Risk On, Risk Off, Repeat

Well, after digesting a cornucopia of data, investors were swimming in a sea of red yesterday. The Bank of England and the European Central Bank decided to leave lending rates untouched. The BoE’s decision came after a knife-edge vote, with monetary luminaries split 5–4 in favour of staying put; however, reductions are anticipated later this year as the Bank lowered its UK growth forecast. The ECB and the euro zone appear to be in as good a place as they can be in the current hectic economic environment. Unless core inflation falls meaningfully in the coming months, no further adjustment is anticipated.

In the US, the labour market sailed into severe headwinds. US employers announced almost 110,000 layoffs last month, according to Challenger, Gray & Christmas. At the same time, initial jobless claims rose more than expected in the latest week, and job openings in December were disappointing. After Alphabet announced a 55% jump in its annual capex, fears of unsustainable AI spending resurfaced. Equities recorded their third consecutive daily fall, bitcoin slipped below $70,000, and not even precious metals were immune to the risk-off sentiment, with silver plummeting 15%.

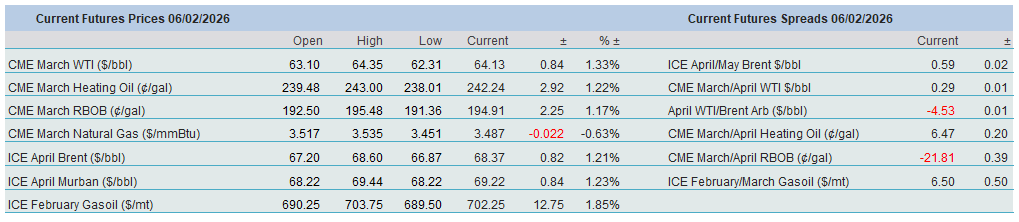

Although Saudi Arabia cut its flagship Arab Light price for March delivery to its key Asian market by 30 cents/bbl, underlining the oversupplied nature of the global oil market, the focus was, and remains, firmly on the US–Iran talks. The adversaries are scheduled to hold the next round of negotiations today in Oman, and the mere fact of the announcement was enough to unwind the length put on the previous night, when talks were seemingly breaking down. Oman is four hours ahead of London, so taking a long lunch in Mayfair could prove to be a costly adventure. And although news of the resumption of negotiations triggered yesterday’s sell-off, there is no room for complacency: one hint or word of disagreement—or an outright breakdown of talks—would send prices back to $70/bbl, while the implausible burying of the nuclear hatchet could push them down to $60/bbl.

Is the Arb Shaping Up to be a Buy?

It might seem peculiar and ill-timed to pick Venezuela as the main topic of this report, given everything that is unfolding around Iran. Still, oil output and exports in the Persian Gulf OPEC member have not been affected (although they could be), whereas tentative changes are underway in its Latin American fellow. Since the abduction of the country’s former president and the imposition of full US control over Venezuela’s oil sector, a guessing game has begun over how quickly oil output will rise. Every available satellite is now trained on the country’s export terminals to estimate how much oil the new ruler is allowing onto the market.

The oil market reaction has been more than reasonable. This seismic and, frankly, unforeseen development was felt most acutely not in outright prices, but in the widening of WTI’s discount to its European peer. The front-month futures arbitrage fell from –$3.43/bbl on January 2 to –$5.29/bbl by January 29, although it strengthened somewhat after the Brent expiry at the end of last month. The logic is clear. With the perceived or anticipated rise in Venezuelan crude exports, the traditional US supplier of heavier and sourer grades, Canada, suddenly finds itself competing for the coveted market share of its southern neighbour. The knock-on effect is that this intensifying rivalry frees up lighter domestic US grades to find homes overseas, pressuring the relative value of WTI.

The possibilities are almost endless. Venezuela, which holds 17% of the world’s oil reserves, or some 303 billion barrels, has failed to live up to its potential because of corruption and mismanagement. Output fell from 3.5 mbpd in the 1990s to around 900,000 bpd in 2025. Exports to the US declined from 1.3 mbpd in 2004 to just 140,000 bpd last year.

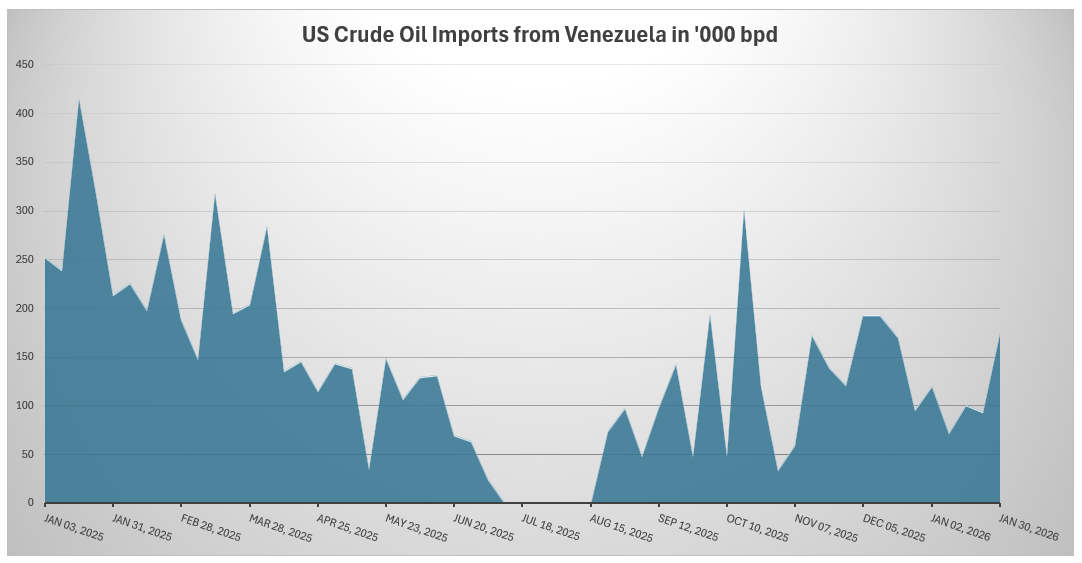

It is tempting to conclude that considerably brighter prospects lie ahead as the wheels of the new oil regime are set in motion. As Reuters noted, the country’s oil exports rose from 500,000 bpd in December to around 800,000 bpd in January. Trading houses exported close to 400,000 bpd last month, chiefly to storage terminals in the Caribbean, before marketing the barrels to interested buyers. Around 284,000 bpd was destined for the US. Although this has not been confirmed by provisional weekly EIA data, which show a January average of 111,000 bpd (see chart below), there is little doubt that arrivals at the US Gulf Coast will become more frequent.

So, are all the ingredients in place for an extended period of WTI weakness relative to Brent? After all, the US Treasury Department now allows the sale of necessary diluents, permits US companies to export, ship, store and refine Venezuelan oil, and Venezuela’s legislature has opened the oil industry to foreign investment.

This optimism, however, may prove blind over the medium to long term. The current jump in Venezuelan export volumes has largely been the result of drawing down stocks of previously sanctioned oil. A sustained increase in production requires political stability. Notably, while the country’s leader has changed, the regime has not. A shortage of skilled labour, elevated arbitration risk, and the absence of a robust legal framework also pose serious obstacles to ramping up production and, by extension, exports to the US. Studies suggest that breakeven costs for Venezuelan oil projects are close to $80/bbl. All these factors stultify oil companies’ enthusiasm, as capital can be deployed more effectively elsewhere, especially given that the US administration has indicated that arbitration claims owed to oil majors following Hugo Chávez’s 2007 nationalisation of the industry are not a priority.

Hope and expectations are building, but for Venezuela, the road to becoming a reliable and permanent partner in global and US oil trade is strewn with thorny issues. If recent events prove to be yet another quick-grab and myopic Trump project, and Venezuela fails to materially increase its oil shipments to the US on a sustained basis, the arbitrage could strengthen again, particularly if the geopolitical risk premium, the other salient driver of relative WTI weakness, subsides. In any case, the EIA’s weekly data on Venezuelan oil exports to the US will be an invaluable tool in forming a view on the value of the arb.

Overnight Pricing

06 Feb 2026