Solid Global Economic Outlook, Ominous Geopolitics

Whilst fully acknowledging the headwinds that prevent oil from crawling convincingly higher, last week can be characterized as powerfully bullish. To begin with, the escalation of the conflicts between Israel and Palestine has reached new heights. In its attempt to obliterate the terrorist group Hezbollah, Israel killed its leader Hassan Nasrallah over the weekend. The Israel Defense Forces unmercifully continued to strike Lebanon irrespective of the growing number of civilian casualties and launched fresh attack son Houthi rebels based in Yemen. As the international community is unable or unwilling to propose a long-lasting solution one cannot help but wonder when the direct Iranian involvement, with all its knock-on effect on oil supply, will materialize. The geopolitical risk premium has not subsided at all, quite the opposite.

To navigate to more peaceful waters, immediate economic prospects ameliorated last week. The most salient development was the monetary stimulus the Chinese central bank announced. The PBOC unveiled its broadest stimulus measures since the pandemic to revive the country’s fortunes. These include a cut in banks’ reserve requirement ratios, lowering its seven-day repo rate, reducing mortgage rates, and decreasing the downpayment requirements on properties. The straw that broke the camel’s back was probably the yield on the 10-year Chinese bond, which plummeted to a record low of around 2% last week. As the threat of a Japanese-style deflation era is looming over the country something has had to be done, although naysayers argue that without fiscal help meaningful improvement is not forthcoming. Nonetheless, the Shanghai Composite Index returned more than 12% on the week and the yuan came within a whisker of the 7 mark against the dollar. The optimism prevails and stocks keep marching higher notwithstanding the grim performances of the manufacturing and service sectors in September.

It is a perennial debate whether lowering interest rates is a sign of economic turbulence or the warranted withdrawal of restrictive policies. Since the strenuous duty of central banks across the globe in the past two years was to rein in galloping consumer prices, it is probably fair to say cutting rates is currently the unmistakable indication of economies standing on firm legs. Last week the Swedish and the Swiss central banks followed the Fed by cutting borrowing costs. US 2Q final GDP was left unchanged at 3% amidst resilient consumer spending and business investment. Add to that Friday’s PCE reading. The headline index retreated to 2.2% in August, down from 2.5% in July. The more relevant core reading climbed from 2.6% to 2.7% but matched expectations. Labour market conditions are buoyant. The latest initial jobless claims rose less than expected. Another rate cut is more than plausible in November, only the extent of it is dubious. In any case, the dollar should remain under pressure; its index against six major currencies briefly fell under 100 last week.

On the oil front, it is impossible to ignore the latest EIA statistics on US oil inventories. Total commercial inventories plunged by 14.6 million bbls as all major categories registered declining values. Admittedly, it is partly the function of hurricane-related shutdowns – both in production and refinery operations. Combined crude/distillate/gasoline stockpiles fell 12.3 million bbls in PADD 3. Proxy demand seems healthy. Refiners supplied 21.4 mbpd of products, including 9.2 mbpd of gasoline and 4 mbpd of distillates.

Adjusting to Reality

It is this backdrop against which WTI lost 4% of its value last week and Brent descended 3.4%. The culprits are Saudi Arabia and the OPEC+ producer group. The kingdom, as first reported by the Financial Times, abandoned its unofficial price target of $100/bbl to regain its fair share of the market both from producers outside the group and from within. The most efficient way to do this is to stick with the plan of gradually unwinding 2.2 mbpd of production constraints over the course of one year beginning in December. It will ostensibly lead to a supply surplus in 2025. Yet it is worth remembering that its impact might be counter-balanced by the pledged compensation plans of three disobedient member countries. It is also intriguing to observe that the EIA foretells significantly higher DoC production in 2025 than in 2004 - +780,000 bpd. Other forecasters tend to share this view.

Saudi Arabia and OPEC+ did not capitulate but aligned their position to the changing nature of the oil market. Perhaps a more acute question is whether the alliance is in a position to do anything to support oil prices; either by improving demand or decreasing supply. Stimulating demand, at least in the short-term, is simply impossible and the narrow near-month premium on the crude oil contracts makes inventory play (selling oil from stocks and replacing it at a later date whilst collecting the backwardation) increasingly unattractive. Oil price movements in the last six months made it excruciatingly clear to producers that any supply restraints will be largely overlooked, and the market is content with the group’s current spare production capacity.

Nonetheless, consumption can be revived in the long term by flooding the market with oil. The price to be paid for such a strategy would be short-term pain. Prices being significantly below the current level would mean a further retreat in inflationary pressure. The global economy would get a boost and so would oil demand. Falling oil prices would hurt competition. Investment in exploration and production would decline. To mitigate the impact of natural decline rates, which Exxon Mobil puts at 15% globally and as high as 30%-35% for US shale oil, would be an agonizing exercise. It would result in a tightening oil balance and a growing market share for OPEC+. It is, however, questionable, whether such sacrifice would gain popularity within the group. The $100/bbl target is out of reach but a drop under $60/bbl would be beyond the pain threshold of most OPEC+ members.

Overnight Pricing

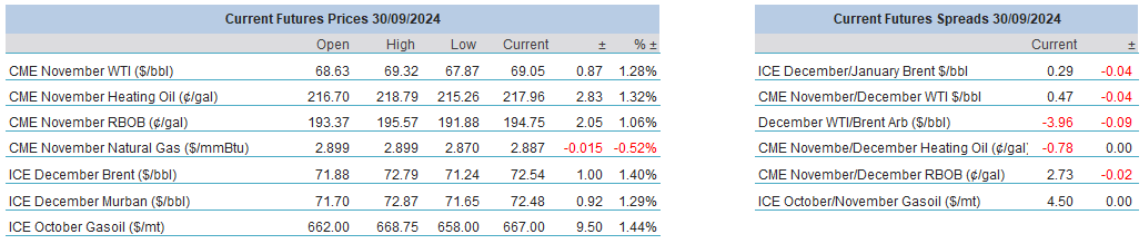

30 Sep 2024