Sanction Bingo

There is quite a head-turning draw in Crude stocks in the private American Petroleum Institute’s inventory report. The decline of 9.3mb is something the oil market will need confirming from the EIA data later, particularly as a Reuters poll indicated an expectation of a draw of only 1.1mb. However, such an outlandish draw is not the author of this morning’s rally. The shuffle higher in prices owes its inspiration from the greatest mover of markets ever seen in one Donald J. Trump. He has now designated Venezuela’s regime as a foreign terrorist organisation and ordered a complete blockade of all sanctioned oil tankers navigating in and out of the South American country’s waters.

Once again oil watchers are dealt another conundrum because as with all Trump edicts, as simple as they may sound, the effects are multi-faceted. It is unclear how a full blockade would be policed and would once again call into question on whether this action is within the remit of the president or it need be ratified by the US Congress. Law making aside, cargo and ship watchers will be counting how much Venezuelan oil is carried by sanctioned shipping and whether legitimate carriers will be caught in the morass. Therefore, the calculation tolerance in what the globe will now lose in supply must be vast as the estimated number of barrels denied to the oceans ranges from zero to possibly a million barrels per day.

From one enforced sanction environment to one that is not and thereby displaying the international double standards we have become so sadly used to. According to LSEG data, backed up by Reuters sources, India imported 1.77mbpd of Russian oil in November, up 3.4 percent from the previous month. This trade is set to continue at the pace of 1.2mbpd in December and will remain steady into January. There can be little other conclusion than prices are so discounted for Indian refiners to ignore, but more importantly, shows an easy attitude the US has toward the Russian oil industry. Keeping Moscow interested in peace talks outweighs any further financial damage that might be achieved to the Kremlin’s exchequer and will once again confirm our market’s suspicion on Russia achieving the upper hand in negotiation should any final peace deal ever see fit to grace our newsfeeds.

Such a thirst for the black stuff, and it is not a famous stout

It continues to amaze our market the appetite still shown by China for crude oil. The extraordinary amount of oil imported can only be down to opportunism in price as Brent for example trawls the depths of prices not seen since the low of $58.40/barrel in April of this year and then beyond to the pandemic-stricken period of early 2021. In November, China’s imports on a daily basis amounted to 12.40mb which is the highest level since August 2023. With domestic refinery utilisation, according to Reuters, falling by 5.3 percent compared with October, such feedstock desire is not then to sate any uptick in China’s internal combustion engine (ICE) mileage or for manufacturing and industry.

The recent economic data set portrays not only a sticky economic situation but one that is in fact deflationary. One can derive from the increased state of CPI that activity has increased, indeed, consumer price index inflation rose to 0.7 percent year-on-year in November, up from 0.2 percent in October, but was largely affected higher by food inflation which increased due to a spike in fresh vegetable prices, which gained 7.2 percent over that of the previous month. Yet, for manufacturing, and searching for demand purposes, PPI (factory gate prices), has now scored 38 months of being negative and arguably offers a much more conclusive state of play.

We are very much fans of following the readings of the purchasing managers’ index of the major economies that have a say in oil prices, and the collective private and official PMIs of China do not ring out with signals on how its industries are anywhere near inspiring domestic oil demand. The RatingDog China General Manufacturing PMI fell to 49.9 in November from 50.6 previously with the official NBS Manufacturing PMI edging up to 49.2 in November after a half-year low of 49.0 but continues in contraction since the year-to-date high expansion of 50.5 seen in March.

These almost bellwether shows of contraction earlier this month, paved the way for the abject metrics laid out from China on Monday. Although Retail Sales showed growth of 1.3 percent in November year-on-year, it pales against the previous month’s 2.9 percent and while Industrial production increased by 4.8 percent, it was both lower than a 5.0 percent expectation and the 4.9 percent seen in October. Nagging everything lower, and not uncommon in contemporary assessments of China, is November’s House Price Index which fell by 2.4 percent. This run of disappointment now stretches back for 29-consecutive months with November’s mark being below both October and September. The link with falling house prices and a reluctance by Chinese citizens to spend is well established and at present it would seem the tendency of low consumption and high savings will not change. The World Bank points out, “The challenges in the property sector, subdued earning prospects, labour market softness, and trade policy uncertainty could last longer than expected and weigh on consumption and investment.”

Given the foregrounding above, it seems only right that in its recent missive, Petroleum Intelligence Weekly asks whether Chinese oil demand is ready to peak? It points to “waning demand for road transport fuels and a sputtering economic growth trajectory,” elaborating on how “Energy Intelligence estimates growth is edging toward zero, with 2025 growth at just 235kbd and an anaemic 140kbd for 2026.” If such a peak state should ever come into being, the blow to the demand side of the oil puzzle would be immeasurable. Pondering on such things will also beg on why China’s unrelenting strategic crude buying continues unabated with such downward forecasts for domestic demand. Anxiety over energy security is one thing, but filling gunnels in times of peace is another. Unless of course, and here is a win for the doomsayers, Beijing will at last make good on one day allowing its forces to take the short cruise across the Taiwan Strait.

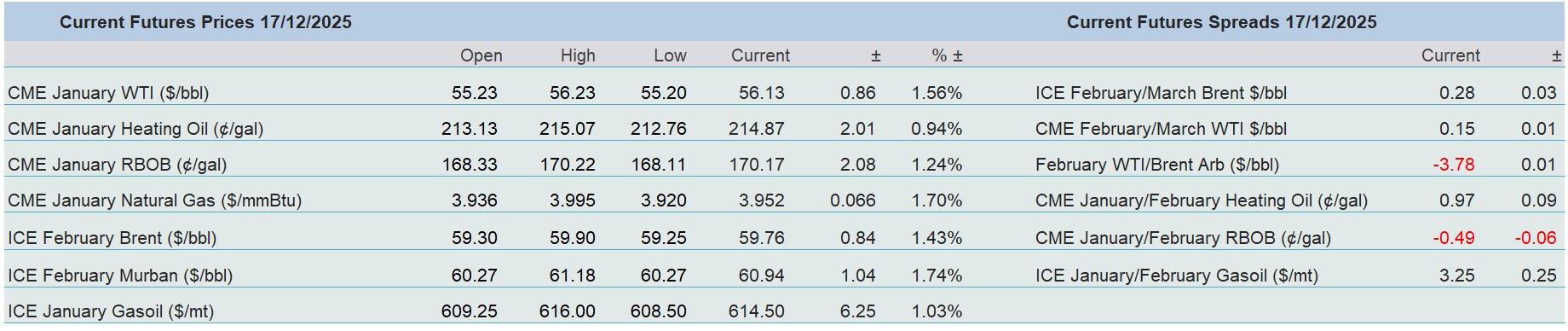

Overnight Pricing

17 Dec 2025