Sometimes Words Speak Louder than Action

The Federal Reserve did not rock the boat. The cost of borrowing was not changed, it remains at a 23-year high of 5.25%-5.50%. The bank’s dot plot, nonetheless, showed that an increasing number of rate setters would expect a gradual rate cut of 0.75% this year bringing interest rates down to 4.50%-4.75% by the end of the year. In its policy statement the central bank emphasized that the labour market has remained strong with unemployment low. The rate decision fell in line with expectations, but encouragement came from the Fed’s chair customary press conference after the FOMC meeting finished. Jay Powell said that recent inflationary readings had not ‘really changed the overall story’ of easing price pressure. Equities jumped, and the dollar also reversed course; its index retreated from a two-week peak reached prior to the Fed meeting. The probability of the first rate cut taking place in June has risen above 70%, the CME FedWacth Tool indicates.

The FOMC meeting seemingly provided the perfect excuse to shed some length in oil during the day. Selling pressure intensified after the release of the US oil inventory data. It showed a healthy draw in crude oil stocks as refiners ramped up their utilization rates and weekly exports jumped to nearly 5 mbpd. A deep drop in gasoline inventories was also deemed bullish, yet focus shifted to plummeting proxy demand reading, which showed a week-on-week decline of 1 mbpd. The price fall seems somewhat exaggerated, especially considering that the underlying fundamental picture has not changed. Russian refinery problems, as discussed below, might provide renewed support for products relative to crude oil and yesterday’s selling spree could and should turn out to be what it appears it was - a healthy correction.

GMT | Country | Today’s data | Expectation |

09.00 | Euro Zone | HCOB Composite Flash PMI (March) | 49.7 |

12.00 | UK | BoE Interest Rate Decision | 5.25% |

12.30 | US | Initial Jobless Claims (16/Mar) | 215,000 |

13.45 | US | S&P Global Composite Flash PMI (Feb) |

|

Repression and Belligerence

Politicians, particularly autocrats, are the masters of squaring the circle and they display unquestionable confidence when presenting controversial situations as the only acceptable truth. Last week’s Russian presidential elections fall into this category. The incumbent, Vladimir Vladimirovich Putin, according to the official count, won 88% of the votes with a turnout of 78%. This is a more than a convincing victory and his only regret might be that less than 100% of the voters put his name on the ballot paper, which, given that elections also took place in occupied Ukrainian territory is not as insane of an assumption as it sounds.

Without meaningful opponents, who were either banned from running or liquidated the result does not come as a surprise and neither does the international reaction. The west and Ukraine collectively labelled the results as sham but perhaps more tellingly, albeit not unexpectedly, China, India and Saudi Arabia all applauded the outcome. The Chinese president said that under Putin’s leadership Russia will achieve great things in national developments and construction. India’s prime minister is looking forward to strengthening its strategic partnership with Moscow and the Saudi crown prince praised the decisive victory.

The predicted election result, which handed Putin another 6 years at the helm will most certainly maintain Russia’s rancorous relationship with its adversaries and it also ensures that the repression of its own people will continue unabated – the latter is the inexorable consequence of the former. The war against Ukraine will undoubtedly drag on as the west fails to provide much needed financial and military support for Russia’s neigbour. Tension with Russia’s enemies will intensify. No-one should doubt that Putin’s ambitions reach way beyond Ukraine. Just think of the country’s military presence in Africa, the ever-increasing rapprochement towards China and Saudi Arabia or the country’s plan to launch a nuclear weapon in space. The war against Ukraine laid bare the disregard of the lives of his own citizens, therefore repression and ideological campaigns will continue whilst the country’s population will inevitably shrink with the consequential damage to its economy.

As for our market, in the absence of any realistic hope of ceasefire or peace the egregious conflict with Ukraine and its allies will continue and so will the Ukrainian countermeasures, which recently have so successfully damaged Russia’s oil industry. At this point it is only reasonable to sum up how Russian refining capabilities have been affected since much of the same can be expected in the foreseeable future. Any sabre-rattling regime will always be as secretive as it can be, and transparency will never be its modus operandi. Nonetheless, data from assorted sources over the last two months suggests that the Russian refining sector has been severely impaired impacting the volume of products available both domestically and internationally.

Reuters estimates that around 370,000 bpd refining capacity was shut down in 1Q 2024, which will ostensibly grow in April and May. Gunvor’s CEO believes that Ukrainian drone strikes have knocked out 600,000 bpd of refining capacity hampering distillate exports, Bloomberg reports. JPMorgan reckons that the strikes reduce Russia’s refinery runs by around 300,000 bpd in addition to the already scheduled maintenance. Whilst views on the extent of refinery problems vary somewhat, the fundamental message, as far as exports are concerned, is clear. Russian shipments of products will be, to a certain extent, replaced by crude oil and this alignment should have a notable impact on refining margins. Crude oil loadings from Russia’s western ports are to jump to over 2.5 mbpd in the second decade of the month (Reuters).

This effect is, curiously, most discernible in the RBOB/WTI crack spread, which rallied hard over the past few weeks with CME RBOB now trading at a premium to Heating Oil. The Heat/WTI and the ICE Gasoil/Brent are relatively stable and even weakening a tad, possibly because the winter season is drawing to an end. Nonetheless, their downside potential will be limited due to ongoing strikes on Russian refiners and the resultant domestic bans on exports. It is also noteworthy that the IEA’s monthly Refining Margin Indicators are showing a worldwide bounce from January to February with the biggest monthly jump of around $5/bbl recorded in NWE medium sour cracking value, which rose from $15.41/bbl in January to $20.69/bbl in February as Ukrainian strikes on Russian oil infrastructure have escalated. The long-term impact of Putin’s re-election is unreservedly negative for geopolitics/geoeconomics but the perceived continuation of Ukrainian assaults in the near future should provide support for a wide variety crack spreads.

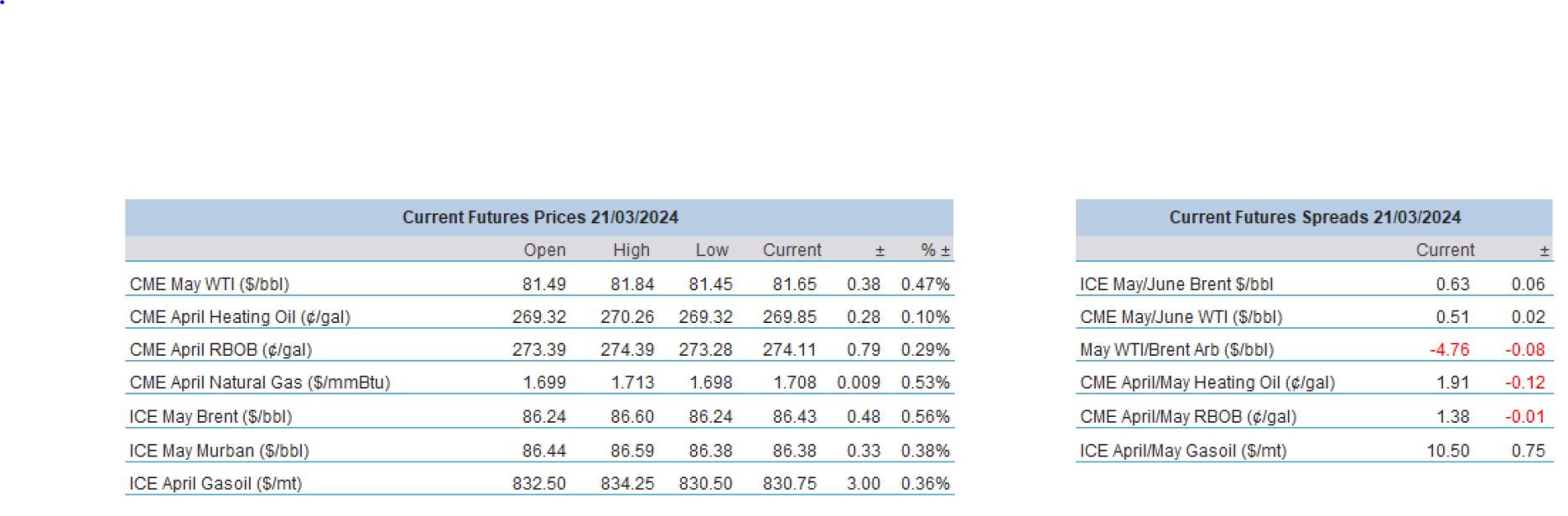

Overnight Pricing

© 2024 PVM Oil Associates Ltd

21 Mar 2024