Souring Investor Sentiment

These days, there is rarely a single reason behind a reversal in market sentiment. Over the past week, a combination of economic data, newly announced import duties, and spontaneous policy decisions, including attacks on independent institutions, have taken their toll on market confidence. Not even the stand-alone tech sector was immune to the anxiety permeating financial markets. The already imposed punitive measures are likely to be followed by others, such as excise duties on pharmaceutical companies and semiconductors, not to mention China.

Following Friday’s gloomy job data, which resulted in the firing of the head of the Labor Department and raised concerns about the accuracy and reliability of future economic statistics, the U.S. service sector failed to expand. Its index, compiled by the Institute for Supply Management, fell from 50.8 in June to 50.1 in July. The impact of already imposed tariffs was conspicuous in the narrowing of the June U.S. trade deficit. If one accepts that import tariffs are effectively taxes paid by the consumer (which they are), then either inflation will accelerate, or consumer spending will slow considerably. Equities drifted lower yesterday.

The U.S. President renewed his threats of secondary sanctions on India as punishment for remaining a staunch consumer of Russian energy. However, he also emphasised that all it would take to pressure Russia to the negotiating table is to send oil prices roughly $10/bbl lower. Regardless of the contradictory messaging, the market perceives greater risk from increased OPEC+ supply and the potential re-emergence of Venezuelan barrels to the international market than from the loss of 1.7 mbpd of Russian oil due to India switching suppliers.

As a result, oil slipped for the fourth consecutive session. Post-settlement API data, nonetheless, provides some relief. It showed crude oil stocks plunging by 4.2 million bbls and gasoline inventories deflating by 860,000 bbls. Whether the 1.6 million bbls build in distillate stockpiles implies that the recent Heating Oil strength is over is discussed below.

Has the Distillate Market Started to Sour?

The almost unconditional and explicit optimism observed in equities has not exactly permeated the oil market. Yet, financial investors are also trying to project a sanguine attitude. At least, this is what the Commitment of Traders reports from the CFTC and ICE suggest.

The latest set of data, covering the week ending July 29, shows that total assets under management (AUM), calculated as net speculative length (NSL) times the price, stood at $34.3 billion. While this is a far cry from the annual peak of $46.6 billion, the doubling of funds invested in the five major futures and options contracts since the end of May suggests that money managers are far from despondent.

This rebound over the past two months has not been driven by the most prominent and liquid speculative oil instrument, WTI. Although it showed a 5,000-lot week-on-week improvement, NSL stood at just 33,370 lots, marking the second-lowest reading since December 2023. Brent investors, by contrast, encouraged by geopolitical developments and sanctions, have been more upbeat, building their exposure to 261.3 million contracts by the end of July, a 64% increase over two months.

Despite being in the midst of the summer driving season, NSL in RBOB paints a grim picture. Net length in this contract stood at a mere 24,000 contracts in the latest reporting period, 20% lower than at the end of May. The engine of recent financial activity in oil is to be found in the middle of the barrel.

Both the CME Heating Oil and ICE Gasoil contracts are attracting significant inflows. NSL in Heating Oil reached 41,400 lots last week, the highest reading of the year. In Gasoil, net length climbed above 100,000 contracts—the most since March 2022. The surprising aspect of this newfound love affair between money managers and Heating Oil/Gasoil is its counter-seasonal nature. In fact, these two contracts now account for 31% of combined NSL, despite their average daily volume comprising just 18% of the total.

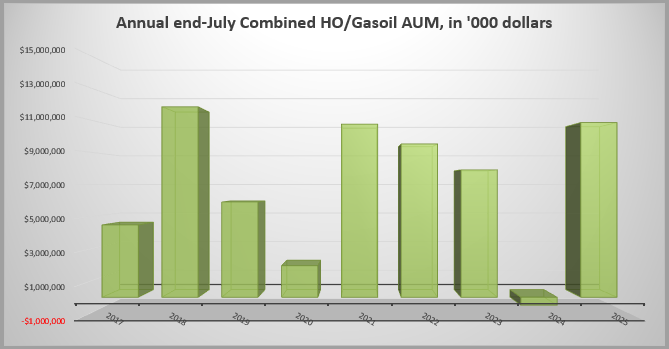

This bullishness is aptly illustrated in the chart below. End-July AUM in CME Heating Oil and ICE Gasoil hovered near $11 billion this year. This is slightly below the seasonal 2018 AUM, when hurricane-induced buying drove a surge of investment into products, and above the July 2022 level, when Russia’s invasion of Ukraine sent shivers down the spines of distillate importers.

Whereas in 2018 or 2022 the rush into Heating Oil and Diesel was largely event-driven, this year it appears to be the result of a confluence of factors. According to Energy Intelligence (EI), structural changes in both crude oil and product markets are responsible for the strength in distillates. These include recent OPEC+ cuts, refinery closures across the OECD, and uncertainties surrounding Russian diesel exports due to sanctions. Reuters estimates that Russia's seaborne shipments in July decreased by 5% month-over-month.

The tightness is evident across all segments of the middle distillate market. Inventories are depleted. Although modest increases were reported in both the US and Singapore in the most recent week, combined distillate stocks, including those in the ARA hub, remain 13% below last year’s levels and 7% below the seasonal average. Despite the usual seasonal contango characteristic for these products at this time of year, the current structure remains one of persistent backwardation, and crack spreads are also significantly stronger than historical norms.

The inventory baseline ahead of the northern hemisphere winter is low. Below-average temperatures could push US distillate stocks below 100 million barrels. As EI points out, Europe will be the key region with the most decisive impact on the global distillate balance. It estimates that Europe imports around 2.8 mbpd of middle distillates, with refining capacity having declined by 1.2 mbpd since 2018. Ongoing sanctions on Russia will compel the region to seek alternatives, potentially leading to further depletion of US stocks.

A determined unwinding of diesel-yielding OPEC+ cuts could help ease the situation, as could the added refinery capacity in the Middle East, China, and India. Therefore, it is not unreasonable to expect the current tightness to ease before winter. However, if hurricane-related disruptions to US refineries materialise, they could cause sharp, albeit brief, price spikes given the historically low inventory levels.

Overnight Pricing

06 Aug 2025