Risk is Fashionable

Even by current standards there was a lot to ponder, evaluate and assess last week. Just think of the abundance of national elections, the variety of PMI releases, the smorgasbord of US job data and the copiousness of crucial US stock readings. Weekly settlement prices suggest that investors liked what they saw in spite of the pre-weekend profit-taking in oil, which continues this morning on the prospect of the resumption of ceasefire talks between Israel and Hamas and the closure of Texan ports because of Hurricane Beryl. The consensus is that both the global economy and the international oil balance is supportive, consequently risk assets have been back in demand. The MSCI All-Country Index gained 2% last week, the Nasdaq Composite Index fared even better as the tech craze continues unabated. The dollar weakened. WTI and Brent returned 1.99% and 1.81% respectively but an even more salient development was the tangible jump in crack spread values.

In the UK the Labour party swept the floor with and obliterated the Conservatives and won by landside. Sterling strengthened. As for the global economy we might expect an EU-friendly government with the possible dismantling of trade barriers although the idea of re-joining the common market is as remote as Dondald Trump being incarcerated. In Iran, the surprise win of reformist Masoud Pezeshkian sets him on collision course with the hardliners, including the Islamic Revolutionary Guard and he faces the Sisyphean battle to better his county’s relationship with the West and ultimately end nuclear sanctions. In France, not only did the far-right fail to secure outright majority but they came third in the run-off election after an unexpected and emphatic leftwing victory. A hung parliament will mean cumbersome governing, nonetheless on a European level, given the spectacular rise of the anti-EU parties, the result is probably the least detrimental.

My esteemed colleague outlined the dire state of the global manufacturing and service sectors. Depending on one’s character and approach, it can be interpreted as concerning (economic prospects are disheartening) or conducive (recent increases in borrowing costs did the job and now it is time to stimulate growth by cutting rates). It is something the US job market would agree with. Initial claims for state unemployment benefits rose in the latest week and private sector hiring was less fierce than anticipated. Friday’s nonfarm payroll data came in above expectations, but joblessness rose to 4.1%, the highest since November 2021. Finally, robust weekly US oil statistics from the EIA provided an additional dose of fuel, or should we say gasoline, to the bulls’ fire. Drawdowns across the board, including the most important motor fuel, insinuated that the long-awaited summer demand increase has arrived.

Whether this is the case or not will surely be the topic of this report in weeks to come. What seems unequivocally obvious is that the two most relevant ingredients in maintaining or even brightening the present buoyant mood are the dollar and the US gasoline landscape.

The Dollar is still Strong

To begin with the dollar, its exchange rate is influenced by a wealth of factors, and it has a profound impact on macroeconomic developments and on oil demand. The higher the US interest rates or the lower the cost of borrowings in countries that make up the dollar basket, the stronger the greenback. The Swiss National Bank has cut its rate twice this year and the ECB also slashed 0.25% off it in June. Another two central banks, the Bank of Canada and the Swedish Riksbank have lowered interest rates this year, too. It is four out of the six components of the dollar index, whilst the Fed employs a ‘wait-and-see’ attitude. As a result, the dollar index has gradually and reliably strengthened this year. US inflation, both headline and core, has been moderating but not sufficiently enough for the Fed to join the party and reverse the trend. The weakening job market is getting ever closer to warranting the first rate cut but whether it will come in September remains to be seen. Such a move, just before the November presidential election, would go a long way to weakening the dollar. Conversely, should the Bank of England, or any other central bank, decide to cut rates the dollar would receive a fresh boost. Central banks’ action and oratory will be as salient during the summer as ever.

US Gasoline Stocks are still High

The US is the world’s biggest gasoline consumer. Demand for this refined fuel gets a seasonal boost at the beginning of the summer driving season, which traditionally lasts until Labour Day in September. Last week’s plunge in US gasoline inventories was a welcome development but further unambiguous signs are needed to maintain the momentum. As of the week ending June 28 gasoline stockpiles, albeit showing a deficit of 0.9% to the historical norm of the 5-yer average, were some 5.6% higher than during the corresponding week in 2023. It is worth recalling that a year ago CME RBOB prices were lower than now but started to rally in the second half of July eventually peaking just below $3/gallon at the end of the month. The RBOB/WTI crack spread peaked at $44/bbl at the end of July 2023. It is currently $25/bbl. To repeat the same feat this year inventories must keep depleting and they will predominantly do so if consumption rises. Will it? Proxy demand data indicates that US gasoline consumption jumped 500,000 bpd last week, to 9.24 mbpd. The latest four-week average is 9.21 mbpd compared to 9.37 mbpd a year ago. It is lagging. Yet, the good news is that the EIA, in its Short-Term Energy Outlook published last month (the updated version will be released tomorrow), foresees an improvement for July and August from 2023. Combined gasoline consumption is seen at 9.22 mbpd, a year-on-year ascent of 70,000 bpd.

A conspicuous improvement in the US gasoline outlook and the floating of the idea of lowering US borrowing costs in September will ensure that bullish expectations will be fulfilled and the $90/bbl barrier basis Brent will be assaulted before prices start to ease gradually, or else.

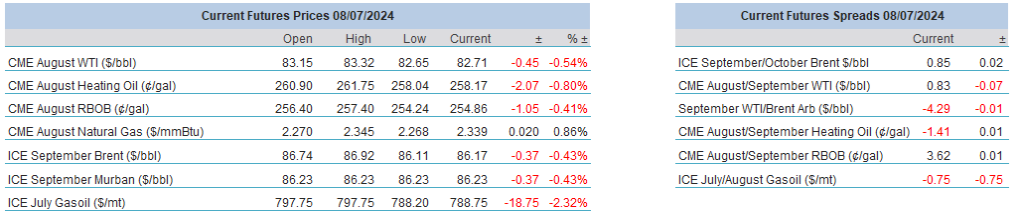

Overnight Pricing

© 2024 PVM Oil Associates Ltd

08 Jul 2024