Rate and Supply Cuts

Front-month WTI ended last week 5 cents/bbl higher and its European peer gained 9 cents/bbl. These seemingly lukewarm performances imply equilibrium in our market where supply and demand are in harmony, whether it is perceived or actual. The broadly unchanged settlement prices, nonetheless, hide an active week, the first half of which took prices to their highest levels since November last year only to experience a somewhat perplexing retreat from Wednesday onwards on comparatively light volumes.

The pullback was all the more mystifying considering a brighter global economic outlook. Additionally, the well documented hardship Russian refineries are facing as a consequence of continuous Ukrainian drone attacks has led to a considerable drop in utilization rates inevitably impacting the country’s product exports providing further upside impetus. The week started on the front foot with improved Chinese factory and retails sale data. The weekly EIA report in US oil inventories was also deemed supportive as gasoline stocks declined much more than anticipated and total commercial oil stockpiles, which make up around 45% of OECD inventories, thinned over 6 million bbls during the week ending March 15.

It was the week of central banks and whilst only two of them lowered the cost of borrowing the general narrative suggested that the rest would follow suit shortly implying a successful fight against inflation. Swiss and Mexican central bankers cut benchmark lending rates by 25 basis points with their Australian and Norwegian colleagues together with the Federal Reserve and the Bank of England leaving the cost of borrowing put but insinuating auspicious economic conditions to join the trailblazers further down the line. By unwinding its ultra-loose monetary policy, the Bank of Japan explicitly declared a victory over deflation that haunted the country’s economy for the past 30 years. It is, most plausibly this generic upbeat view on inflation/deflation that led to a bout of long liquidation in oil in the latter half of last week, simply because the dollar has strengthened. Given the favourable economic backdrop, relentlessly ascending equities and the widely expected scarce availability of Russian refined products the downside correction the market underwent in the second half of last week could turn out to be a temporary phenomenon. If this observation is accurate then the salient question is how high oil prices could climb in the medium-term.

Finite Upside Prospects

Although the retracement towards the end of last week might have been somewhat puzzling the general trend is still firmly up; Brent has risen from $72/bbl back in December last year to almost $88/bbl last Tuesday. Recession has been, it appears, successfully fought off, inflation is under control, the global economy is set to expand, and developments both on the supply and the demand sides of the oil coin foretell depleting global oil inventories this year. Yet, we believe, there are warning signs flashing and the current snapshot does not justify unconditional strength in oil prices.

The major geopolitical hotspots are around pivotal oil producing regions. The Middle East conflict, despite the suffering of Palestinians, elusive truce and the ceaseless Houthi attacks on commercial ships in the Red Sea, has not resulted in actual supply disruption. In Russia, the Ukrainian assaults on oil infrastructure are undeniably causing anxiety amongst oil market actors but considering the US pressure, as reported in the FT last week to halt the attacks, they might come to an end in the not-so-distant future, especially if the US push is coupled with financial support. Barring any unexpected supply side development, geopolitical tension adversely effects geoeconomic and last Friday’s abhorrent act of terrorism on a Russian concert hall will do nothing to cool the worryingly high temperature. One can only hope that it will not be used as a subterfuge to accuse Ukraine for the tragedy. The tacit advance of nationalists, isolationists and autocrats is another ominous sign of the headwind the global economy needs to deal with, especially if the far-right gains considerable ground in the upcoming EU elections and if Donald Trump wins the US elections in November. As anti-globalists go global, the economy suffers.

Since the dip in equities last October the Nasdaq Composite Index has shot up 30%, the MSCI-All Country Index 24% and the Shanghai Composite Index less than 4%. It is the US that is fueling the optimism because of the AI craze, the generous post-pandemic stimulus and savings and the fact that the historic jump in interest rates has not affected borrowers since low rates had been locked in prior to the monetary tightening. No wonder that the US economy managed to achieve the impossible triple objectives of reining inflation in, keeping unemployment low and avoiding recession. When savings dry up and current loans expire the landscape could be very different, especially if it coincides with the bursting of the AI bubble. Impending rate cuts might not deliver the desired effect.

And finally, over to oil balance. Demand for the black stuff is at record highs as the recovery from the health crisis and the inflation-induced dip continues. It is, however, noticeable that the 2024 global oil demand forecasts have been broadly stagnant over the months. The IEA has revised it up by a mere 50,000 bpd since it published its first estimate, the EIA and OPEC by around 200,000 bpd. The Chinese economy, sluggish manufacturing, the abyss its property sector is staring into and Chinese consumers choosing saving over spending do not bode well for oil demand growth in the world’s second largest economy either.

The mediocre upgrades in global oil demand are more than countered by the optimistic views on non-OPEC supply. The comparable upward revisions were 2 mbpd (OPEC), 2.08 mbpd (IEA) and 2.48 mbpd (EIA). The call on OPEC has been constantly revised down for this year. No surprise then, that the producer alliance has been reluctant to taper with its ambitious output policy and left the production quotas in place throughout the first half of this 2024. By doing so, it has created a significant buffer that can be used in case of a genuine supply shortage.

This comfortable spare capacity from OPEC is one of the three trump cards when arguing against a sustained rally over 90/bbl. The other two are the US elections and the potential of re-igniting inflationary pressure. The US election promises to be the most brutal and repulsive one in the country’s history and any jump in domestic retail gasoline prices will be met with fierce countermeasures from the incumbent administration. And should oil prices spike considerably in the foreseeable future for whatever reasons, concerns about renewed upward consumer price pressure with all the monetary reverberations will make investors hesitant to commit themselves impulsively to the upside.

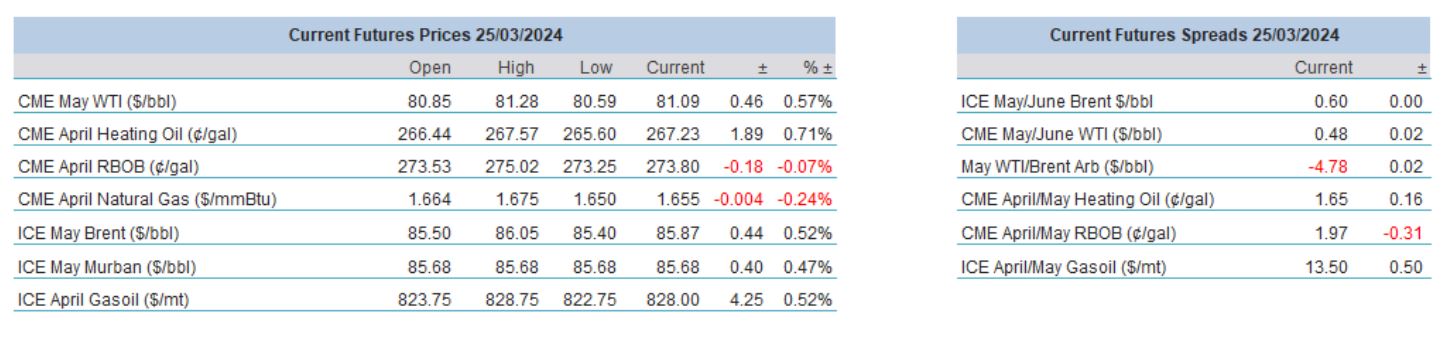

Overnight Pricing

© 2024 PVM Oil Associates Ltd

25 Mar 2024