Some Relief, at Last

We have pointed out on the pages of this note that the interpretation of a news item or development can greatly diverge in a rising from a falling market. Stock draws, wildfires close to oil producing regions or economic buoyancy might be dismissed when the underlying backdrop is sanguine but could provide the perfect excuse to cover short positions after a few days of heavy retreat. It is the latter that was on display yesterday with oil temporarily halting the descent from the July peaks whilst stocks also strengthened only to get, ominously, sold off right on the close.

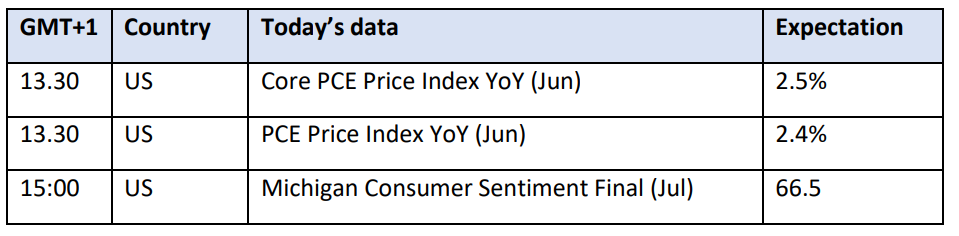

Of course, it was a belated reaction to an overwhelmingly bullish US stock report, which saw combined inventories in major categories decline by more than 12 million bbls. The raging Canadian wildfire, although has not threatened oil production or supply, remains a significant concern. The real catalyst, however, was provided by the constant belief that the Fed will cut interest rates, latest in September. The CME FedWatch tool puts the probability of such a move at 88%, up from 78% before the US GDP data and initial jobless claims were released. The US economy grew 2.8% in 2Q, stronger than the expected 2% and twice the speed of the 1Q expansion. Further easing of price pressure potentially exhibited in today’s PCE Price Index will go a long way to provide an extra boost to investors’ confidence.

Undoubtedly, those running short positions in oil futures were further incentivized to bank some profit by the submission of a plan from OPEC+ laggards, namely Iraq, Kazakhstan, and Russia, to make amends for their disobedience in the first half of the year, which resulted in an overproduction of 2.28 mbpd. According to the OPEC, this surplus will be taken off the market between now and September 2025 equating to 150,000 bpd, Energy Intelligence calculates. It sounds reassuring but is it credible? Probably as much as the Venezuelan opposition gliding through this weekend’s presidential elections in a fair and transparent manner, removing Nicolas Maduro and setting the country to become an integral part of the global oil market. Yesterday’s advance might persist in the immediate future, but its lifespan could not be much longer than that of a mayfly.

Something is Rotten in the State of…

…well, not in the state of Denmark, but in the United States of America and in the world. By no means we are referring to the fraying social fabric and the spectacular gains autocracies and the far right achieve all over the globe but to the stellar performance of equity markets. Conventional wisdom has it that stock markets, global as well as regional, are a true and faithful mirror of the economy. The logic is unquestionable. The economy can be defined as the sum of household consumption, business expenditures, government spending, and net exports. The more consumer spends, the more business expands, the more government invests in infrastructure and the more a country exports the greater the contribution to wealth, and it ultimately surfaces in stock markets in the form of improved earnings.

Therefore, it would be irresponsible to defy the logic of the equation that sees an expanding economy echoed in strong equity markets and, of course, vice versa whereas a shrinking economy will lead to an outflow of capital from stocks. Although the exact relationship between GDP growth and equity markets is a complex one, the connection is undeniable and can be quantified. One way of doing so is to compare the rate of growth to the changes in stock markets, preferably on an annual basis. When doing that, one will find that in this millennium an average annual global growth rate of 3.57%, as seen by the IMF, has been coupled with an annual average return of 5.43% in the MSCI All-Countries Equity Index. In the US, an economy that expands by 2.26% pushes the DJIA Index 6.26% higher and supports the Nasdaq Composite Index to the extent of 9.81% per year.

Keeping these figures in mind one cannot help but notice that the last two years have been strikingly out of sync. Global growth of 3.3% and 3.2% in 2023/2024 helped the MSCI index jump 20% and 14.5% to this month’s high respectively. In the US an economy that grows by 2.5% and 2.6% helps the DJIA index advance by 13.7% and 9.3% and Nasdaq by an eye-watering 43.4% & 23.6%, again, again, using the July peak for this year. These better-than-average returns are most plausibly the function of consumers spending their savings accumulated during the pandemic in tandem with the explosion of tech and AI stocks with the inevitable side impact of FOMO as seen in the performance of the teach-heavy Nasdaq. The MSCI-All Country and the DJIA indices appear unambiguously more optimistic than justified whilst the jury is still out whether Nasdaq is overvalued or not but given the financialization of risk assets a painful correction cannot be ruled out and it might have started in recent days as disappointing earnings emerged.

Which leads us to the perennial dilemma of global oil demand. The chasm between the IEA and OPEC forecasts has been well-publicized and it is significant, it can be viewed as the difference between a bull and a bear market. Oil demand used to be the salient price driver of oil price, but this connection was complicated by the emergence of the US shale industry. Still, the relationship between oil demand growth and GDP growth have remained intact and tenacious. The correlation has, in fact, been 86% in the past 24 years, using IMF and IEA estimates. Absolute demand also tends to match the movements in stocks, more so in global equities and the DJIA than Nasdaq.

Those who strongly believe that equities are running ahead of what would be fundamentally vindicated are wary of sanguine oil demand projections. To approach the issue from a different but related angle, they would trust the IEA estimates more than that of OPEC. They would also consider the fact that the transition from fossil fuel to renewables is irrevocably taking place, albeit admittedly the pace of it is disturbingly ambivalent. Nonetheless, alternatives to fossil fuel will become ever so prevalent further hindering healthy growth in global oil demand. Brazenly jumping to a hasty conclusion, if the upside in stock markets does prove limited, a considerable correction is impending and the switch from traditional energy sources to new ones continues unabated, $100+ prices are more than unlikely unless elevated geopolitical tension will adversely impact irreplaceable oil supply. To refine the above view OPEC might be too buoyant on demand growth prospects but the IEA could underestimate the time frame of peak demand. Either way, price support from the demand side will likely remain lukewarm if that.

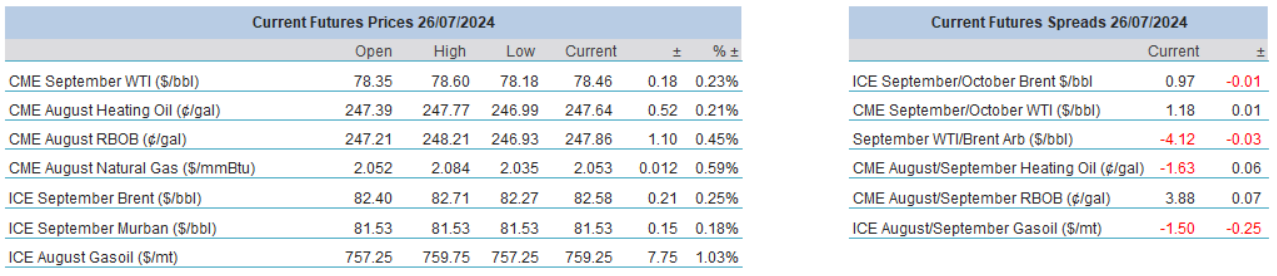

Overnight Pricing

© 2024 PVM Oil Associates Ltd

26 Jul 2024