Risk Premium Dumped

If there were a debate about the major driving force behind oil prices, it has probably been settled over the last two weeks. It is supply and output. Demand is what it is; it appears healthy, and perceptions of it do not turn on a dime. Equities and gold do their thing, and investors closely watch the tech sector, financial and job data, and the charade surrounding the Fed chair. The value of the dollar realistically reflects trust in US economic policies in general. Colonisation attempts outside oil-producing regions do not have a tangible impact on asset classes either, although it should be noted that the recent “reconnaissance missions” by several European nations to deploy small military contingents to Greenland will not go unanswered by Uncle Don. The resultant flare-up in tensions could well permeate and further sour trade relations between former friends.

When it comes to US intervention in Venezuela and Iran, however, the oil market becomes nervous and volatile. The latest episode is rooted in the breakout of anti-government protests in the Persian Gulf OPEC nation, where the ruling elite failed to heed the call of the people and, instead of listening, retaliated ruthlessly. Death-toll estimates range from 2,000 to 12,000, and oil prices, Brent more than WTI, rallied hard on US threats, which included possible military action, over what was described as “unacceptable repression”. President Trump even encouraged protesters to “take over your institutions” and said that “help is on its way”.

That help came in the form of sanctions on five Iranian officials, and the President, at least for now, appears content that the killings are ending and executions will not take place. The tempest over oil fields, ports, and the Strait of Hormuz has passed, possibly temporarily. Focus has therefore naturally returned to oversupply, and after a handbrake turn, the two major crude oil contracts finished the day almost $3/bbl lower.

Updates Corroborate Glut

Amid the latest geopolitical upheavals in Venezuela and Iran, the updated views from the EIA and OPEC on the global oil balance, which now include estimates through 2027, can, should, and must be read as sobering assessments. (The IEA will share its own findings with interested parties next Wednesday.) Unexpected supply disruptions precipitated by military strikes on oil infrastructure, as well as primary or secondary sanctions on oil-producing countries and on those dealing with them, can always create some degree of tightness; nonetheless, it is worth stressing that these possibilities have, so far, failed to meaningfully trigger actual and severe disruptions in oil supply, production, or exports. This leaves us with the backdrop of a well-supplied global oil market this year and even into 2027.

The EIA does not beat around the bush and sticks to its in medias res approach by presenting its price forecast on the opening pages of its Short-Term Energy Outlook. The statistical arm of the Department of Energy expects Brent to average $56/bbl this year, an annual decline of 19%, and to shed another $2/bbl in 2027. These rather gloomy prognoses assume rising inventories, which is, in fact, the conclusion of both reports.

Looking at the predictions in chronological order, notwithstanding the consensus on swelling stocks, the chasm in views is palpable even for last year. The EIA recorded a build of 2.59 mbpd in global oil inventories, versus a drawdown of 400,000 bpd reported by OPEC. These diverging assessments explain why the former estimates that OECD stockpiles finished the year at 2.931 billion bbls, whilst the latter puts them at 2.839 billion bbls. OPEC saw last year’s global oil demand and non-DoC supply as being 1.4 mbpd and 400,000 bpd higher than the EIA’s estimates, respectively, resulting in a gap of more than 1 mbpd in the call for DoC oil—42.30 mbpd versus 41.21 mbpd.

Looking ahead, the researchers agree that global oil consumption will increase considerably in 2026 and 2027, a clear sign of the slowing transition from fossil fuels to renewables in the lukewarm battle against a warming planet. The EIA expects global oil demand to average 104.82 mbpd this year and 106.08 mbpd in 2027, 1.73 mbpd and 1.80 mbpd less than OPEC, respectively. The increase in consumption, nonetheless, will not be matched by growth in non-DoC oil supply, which is seen at 240,000 bpd and 380,000 bpd in Washington, DC, and at 600,000 bpd and 570,000 bpd in Vienna. In other words, reliance on the oil of the producing alliance will continue to expand.

Because of the significant differences in demand estimates, forecasts for the call on DoC oil also deviate widely. These are put at 42.09 mbpd and 42.98 mbpd for 2026, and at 42.99 mbpd and 43.60 mbpd for 2027, in favour of OPEC. Yet these projections are meaningless unless they are set against DoC production estimates. The EIA sees these at 44.93 mbpd and 45.08 mbpd, while we arbitrarily assume 43.95 mbpd and 44.00 mbpd from OPEC, which publishes only OPEC+ output aftercasts rather than forecasts.

Apologies if this sea of numbers makes the analysis somewhat cumbersome to digest. The bottom line is that, under these scenarios, global and OECD commercial oil inventories will register growth. Statistical evidence shows a more than healthy inverse correlation between OECD stocks and prices; therefore, the logical conclusion is that oil will be cheaper in 2026 than in 2025 and will continue to trend lower in 2027. The EIA has shown its cards, as mentioned above. Our own box of tricks indicates that the OPEC oil balance envisages a roughly $8/bbl drop in oil prices in 2026, followed by another $4/bbl decrease in 2027.

This is a neat and convincing summary of the updated reports, but we know that, given the enormous degree of uncertainty, constant revisions will be required. The blackest of these swans is likely to be how the OPEC producer group attempts to navigate in the current fragile political environment. Or, to put it more bluntly: will geopolitical events surrounding Venezuela and Iran force it to dig up the hatchet and fight for an even larger share of the export market, or will it prioritise oil revenues by reducing quotas and output, risking the ire of the White House? Will it even survive these turbulent times at all?

In an ideal world, numbers, with the odd tweak here and there, could be relied upon, and based on the latest data sets, one could count on the abundant availability of oil in the near future. But, as we have learnt the hard way over the past year, this world is anything but ideal. Therefore, one must continue to hope for the best, the predictable and the boring, while preparing for the perpetual turmoil and turbulence

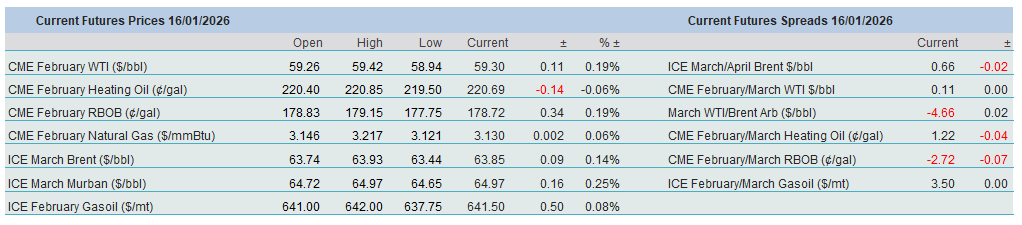

Overnight Pricing

16 Jan 2026