Relief, But Not Full Redemption

Oil prices have at last found some reprieve due mainly to the higher draws in US inventory and OPEC news. The EIA/DOE report show US Crude stocks fell by 515kb last week, Distillate by 1mb, but with arguably the biggest market reaction coming from the Gasoline draw of 2.7mb. An odd time in the year for Gasoline demand but its proxy for measure, Gasoline supplied, increased to 9.2mbpd on the week from 8.8mbpd. Within the many data that came to light yesterday, and giving a kicker to the Gasoline demand numbers, was the US Commerce Department's advance estimate of third-quarter GDP. Although the annualized figure of 2.8% growth was under the 3% forecast, disappointing the macro suite, there remains much strength in the US economy with investment in business and equipment remaining at a high pace. Outside of the US, OPEC+ have floated an idea across wires that it might not bring back 180kbpd of oil shuttered as part of the voluntary cuts in December. The combination of all the above have served prices well, but one must wonder if the muted overall response is less than what 'sources' of OPEC that leaked the idea were looking for. Such divulgences are probably set to continue across November as we head to the full OPEC+ ministerial meeting due on December 1.

The oil and auto industries continue to rethink the future

It feels as if oil and gas companies among others charged with being polluters, on an increasing regular basis, are abandoning oil, gas and emission reductions. Those with strong opinion from the green lobby no doubt dwell on collusion, but energy and car companies alike can only respond to consumer behaviour, serve the markets they are in and ensure their own profitability. It is probably fair to say that much optimism was shown by auto makers forecasting great sales for EVs and courting high ambition for battery powered vehicle growth. For Ford, Volvo, Mercedes-Benz, General Motors et al, the perceived markets have just not turned up. Reasons abound, lack of range on cars and sparsity of charging infrastructure may well be blamed, but consumers hate to be dictated to particularly by price, and the eventual outcome is a more diverse offering of cars with internal combustion, hybrids and of course EVs, serving as choice. Sadly, the cost of enforced ideology is the current plight of Volkswagen. Such is the pressure on the company that it is now facing closing three of its plants and sacking thousands of employees. The inability to compete with local EV brands in China is cause enough, but so is the much higher manufacturing costs of producing battery powered cars.

The struggles in the auto industry have not been missed by massive oil companies, and rather than getting to the crisis point seen in Wolfsburg, home to VW, energy giants are shifting quickly. Earlier in the year Shell chose to retire its 2035 target of 45% reduction in net carbon intensity. It also reduced the percentage of reduction in carbon intensity in the preceding years to 2030 describing the decision as a change in business priorities. Pointing out that the rate of decline in demand for fossil fuels was dropping at a much slower rate than previously thought, investment in oil and gas was driven by consumer trends and while it maintained plans to keep investing in low-carbon energies, it was wrestling with value and has acted accordingly as all such huge Public Limited Companies must when protecting shareholder interest.

In August Exxon also suffered a bout of realism when it admitted that achieving net-zero emissions by 2050 becomes harder every year as demand for energy, no matter the form, continues to rise. Instead, it predicted that oil demand will stay above 100 million barrels per day through 2050. Demand will be high enough that failing to invest now in new fossil fuel projects would be “catastrophic,” the oil major said. Without new investment, Exxon sees oil supply falling 70% to 30 million barrels a day by 2030, sending crude prices soaring and decimating the global economy.

On Tuesday, BP reported the lowest third quarter profit for 4 years. While the slowdown in China, lower crude prices and the issues with refinery margins seem to be taking much of the blame, there has been for some time growing investor anxiety in how BP, compared with others, had accelerated energy transition plans. At the start of this month, Reuters quoted sources that BP were about to abandon its pledge to decrease oil and gas production by 2030. This ties in with renewed thinking from the new CEO who has since moved away from renewable expansion overseen by the previous regime. Murray Auchincloss told Reuters on Tuesday that BP will focus on value, driving home earlier-in-the-year assurances of a concentration on high-margin businesses.

There can be little doubt that energy transition is amongst us and set to continue. It would be head in the sand not to think so. However, if Exxon, Shell and BP, the fourth, fifth and eighth largest oil companies foresee an elongation in the process. If the auto industry continues to have a change of heart when offering vehicle choice to consumers. Wars in the Middle East, divisive US elections, refining margins and arbitrage will have a place in oil trading to price themselves for some time to come.

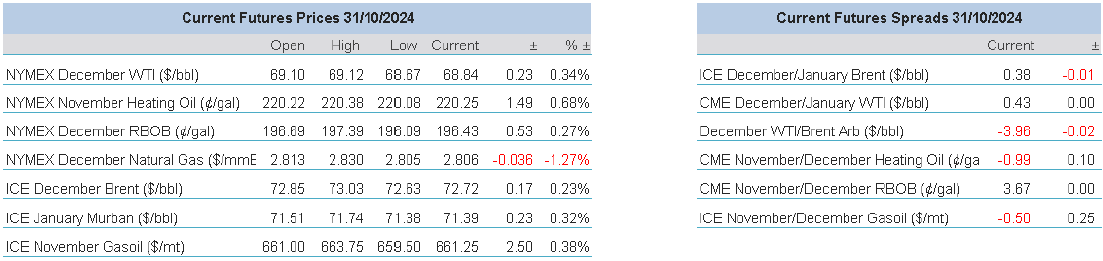

Overnight Pricing

31 Oct 2024