Risk Off, Prices Off

Given an approaching end of month, end of quarter and the long Easter weekend, it is understandable that a little froth comes off the markets as the investor fraternity around the globe de-risk. That decision is made easier due to the US PCE inflation numbers due on Good Friday when many markets are closed and given that the FED has predicted something of bumpy ride in further interest rate decisions, it would seem position discipline is important because Jerome Powell will be speaking at the central bank’s San Francisco branch on the same day. The oil market will also adhere to a blunting of views and exposure due to the same influences but has added micro-reasons to be careful with a Brent, RBOB and Heating Oil expiry tomorrow and an OPEC+ meeting next Wednesday.

It appears the Joint Ministerial Monitoring Committee (JMMC) is unlikely to offer any sort of change in policy until the full ministerial meeting in June, but as the remit of the meeting is to report on the market and note members’ compliance to promised cuts, one can never dismiss the possibility of a rogue headline or untoward comment. As it is, yesterday’s likely trimming of length and the resultant negative day is exacerbated by a surprising build in crude stock data produced by the API. Polls had suggested a draw of 1.3mb, but Crude actually built by 9.4mb and if that is emulated in the EIA Inventory Report later, there will be little reason for bulls to sharpen their knives until next week and after the described news events. The API went on to report a Distillate build of 0.5mb, a further Gasoline draw of 4.4mb and that the Cushing storage hub increased stock by 2.4mb which runs somewhat in line with the TankWatch call of +1.8mb.

Oil watchers looking for inspiration further afield will fall foul of the confusion currently underway as the world tries to work out the repercussions of Japan’s exit from its easy money policy. Governor Ueda reverts to conservative type and had been offering language of the unhurried as to the pace of the interest rate plots. Some comments from the BoJ that it will not raise rates as quickly as the FED when it too exited from monetary easing has sent the JPY into free fall leading FOREX commentators expecting intervention from the BoJ any time soon. This is not particularly oil relevant, but its effect on the US Dollar is, the Dollar Index (DXY) is currently trading at 104.40 and only just shy of its 2024 high and is another reason why bulls will remain cowed for the moment.

GMT | Country | Today’s Data | Expectation |

08.30 | SW | Riksbank Rate Decision | 4% |

10.00 | EU | Consumer Confidence, Economic Sentiment, Industrial Sentiment Final (Mar) | -14.9, 96.3, -9 |

It’s all about the Americans

As we discussed Friday, whatever your political leanings in the US, or for the rest of the world bemusement at the chosen candidates, oil prices and the oil industry will look like an inviting teed-up beach ball for Messrs Biden and Trump to swing and swing again at. One might assume that delineation in views would be fairly simple in that any sort of Democratic manifesto would be tinged green from top to bottom and that a Republican one could be relied on to be full metal jacket pump and burn. Therefore, the Republican swipe at the IEA last week on being an ‘energy transition cheerleader’ and a thinly veiled threat to scrutinise the US’s contribution to the agency comes as little surprise and neither would be an expected counter view from the hierarchy that line up behind the Democratic donkey logo.

Yet that does not appear to be the case according to the Financial Times. At COP26 in November 2021, 39 countries and institutions signed a joint commitment on “International Public Support for the Clean Energy Transition” to end any support for fossil fuels flowing abroad by the end of 2022, and in its place prioritise finance for clean energy. It took Japan and S. Korea a little while to partly join in, but in the end the agreement boasted the inclusion of the G7 countries that would steer away from the public financing of fossil fuels. The unity of this agreement had already been brought into doubt by backsliding on commitments after the energy security pressures felt from the Ukraine invasion and, now, shared by the FT source, that in a closed session of OECD countries, a proposal by the UK and the EU to cut off most export credit agency funding for oil and gas has hit a mighty buffer in the size and shape of the United States. The US’s credit export agency Exim will no doubt be blamed by the Democrats, but it is the incumbent administration doing the negotiating and it is more than just a curious coincidence that the US will continue discussions on the EU’s proposals in June and the election month of November. The green credentials of the Democrats will not be so reliable in the face of oil price expediency, particularly as it is an easy target for ‘I love oil, Trump says pump’ to take aim at.

In fact, if it does turn out to be The Donald, legal wrangles allowing, that ends up in a face-off with President Biden, he might just not have to do too much work on the oil price front. The SPR chamber is spent, there are no millions of barrels of oil laying around to stem an OPEC inspired tighter oil stock scenario. Chumming up to Venezuela seemed to last all of five minutes, with the South American oil-reserve giant eventually and unsurprisingly cocking a snoot at Washington’s election demands. And as for extending the blind eye currently deployed to how much Iranian crude gets to water under sanction, would be yet another piece of fodder for Republicans to gobble up. Ever since OPEC announced production cuts, President Biden has unleashed his lieutenants of energy, economy and diplomacy in an attempt to chivvy support from the oil producers of the Middle East to renounce cuts, when all the while booming US oil exports have antagonistically found their way into the very same markets populated by those who he fetes.

Nostradamus could not have predicted how sanctions made allies of Russia/China, Russia/India and probably made Russia much more manageable for the author of the current OPEC+ success, Saudi Arabia. Modern warfare brings turns of events where none are expected, which refers to the drone attacks on Russian refineries by Ukraine forces and the ensuing rally in gasoline prices in front of the driving season the precedes the US election. Would that it were proven that one of the drones unleashed by Ukraine was sponsored by the very monies that the Biden administration has donated. The irony is just too delicious. OPEC cuts, the Gaza conflict, the Ukraine war and a soaring stock market are players in the outcome of where oil prices will end up at the end of 2024. But for us here, none will have more influence than the US election and how the protagonists, intentionally or not, make oil one of the most important of political footballs.

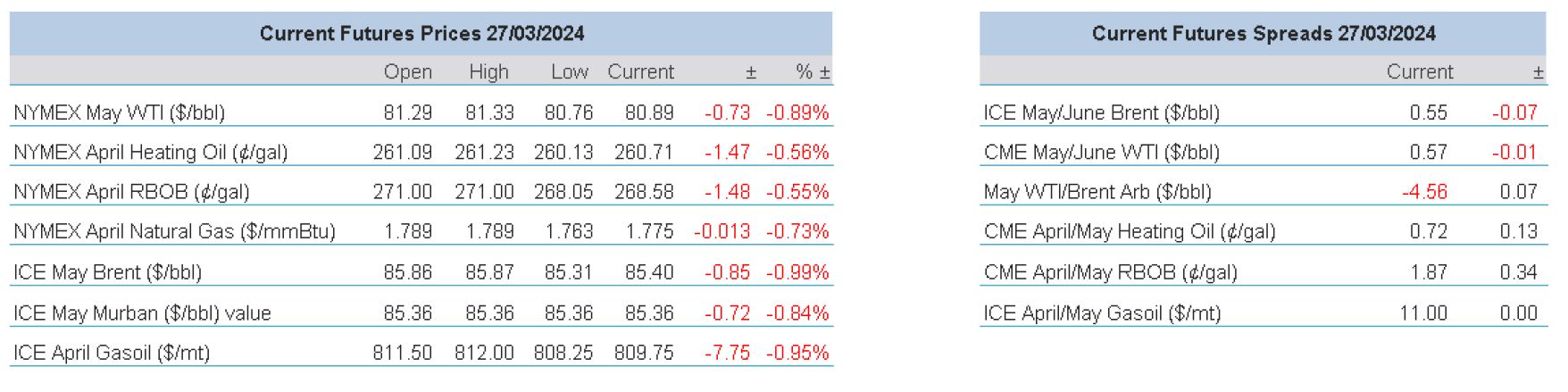

Overnight Pricing

© 2024 PVM Oil Associates Ltd

27 Mar 2024