So Much to Consider and Nothing is Certain

Markets are crashing into waves of varying drivers yet again and although the lifeboats deployed last Monday are a long way off, it is wise to wear one's life jacket on the Good Ship Uncertainty. The root of the panic of the previous week, namely Japan, is not done with causing consternation in markets. Prime Minister Fumio Kishida announced he will step down as leader of the Liberal Democratic Party as his premiership has been beset with political funding scandals, low approval rates and a massive rise in government debt. While there is little reaction in markets at present, because frankly there are too many other things to concentrate on, political upheaval in Japan is not going to calm fears that there might be an aftershock from that notorious Monday madness.

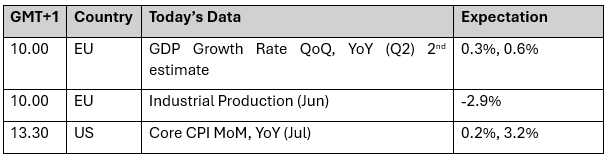

Macroeconomic eyes remain very much glued on the state of inflation in the United States this week. With US PPI coming in 0.1% softer-than-expected yesterday, any such replication in the CPI reading today will hear not only a clamour of calls for the US Federal Reserve to cut interest rates but see another bout of speculative equity buying. As it is, the CME FedWatch tool is seeing pricing for a 50-basis point cut in September rise above 50%. One wonders if such speculative practices might just backfire given the recent history of the FED's propensity of not matching policy to the likings of market participants. Uncertainty indeed.

As for oil prices, they are subject to the mercy of geopolitical concerns. There is an opinion much bandied on wires that Israel must be more open to ceasefire talks in Gaza if it is to avoid retaliation from Iran due to the killing of Hezbollah and Hamas leaders. Yet, Israel does not seem to be harried into such a diplomatic triangle by its greatest ally the United States. It was announced yesterday that the US has approved $20 billion in arms sales so says the State Department. The idea that an Iranian attack could be a gun-to-the-head reason for a change in its current campaign is made moot by the arms sales and the parking of extra US military hardware in the vicinity of the conflict.

The API data this morning also adds a fillip to prices that came under pressure yesterday due to a failing at key technical numbers and slight over-extension of a weekly 8% rally. The Crude draw of 5.2 million barrels is the seventh successive decrease in stock and why WTI remains the leader in the oil complex rally, as represented by the very healthy front month futures backwardation. There is too much in the market, even without mentioning Ukraine and Libya, to allow a comfortable bearish attitude. However, products prices are not matching the Crude rally, and therefore refiner margin will struggle. With demand worries in China, referred to in both of this week's monthly reports from OPEC and the IEA (touched on below), and sentiment in Europe at shockingly low levels as witness in the ZEW surveys of yesterday, the course heading of uncertainty remains the only one.

Not much change in the monthlies

Each month brings a chance for market observers to see into the thinking of the two most important monthly reports on the state of the oil market. OPEC’s Monthly Oil Report and the IEA’s Oil Market Report can sometimes offer grand chasms of differences in data and opinion, but not this time. There are more tweaks than leaps. OPECs’ over production in July, the difference in Non-DoC production and the decrease in 2024 demand forecast are the main contention points. Nevertheless, with so many unchanged forecasts compared with the previous month, there is little difference in either report that will make one reach for the buy or sell button. Indeed, there is accord on the recognition of third quarter demand, strength in the US and weakness in China.

OPEC

The oil alliance sees world economic growth forecasts at 2.9% for 2024 and 2.9% for 2025 holding the same assessment from the previous month. Keeping alive growth is the strength of the US economy after a strong showing in the first quarter of 2024. This year’s growth sees a US revision higher to 2.4% and despite ceding to issues in Japan by trimming its growth to 0.2%, OPEC seems to adopt the view that the world is in reasonably good shape by keeping forecasts in the main unchanged. China at 4.9%, India at 6.6%, Brazil at 1.8%, Russia at 3.1% and even the Eurozone at 0.7% all receive an unchanged status that spills into 2025.

However, it does appear that the normally bullish take on world economics sees an OPEC report unable to ignore the poor showing of many economies outside of the ebullient Unites States. Yesterday, one of the negative drivers that kept not only the Middle East news at bay and the soaring WTI market, was OPEC’s take on global oil demand. The growth for 2024 saw a decrease of 135,000 barrels per day from the previous month’s assessment easing from 2.25 to 2.11kbpd rounded. There has not been a reduction for over a year, and much is owed to ‘softening expectations for China’s oil demand growth in 2024’. This really is the first admission from the group’s monthly report that not all is well in South-East Asia.

Non-DoC supply, those outside of OPEC+ and allies, will again be judged at 1.2mbpd for 2024. With just over a month until the DoC (Declaration of Cooperation, those within OPEC+ and allies) must decide on whether to roll back some of the voluntary cuts. This decision is made all the harder by not only the issues in China, but Crude oil production by the countries participating in the DoC increasing by 117kbpd in July compared with the previous month. The lack of discipline in quota adherence is even acknowledged in the groups’ publication.

IEA

The Paris-based agency has produced a report that does not have any outlandish claims on peak anything and even concedes that at present there is some current tightness. ‘For now, supply is struggling to keep pace with peak summer demand, tipping the market into a deficit’. But, Oil demand will grow by less than 1 million barrel per day in both 2024 and 2025, which is consistent with last month’s report, maintaining a very large forecast decrease when compared to the 2.1mbpd seen in 2023.

Where there is also an interesting allusion to tightness is the observation that the world’s oil inventory in storage fell by 26.2mbpd in June. Accordance with OPEC is found in the view on the United States. A powerful service sector that adds to the driving behaviour of US citizens has resulted in OECD oil consumption flipping from a 300kbd annual contraction in the first quarter to growth of 190kbd in the second quarter of 2024. Still, beyond the current acceptance of summer/third quarter demand, supply is still set to increase. Non-DoC production growth in 2024 will be 1.5 million barrels per day led largely by the American foursome of the US, Canada, Brazil and Guyana.

There will be an oil surplus if OPEC decides to bring back barrels that have been shuttered due to voluntary cuts. However, the agency concedes that much of the tightening seen in North Sea dated contracts and affiliated derivatives is in part due to OPEC’s cuts. Yet, and with the usual caveat of market conditions, even if the cuts remain in situ for 2025, global inventories will increase by 860kbpd. Indeed, and in the present, global oil supply rose by 230kbpd in July on significantly higher OPEC+ production.

The IEA observes that outside the developed countries of the OECD, oil demand in the second quarter of this year was the slowest since the pandemic year of 2020. This is expanding on by how continued lacklustre readings from global macroeconomic indicators will result in oil demand growth being limited. The OPEC Monthly Report’s opinion may not run in parallel misgivings, but the lack of overly buoyant language is interesting. So, is its matching by the less-than-usual dire-filled vocabulary of the IEA.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

14 Aug 2024