Risk is Off, but For How Long?

It is premature to draw far-reaching conclusions from yesterday’s sharp decline in risk assets. It may have been timely profit-taking, exacerbated by a technical sell-off as crucial upside barriers proved too strong to overcome on Wednesday. In equities, souring sentiment on tech stocks was the predominant cause for the plunge, while the release of today’s US inflation data may also have served as the pretext for the retracement. If it does not disappoint and given the healthy state of the US labour market, the weakness may prove to be an irresistible buying opportunity, whether or not the case for an imminent Fed rate cut wanes.

The latest set of monthly data on the global oil balance offers plenty of food for thought regarding a plausible oversupply and is discussed below. The IEA report is one possible contributor to the $2/bbl price drop, along with the US–Iran stand-off. Although the situation around the Persian Gulf and the Strait of Hormuz remains fluid, tensions are confined to rhetoric, and there appears to be no explicit or immediate threat to oil flows and transportation from the region. At the same time, there is a growing belief that the volume of available Venezuelan oil will rise.

Stubborn or Fragile Optimism?

As was pointed out in yesterday’s note, the market tends to shrug off developments, which might indicate that the oil balance shows no shortage. In fact, looking at the latest set of monthly data from the EIA, OPEC and the IEA, one cannot help but think that the current script in the theatre of oil has been written by the reincarnation of the famous Irish playwright Samuel Beckett. In the same way that Vladimir and Estragon waited for Godot in vain, the price fall, well justified by the gamut of forecasts, has not arrived, at least not until yesterday.

We touched upon the updated EIA and OPEC oil balances in recent days; now, let us dig a little deeper. Starting with the statistical arm of the US Department of Energy, its prognosis is so bearish that it has little alternative but to envisage a Brent price of $58/bbl for 2026 and $53/bbl for the year after. This compares with the current forward curve of around $65.40/bbl and $64.20/bbl, respectively.

In its latest outlook, the EIA slightly revised down its 2026 global oil demand forecast and amended its non-DoC supply estimates up by 320,000 bpd, resulting in an annual call of 41.75 mbpd for the alliance’s oil, 350,000 bpd less than deemed in January. Although demand growth is expected to outpace the increase in non-DoC supply, rising DoC production, projected to average 44.80 mbpd this year, will ensure a rise of more than 3 mbpd in global oil inventories in 2026, with OECD stocks reaching 3.1 billion bbls by year-end, a swelling of 220 million bbls from 2025.

OPEC, traditionally the most sanguine among forecasters, has hardly changed its view from the previous month. It sees growth in 2026 global oil consumption (+1.43 mbpd) comfortably outpacing the increase in non-DoC supply (+600,000 bpd), leading to a jump of 650,000 bpd in the DoC call once the 180,000 bpd increase in DoC other liquids is accounted for. The absolute number for this year is 42.95 mbpd, still some 900,000 bpd below the group’s expected output level. Although end-of-year oil stocks in the developed world will stand at 2.98 billion bbls, more than 100 million bbls less than the EIA’s projection, they will still climb by 130 million bbls year on year. The inverse relationship between OECD stocks and prices, therefore, implies a 2026 Brent price of around $56/bbl. Again, the Brent curve strongly disagrees. As correlations are never static, this relationship may have to be reassessed.

The IEA has not amended its stance either. It anticipates a mammoth supply surplus amounting to 3.73 mbpd, easily trumping even the bearish EIA findings. OECD commercial oil stocks are projected to increase markedly in every quarter of 2026, soaring to a colossal 3.39 billion bbls by December, an annual swelling of 543 million bbls. Of course, this figure can be mitigated by the notorious “missing barrels” category, which stood at 1.2 mbpd in December and 830,000 bpd for the whole of 2025.

No one, and unfortunately that includes us, is smarter than the market. It is always right, although it reserves the right to adjust its view on a second-by-second basis. Yet, given the significant divergence between the forward curve and several price forecasts, and after our candid admission of fallibility, the most obvious course of action is to attempt to reconcile this gap between fiction and reality and identify when, if ever, the market might course-correct.

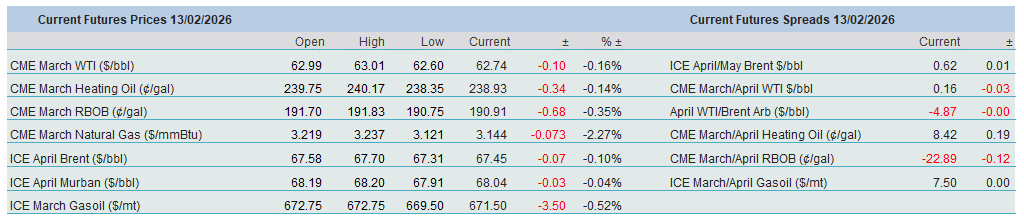

Pinpointing the supportive factors is a good place to start. The two major crude oil benchmarks are, for whatever reason, in backwardation, suggesting tightness, particularly the European benchmark. This is confirmed by Brent CFDs, which show a hefty front-end premium over the forward contract. Brace yourself for lower prices when either of these weakens, and when it happens, it is likely to occur in tandem. Galloping equity markets, auspicious economic data and relative calm in trade wars all paint a positive demand picture. A weak dollar is also seen as supportive.

On the supply side, there is a hefty risk premium built into prices. Using an admittedly arbitrary approach, it may be estimated at around $5/bbl, even after yesterday’s price erosion. The OPEC+ producer group’s recent strategy of halting the reclaiming of market share might be deemed yet another ingredient in this somewhat bullish cocktail, as are intermittent product exports from Russia.

We will present a convincingly buoyant price prognosis beyond 2026 in Monday’s report. For now, however, we must jump off the fence and make an audacious prediction as to whether the current resilience will be maintained, amplified or reversed this year. In equity markets, hard data tend to supersede expectations or soft data; in oil, the backdrop is mixed. Perceptions of supply disruption in the Middle East and Russia, weather-induced strong refining margins (which have started to weaken, by the way), and generally robust demand underpinned by a conducive economic outlook have, so far, outweighed the very tangible signs of surplus.

In this overwhelmingly chaotic trading environment, it is probably reasonable to assume that geopolitics is the mother sauce of the present and ostensible price stability – no coincidence that the Brent backwardation is deeper than that of WTI. Once accepted, admittedly a simplistic approach, it is tempting to conclude that, before the November midterm elections, there is no way on earth that the US would take action that might send domestic forecourt gasoline prices skyrocketing. The current strength will prove unsustainable, and eventual revisits of the $70+ level will probably be met with re-invigorated selling activity, as always in the last 4 months. Ignore the US President’s pledge to send crude oil prices back to $50/bbl at your peril.

Overnight Pricing

13 Feb 2026