Reciprocal Attacks in Ukraine and Russia Intensify

We have long held the view that, for domestic political reasons, namely preventing US retail motor fuel prices from rising and inflationary pressures from re-emerging, the US Administration is unlikely to impose sanctions on Russia. There appeared to be no reason to revise this outlook even after last week’s US–Russia summit, which confirmed that Vladimir Putin’s territorial demands and security concerns, including Ukraine’s potential NATO membership, remain as firm, if not more entrenched, than ever. Yet, Washington’s conciliatory stance towards Moscow might just be shifting.

Shortly after Donald Trump’s re-election, the President expressed interest in involving US companies in rare earth mineral extraction in Ukraine. One of the benefits of such cooperation, he stated, is that “We will be on the land, and that way there is going to be automatic security because nobody is going to be messing around with our people.”

According to the Financial Times, Russia’s latest drone and missile strikes hit a US-owned consumer electronics factory in the western part of the country. Whether this triggers a US response remains to be seen; nonetheless, oil prices received a boost, further supported by Ukrainian retaliatory drone attacks on several Russian refineries. The two major crude oil contracts ended the day around 90 cents/bbl higher. The refinery attacks, however, provided more meaningful support for products and recent builds in gasoil/distillate inventories in Singapore, the ARA region, and the US have, for now, been overlooked.

Global business activity showed encouraging results, except in Japan, where factory activity declined. India’s manufacturing and services sectors are booming, as are Europe’s, supported by a rise in new orders. In the UK, a stronger-than-expected Composite PMI offset the surprise increase in consumer prices, while in the US, it was the manufacturing sector that lifted business sentiment. Despite this broadly supportive set of data, equities closed lower, weighed down by the tech sector as investors continue to reassess whether the recent enthusiasm over AI was justified or misplaced. Jerome Powell’s speech today (10 am ET) will be another factor for markets to digest in their ongoing attempt to find some method in the madness that defines today’s investment environment.

US Oil Snapshot

Uncertainty lingers everywhere, and oil is no exception. Forecasts, and sometimes even aftercasts, show yawning gaps. The most cited example is the divergence between OPEC and the IEA on the global oil balance. While the future may be inherently unpredictable, it is still useful to compare the present with the past. Since the US is both the world’s largest oil producer and consumer, below we take a close look at weekly data on demand, production, and inventories, published every Wednesday by the Energy Information Administration (EIA), the statistical arm of the US Department of Energy, complemented by a glance at its monthly Short-Term Energy Outlook.

US oil demand, as measured by products supplied by domestic refineries, remains healthy and encouraging. It was estimated at 21.50 mbpd for the week ending August 15, up 150,000 bpd week-on-week and more than 1 mbpd above the comparable period in 2024. The figure also stands 350,000 bpd above the long-term seasonal norm. Curiously, gasoline was not the main driver, with proxy demand below 9 mbpd last week despite the peak of the summer driving season. Distillates showed stronger support, just under 4 mbpd, seasonally high and above the 5-year average. The real outlier, however, was the “other products” category, at 5.8 mbpd supplied, over 400,000 bpd higher year-on-year and nearly 600,000 bpd above the 5-year mean.

Reflecting robust consumption, refiners are running nearly flat out. Utilisation stood at 96.6%, well above last year and the 5-year average. Operations were particularly intense in the Midwest, where runs have exceeded 100% for two consecutive weeks. Weekly crude oil inputs reached 17.21 mbpd, up 500,000 bpd from the same week in 2024 and 600,000 bpd above the 5-year average.

On the supply side, crude availability looks ample but may be misleading. Last week’s output of 13.38 mbpd was just shy of June’s record 13.44 mbpd, and comfortably above both year-ago and seasonal levels. Yet, as discussed in Wednesday’s report, growth is slowing, rig counts are declining, and producers do not anticipate a significant step-up in production.

Import and export figures reinforce the picture of tightness. Net crude imports continue to fall. They were at 2.12 mbpd last week, well below both annual and long-term benchmarks. The key driver is surging exports: nearly 4.4 mbpd of US crude was shipped abroad last week, above both last year’s level and the 5-year average, underscoring sustained overseas demand.

Product exports are also elevated. The latest weekly reading of 5.1 mbpd brings the year-to-date average to 4.97 mbpd, the highest annual pace so far. This confirms a five-year trend of progressively rising net product exports.

The combined effect, healthy demand, stagnating production, falling crude imports, and rising product exports should entail depleted inventories. Crude and distillate stocks are both below year-ago and 5-year averages. The distillate shortfall is particularly striking, likely linked to sanctions, Middle East turbulence, and OPEC+ production constraints (which are now being gradually unwound). Gasoline stockpiles, by contrast, remain comfortable. Overall, commercial oil inventories are 1.4% lower than last year but marginally above the 5-year norm.

Depending on one’s stance, the picture can be cast as bullish or bearish, though an unbiased reading leans slightly toward the former. The EIA’s monthly outlook suggests crude output will barely expand in the near term, while inventories in key categories, such as crude oil, gasoline, and distillates, are expected to build between 2Q and end-2025. US demand growth, however, looks muted at just 50,000 bpd for July–December. Taken together, the outlook points to oil prices remaining bound by the range of the April low of $55/bbl and the July high of $70/bbl (WTI basis) through year-end.

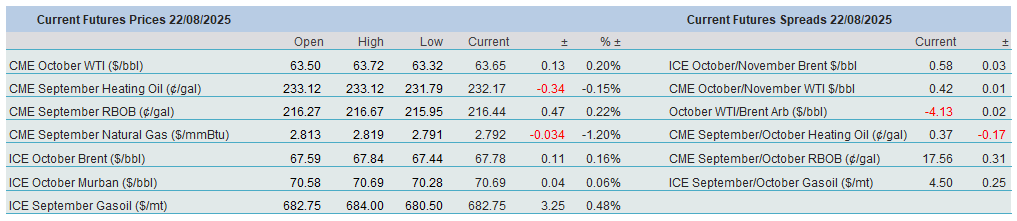

Overnight Pricing

22 Aug 2025