So many moving parts, so many questions

The US Inventory Report came and went yesterday and probably left as many questions as answers as far as price performance is concerned. This alludes to the rally baton being passed once again to the distillate market as WTI registered a rather tepid performance on the day. M1 WTI ended -$0.67/barrel but this was despite a week-on-week draw of 6.307 million barrels, a year-on-year draw of 10.554mb and is 21.585mb below the 5-year average. Although numbers remain steadfastly 16.069mb below the 5-year average, Distillate stocks showed a small build of 0.679mb on the week, 6.801mb build on the year, yet M1 Heating Oil finished the session 1.96c/gallon better off. This counter-intuitive move might be put down to WTI having just entered technical overbought territory, that refinery utilisation was -0.2% on the week or that cracks had retreated enough, being represented further afield by the Gasoil/Brent M1 futures differential that recently lost $8/barrel in 5-days, but rallied nearly $2 yesterday. Finishing this confusing reaction is Gasoline that ordinarily would be seasonally distressed after the Labour Day bank holiday, but stocks drew 2.666mb and M1 RBOB ended 1.62c/gallon higher. Still, total commercial stocks are 32.386mb below the 5-year average allowing the continued consensus that inventories remain tight.

As always seems the case in recent history, micro views on oil can never be comfortable in a world where the greater markets swing with macro concerns. Inflationary markers are again running as warnings that Central Bankers might need to take action and therefore the greatest inhibitor to commodity advances, the US dollar, continues in strength and with the Dollar Index (DXY) ticking above 105 yesterday and the highest for 6-months, investor reaction inevitably turns sour.

Running in league with the Foreign Exchange dampener is some poor trade data emerging from Japan this morning. Not only has its annualised GDP been revised down to 4.8% from 5.5% (April-June), Reuters report on a 1% fall in capital expenditure and that wages in real terms have fallen now for 16-straight consecutive months. As bad as this news is, the ticking trade time bomb that is the US/China relationship has taken another ugly turn in the on-going techno-war. The US has vowed to investigate ‘made in China’ Huawei chips which has been seen and raised by China as it looks to extend its ban on iPhone use. Overnight Apple product supplier stock values decreased, as did the ever-important Apple share price which has fallen $10 (5.5%) in 5-days.

Oil’s rally deserves all the plaudits of the impressive type but faces some intriguing times. These are not only from within the confines of its own complex, but from the very real danger of what is going on in the wider suite. How the next 2-week’s Central Banks’ decisions will affect progress is about to keep oil on tenterhooks for some time.

What to do for the ECB

One of the problems that Saudi Arabia and its ally in production cut, Russia, now face is that commentators, including this report, will immediately turn their eyes repetitiously to inflation. When Governing Council Members of the European Central Bank such as Klass Knot, in an interview with Bloomberg, comments how uncomfortable it would be if the target of 2% inflation was pushed farther out due to any development, speculation and much print copy will arise again as to what interest rate decision the ECB will come to at its meeting next week. Being that Mr. Knot’s observations were made before the joint Saudi/Russia announcement, market participants across all suites will ponder on whether this latest curb to oil supply is a development that might fit Knot’s criteria.

Riyadh is acutely aware of the tightrope it walks between tightening the market and upsetting any up-and-until-now progress achieved by central banks in taming price-rise driven inflation. Although other factors qualify in consideration, the caveat of assessing the cuts on a monthly basis might just be the emergency brake of appeasement if the pressure from an aggrieved United States and Europe require some diplomatic deft. As we commentated on yesterday, the US has been far more successful than Europe in taming inflation because Americans have not felt the same pinch in commodity supply caused by the Ukraine invasion and the financial sanctions deployed because of it.

Euro-zone inflation gauges reveal inflation itself has fallen from an October 2022 high of 10.6% to 5.3% in August. However, and apart from a dip July23-August23 of 0.2% to 5.3% and the low of this year, CPI remains stubbornly over twice the required rate that the ECB would like. There have been 5 occasions this year when Brent flat price has swooned to the low $70/barrel area, yet CPI has travelled its chart left to right without any real attempt at improving. Rightly, this could be argued that oil prices have had little effect on CPI and with Brent averaging at around $79/barrel for the year and the last $10 of this rally happening in the recent 2-weeks, a rush to judgement that the ECB will take action because of oil prices is premature. Countering that argument is that despite a benign European crude price, CPI has not markedly fallen. If, as some analysts suggest, there is a continued period of over a 2-million barrel per day global crude deficit, then Brent might track into the $90s and threaten 3-digits with an accompanied jump in inflation. Gambling with coincidence, which is what we like to do, this could happen concurrently with elevated gas prices due to the industrial action in Australia which will curb LNG exports to global markets already competing to buy the liquefied fuel.

Two vital parts of Europe’s energy complex rallying in unison for a sustained period will make for an uncomfortable ECB decision. Whether this recent rally is too soon to affect the outcome of next week has plausible merit. However, a continuation in higher energy components must at some stage feel the smack of a frustrated European Central Bank.

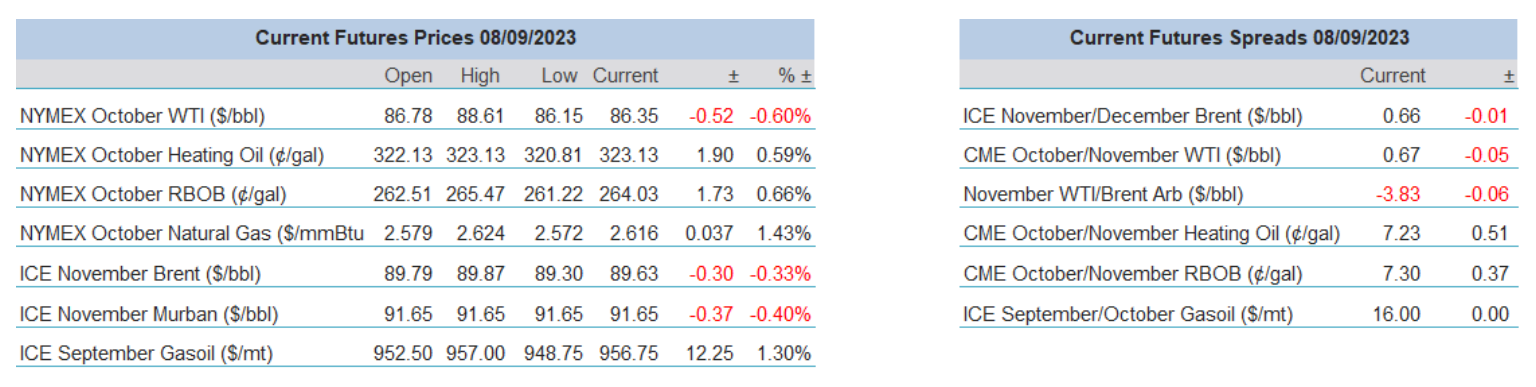

Overnight Pricing

08 Sep 2023