Saudi wrestles, Fitch still bothersome

In another timely smash and grab of the narrative, Saudi Arabia, judging well the twitch factor being experienced in markets after the broad sell off due to the US downgrade by Fitch, pre-empts the OPEC JMMC due today and extended its voluntary cut of 1 million barrels per day into September. In a joined up and flanking movement Russia then announced that it too would extend exports by a reduced 300,000 barrels per day, which if done in isolation would probably have the market thumbing its nose at it, but paired with the Saudi announcement it encourages and reinvigorates those that seek evidence of a tightening crude supply.

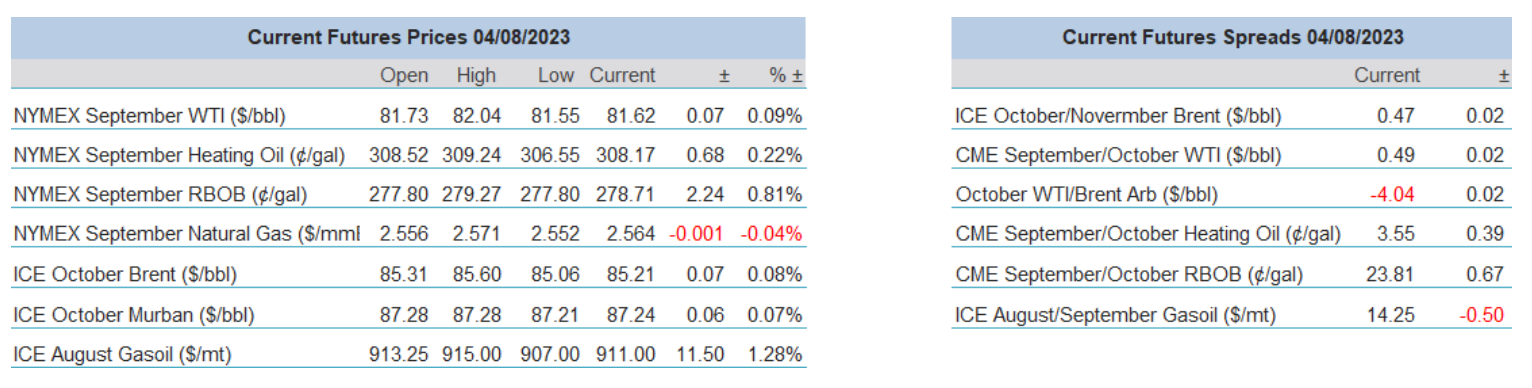

Masters of recent hyperbole, Saudi went on to say that the cut maybe ‘extended, or extended and deepened’ and although prices took a little time to react, the recent uptrend was resumed and now crude prices look to hold on to a run of 6-week gains. Logically, it is Asian grades that start to show great gains as there should be less Saudi crude entering the area. Dubai structure rallied; Murban, such a favoured crude gained against all grades and the other Asian grade marker Oman remained steady in premium over Dubai. The Saudi intervention has once more returned the market’s gaze upon a tightening oil market and stories of very large refining margins are likely to return as well. The Gasoil futures crack has rallied over $10/barrel in 2-weeks from $16.80 to $28.40.

There is always a however for oil rallies at present and it usually comes from the wider suite. The shadow cast upon investors yesterday from the US sovereign downgrade by Fitch will not be easily swept under the carpet. Nor will the state of global PMIs which continued to register disappointing readings yesterday. The behaviour of labour markets continues to cause cuticle nibbling from Central Bankers and remains a thorn in the side of those that champion a forthcoming monetary easing season. In isolation, oil looks so very good. But we have not traded in isolation for years and although we often like to feel our market is detached from the wider suite, it is not. It is a large piece in the puzzle of global markets and while macroeconomic data deliver unfavourable growth signals, the however(s) will continue.

|

GMT +1 |

Country |

Today’s data |

Expectation |

|

13.30 |

US |

Non-Farm Payrolls |

200K |

|

13.13 |

US |

Unemployment Rate |

3.6% |

2011 v 2023

The last time the United States experienced a downgrade was in 2011 when Standard & Poors cut from AAA to AA+. Political brinkmanship might be an accepted remit for those that stalk the halls of the US Capitol, but their shenanigans are ill-received among investors and financial watchdogs. In 2011, after repeated standoffs and the usual peppering of resolutions to muddy waters, the Budget Control Act of 2011 became law on August 2, but the damage had been done and 3 days later S&P downgraded the US. In that year alone it raised the cost of borrowing for the US Treasury by approximately $1.6 billion. This was during an incremental increase in the debt ceiling that eventually reached $16.4 trillion by January 2012 from $14.3 trillion.

There is symmetry in this week’s Fitch rating decision. Some months before the downgrade of 2011, S&P had issued a negative outlook for the US. On May 24 this year, Fitch issued a similar watch during a protracted standoff in the debt negotiations culminating in the same regrade to AA+ from AAA. In 2011, the Obama White House challenged the S&P decision as unprecedented and based on poor models and analysis. Echoing through the years are US Treasury Secretary Janet Yellen’s protestations that Fitch rating change was “arbitrary and based on outdated data”. With no political bias intended, the most constant standout is that Joe Biden was Vice-President in 2011 and President in 2023, therefore being on the top ticket of the 2 times in history when the US has endured the ignominy of a downgrade.

Reputational damage is hard to quantify, yet this is a slap across the notion that the US is the ultimate place to do business. Sentiment aside, it was only a few decades ago that the US boasted on large budget surpluses and a GDP to debt ratio in the mid-1990s of just over 40%. That ratio as of March 2023 was 120% and contemporary times see eye-watering budget deficits and alarming phrasing such as ‘default and government shutdowns.’ In fact, after a congressional vote in December 2021 the debt ceiling was increased by $2.5 trillion and signed into law at an approximate limit $31.4 trillion. With the June debt ceiling resolution being tantamount to a kicking of the can down the road, the future looks full of repetition.

Counterintuitively, during the 2011 downgrade the US Dollar rallied as did US bonds, investors felt that even with a serious flush in risk, the stalwarts of American stability remained safe, which has been completely replicated thus far in the last few days.

The high for WTI on Aug 4, 2011, was 92.59. On Aug 9, four trading days later, it printed a low of 75.71 before taking a week to regain about 50% of the loss, trading sideways for Sep 2011 before testing the low again in early Oct 2011 and bouncing away. In the same 4-day period, S&P500 high to low was 1260.23/1101.54, made a lower low at the end of Sep 2011 and it too bounced away. The US Dollar Index (DXY) rallied hard on Aug 4, 2011, from a low of 74.02 to a high of 75.55 and continued in strength for the balance of the year. This brief snapshot of data suggests that while the downward swings caused by the Standard & Poors downgrade were dramatic, they were short-lived and arguably used as a corrective process allowing for fresh impetus.

There is little doubt that the Fitch downgrade brings into focus troublesome issues facing the US economy. Rising inflation and soaring debt will offer hurdles to those that have been, up until now, happy investing in long-term US government debt/bonds. International holders of US debt will feel uneasy, with any tightening of credit giving cause for a look at US domestic banks that only a while ago were seriously feeling the pinch after the debacle of Silicon Valley Bank.

Macro-economic negative influence will be around for some time to come and at times, more pronounced than others. They will not all be US based either. However, if 2011 and price behaviour is anything to go by, investor confidence will only be dented for a while, although the doldrums of August might exacerbate, and the world’s buy based trading will eventually come back. There is a convenience of the move for oil too, as in 2011. Technical watchers would have been pleased yesterday to see the overbought status, particularly in products, diminish a little with a welcome correction, leaving the oil fraternity to concentrate on how exactly short the market is on supply and a probable resumption to the 6-week rally.

Overnight Pricing

04 Aug 2023