Sanctions are Different for Friends and Foes

Sometimes it is finger-drummingly infuriating to keep up with the double standards and contradictory decisions or intentions of this present form of American government. This morning, Reuters reports on how the US has allowed a waiver on oil sales out of the Sakhalin-II project. The oil and gas development project, in the Sea of Okhotsk is managed under a consortium led by Gazprom and had been subject to sanction from the Biden Administration. It is an important source of energy for Japan, which being an important strategic and economic ally of the United States allows it to not be the subject of scorn meted out on India and China for their continued imports of Russian oil. It does, in part, make a mockery of the White House readying new sanctions against Moscow if it walks away from the Ukraine peace deal being brokered at present. Still, intentions lead to market moves and the current jockeying of threats is enough to inspire a small correction in oil prices that in technical terms were in danger of being oversold. With a full-blown blockade of sanctioned vessels carrying Venezuela oil by the US being touted, the oil market is forced to adjust prices accordingly bearing in mind the estimated 500k to 1mbpd the South American country currently exports.

End of year central bank clarity? Not a bit of it

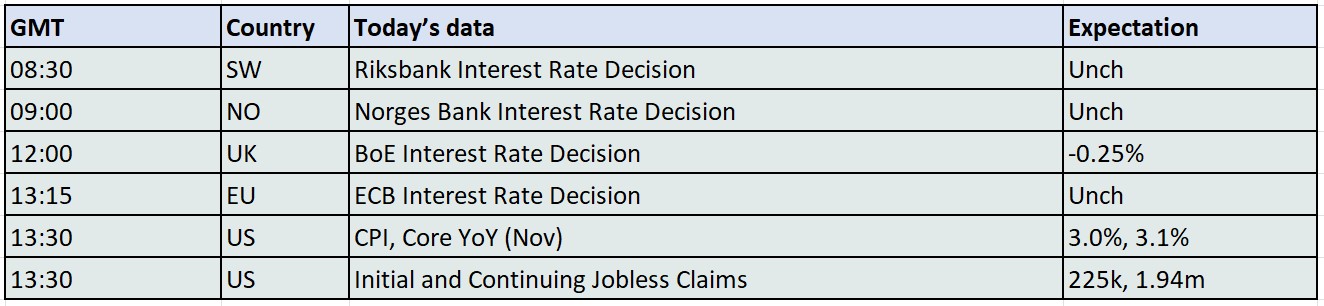

There has been a justifiable besottedness in the decisions and make up of the Federal Reserve of late. After all, it is the most powerful central bank, presiding over the most powerful economy in the world with the most powerful currency. The clamour surrounding Jerome Powell and his merry men of banking has drowned similarly important points of decision for other keepers of economies. In fact, whatever the Fed decides to do must impact on the forward thinking of other central banks given how nearly all currencies are judged on their pairing values versus the US Dollar. A split decision in the FOMC, a period of not knowing the identity of the next Chair and if the choice will be swayed by an interfering White House, and a dot plot where the bank envisages only one further cut for 2026, but the market is pricing in two; is more than a headache for the likes of the Bank of England, the European Central Bank and the Bank of Japan. Bankers love certainty, that is why they wear grey, and an undecided US Fed, might just have more impact on decisions rather than domestic metrics.

There appears to be a beleaguered government in the United Kingdom presiding over a stuttering economy. GDP in October fell 0.1% month-on-month, the second in succession, according to the Office for National Statistics (ONS). However, and despite a government intent on political self-harm, it is not all bad news. The S&P Global UK Manufacturing PMI rose to 51.2 in December from 50.2 in November, Services PMI rose to 52.1 from 51.3 previously with the Composite achieving 52.1 against 51.2 and is the only major European economy to boast expansion that beat expectations. The BoE notes mortgage approvals are up 11 percent from last year and higher by 33 percent when compared with 2023. Yet there are warnings waiting in the wings. Yesterday’s better-than-expected inflation data which saw price increases slow from 3.6pc in October to 3.2pc in November year-on-year is more than a welcome development, but it comes at time when employment is falling. The rate of UK unemployment rose to a four-year high of 5.1% in the three months to October as seen in ONS figures, with wage growth excluding bonuses falling to 4.6% in October, from 4.7% in September and the lowest since early 2022. Little wonder then when eyeing a triumvirate of shrinking GDP, employment and wages the fall in inflation is being judged by some as consumer reluctance and may indeed be the first vestiges of recession. Thanks to the surprise CPI drift, the BoE is more likely to eke out a cut in rates today, but with a Labour government intent on ‘tax and spend’ the central bank is not only inundated with domestic considerations but not knowing how the Fed’s playbook looks like in 2026 gives the Old Lady of Threadneedle Street limited options.

This worry on what the US does echoes with the European Central Bank. The current rate of inflation is sitting quite comfortably at 2.1 percent as of November’s reading, matching that of October and being well within tolerance of the ECB’s 2 percent target. It is telling on how it has not cut rates since June whereas the Fed has proceeded with 3 cuts since. Keeping interest rates at 2 percent is the likely outcome of today’s decision and while European bankers are very much aware that any more divergence in the amount of rate cuts could lead to an unwanted valuation hike in the Euro, having already risen against the US Dollar by 13 percent this year, it must consider the amount of spending set to come from its largest member, Germany. How the budget and debt brake busting €500 billion stimulus from Berlin designed to boost every aspect of Germany’s way of life is implemented is not exactly clear, but such an eye-watering sum is scaring the hawks of the ECB who suspect it will come nailed on with greater inflation. ECB board member Isabel Schnabel told Bloomberg News last week that the ECB’s next move might indeed be an interest rate hike. The Old Continent’s exporting businesses might have to get used to further Euro strength.

The results of the BoJ’s quarterly “tankan” survey recently showed business sentiment improving to its best level in four years. This has come about in response by some business leaders suggesting the impacts of the U.S. tariff policy on the Japanese economy are now seen to be smaller than originally thought and are thankful on how Tokyo reached an early deal of 15 percent in July and left negotiations with boasts of goodwill from both sides. At present, Japan is enjoying a strong bout of export competitiveness as the Yen continues to underperform but such weakness is often associated with central bank intervention. Forex traders suspect that repeating the moves seen in 2022 and 2024 might not be met with similar success because there are not the same big bets against the Yen therefore fewer shorts forced to reverse. Japan’s currency can ill-afford to devalue any more because of the inflationary strain it will press on households and push higher costs onto home-grown businesses. There is little doubt the BoJ will opt for a rate hike tomorrow, but it too must be cognisant of diverging policies from the US Fed and suddenly inflating the Yen could be as damaging as the restrictive trade outcomes so feared under the new international tariff regime.

Overnight Pricing

18 Dec 2025