Red Sea Worries Drone On

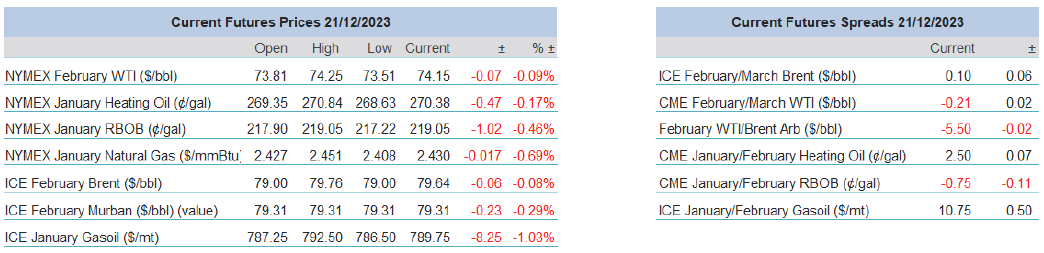

Oil concerns itself with the state of US production this morning and enters the day less buoyant than that of late. The news that the US is now the world's largest producer is backed up by an increase of production to 13.3 million barrels per day, according to the EIA, which is up 200.000 barrels on the previous week and is the largest weekly increase in EIA data history. It is often the case that US inventory data takes a little time to be absorbed, and if it were not for the current anxiety playing out in the Red Sea, the builds across the board might have put a sword to the current rally. Although refinery utilisation rose 2.2% and refinery runs were up 403,000 barrels per day, none of the main inventory constituents registered draws. Crude built by 2.9mb, Gasoline by 2.7mb, Distillate by 1.5mb and yet again more oil poured into the storage hub at Cushing, Oklahoma to the tune of 1.7mb.

With such a heavy load of US crude reported in increased measure, one can only assume that the market remains edgy in regard to supply diversion or even hiatus caused by the Houthi attacks on shipping. According to Reuters yesterday, the situation remained rather unclear on the when and how many ships might be dispatched by the naval coalition to thwart the drone attacks, but the lack of clarity and little presence of counter measures so far has continued to see shipping companies not only diverting goods around the African Cape but even considering alternative transport measures to get customers wares to market. Commenting on reports that the US among others were considering strikes on Houthi bases within Yemen, Iran poured flames on geopolitical tension by saying such attack would be met with retaliation. Until the naval coalition, interestingly without Saudi Arabia's membership which adds to the intrigue and concern, shows its teeth, the Red Sea situation will continue to have an outsize influence on oil players' thinking.

Copious Supply

In the last two reports we laid out the potentially price supportive impact central banks might have on oil prices going into 2024. Perceived weakness in the dollar, coupled with gradually weakening real interest rates ought to stimulate demand, however, we concluded, Chinese economic headwinds together with US excess saving drying up might cap the move north. Gently encouraging demand side factors then have to be set against supply side developments. They were rather disappointing in 2023 and no marked changes are impending for the new year.

Looking at this year’s oil balance, especially the second half of 2023, it could be somewhat perplexing to observe that front-month Brent, the European benchmark, is nearly $20/bbl below the October summit of $97.69/bbl. After all, global oil consumption is reaching record highs. Although forecasts widely swing, there is a conspicuous consensus that oil consumption is the highest in the incumbent quarter and will keep rising throughout 2024 averaging at yet another annual record next year. The IEA and OPEC, that have recently locked horns about the oil balance agree that 2024 should see depletions both in global and OECD inventories (albeit there is an extreme divergence in absolute numbers). Throw in the announced cuts of the OPEC+ alliance and one could reasonably foresee ostensibly more elevated price levels.

Yet, a reassuring rally fails to materialize. We discussed the headwinds the demand side of the oil equation faces but equally, there are stumbling blocks from the supply side, too. The producer group has reduced its official production level by more than 5 mbpd since last year. This is an enormous number. In October 2022 they agreed to cut production by 2 mbpd. It was followed by a further 1.6 mbpd slimming in April this year. Saudi Arabi and Russia volunteered to take an additional 1.5 mbpd off the market with the total amounting to 5.1 mbpd.

Only that it has not worked in practice. The IEA puts 2H 2022 OPEC+ crude oil supply at 44.6 mbpd. It is seen at 42.9 mbpd during the corresponding period of 2023. The difference is a far cry from the 5.1 mbpd announced cuts. Energy Intelligence comes broadly to the same conclusion. They estimate that the group’s output of 43.1 mbpd in October this year was a mere 1.5 mbpd less than the preceding year. Whilst Saudi Arabia has been the vanguard in the attempt to tighten the market those with exemption were the chief laggards. Iran, Libya, and Venezuela added a combined 700,000 bpd of production between 2H 2022 and 2H 2023 whilst Kazakhstan also ramped up output by 100,000 bpd. Those with no output ceilings, of course, cannot be held responsible for not chipping in but that does not change the fact – their understandable action has greatly contributed to the recent decline in oil prices. It is also imperative to point out that with the Middel East heavy weight producers being as disciplined as they are the supply cushion or spare capacity of around 5 mbpd acts as an insurance in case of unexpected disruptions – hence the lukewarm reaction to the Houthi attacks on commercial vessels in the Red Sea and to the re-calibration of shipping routes.

Then there is the non-OPEC+ group. It has become blatantly evident that predictions of stuttering growth in US shale production after the Covid-19 pandemic have been misplaced. Weekly EIA data puts total domestic output over 13 mbpd. It is expected to average 12.93 mbpd in 2023, an annual growth of 1 mbpd and increase by another 180,000 bpd in 2024. Total non-OPEC+ production will grow 3.5 mbpd between 2022 and 2024 – 2.2 mbpd this year and 1.3 mbpd next, greatly aided, apart from the US, by Brazil, Guyana, Norway and possibly Canada. The jury is out whether global oil demand expansion will exceed that of non-OPEC+ supply growth next year, but ample supply outside the producer cartel will ensure sub-$100 prices in 2024. The Saudi determination of balancing the market is the only thing that keeps prices from falling considerably and one can only speculate how long the Kingdon’s patience will last with others are riding its gravy train.

Tamas Varga

Overnight Pricing

21 Dec 2023