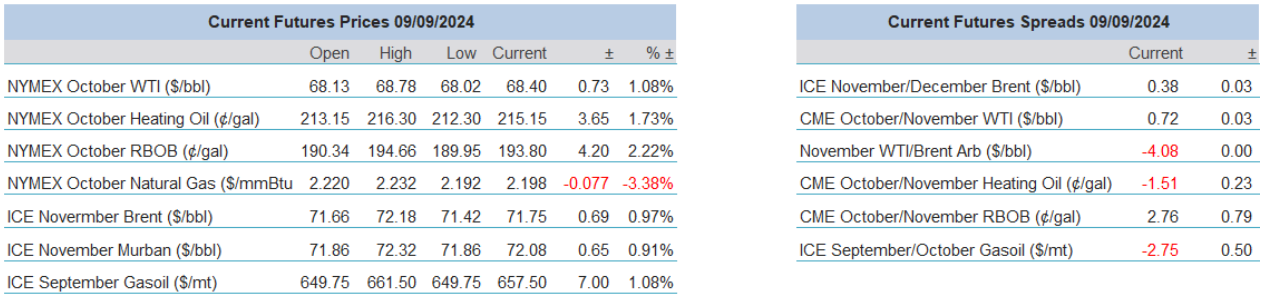

09 Sep 2024