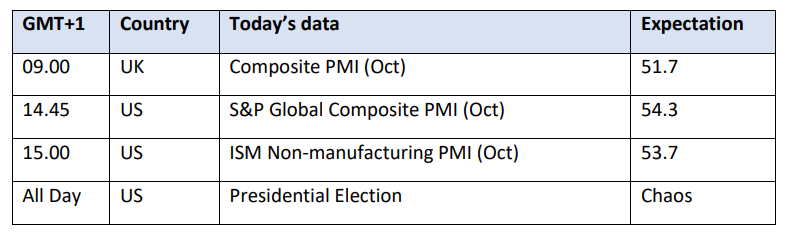

Squeaky Bum Time

Today’s US Presidential Election is considered to be the most consequential one since World War II with evidently far-reaching reverberations around the US and the world. What is at stake is whether the next occupant of the White House will be a predictable Democrat or a disruptive and divisive Republican. The outcome will likely be decided by a handful of votes in a handful of states. Most forecasters foresee a very tight race with differences well within the margin of error. The result might not be known for days, if not weeks and it will most plausibly be challenged and contested.

Markets are, indeed, facing a few very nervous days. Volatility will persist as results from individual states are announced. Attention is understandably on the presidential race, but it must be noted that the fate of the US legislature will also be decided and is almost equally as relevant. A trifecta, whereas one party controls the executive branch, the House of Representatives and the Senate could hand a carte blanche to the ultimate winner of the presidential election.

Yesterday, however, it was the OPEC+ group that stole the show. Brewing Middle East tension and the weaker dollar also played their parts in sending oil $2/bbl higher but the main catalyst behind the rally was undeniably the decision from the alliance to delay the planned gradual output increase by a month. Why the move will fail to provide prolonged price support is discussed below. Overnight the Australian central bank left interest rates unchanged, whilst hopes for a sizeable Chinese fiscal stimulus lifted the country’s equity market.

Finite Support from OPEC+

Considering today’s US presidential vote, the ominous stand-off between Iran and Israel and the perpetual war Russia wages against Ukraine, it is almost surprising to see a rally to the extent of nearly $2/bbl simply because eight members of the OPEC+ producer alliance decided to extend their 2.2 mbpd of voluntary output cuts by one month, until the end of December. Of course, one might argue that the price jump was not triggered by the latest U-turn from major producers, but the timing of the price rise seems more than coincidental. According to the press release on Sunday, in addition to the decision not to reintroduce 180,000 bpd of oil monthly over the next year to the market, these countries reaffirmed their commitment to full compliance whilst Iraq, Kazakhstan and Russia reiterated their pledges to compensate for their past production disobedience by September 2025.

In its Statute, the organization’s three declared objectives are safeguarding the interests of the member countries, both individually and collectively, ensuring stable prices and eliminating ‘harmful and unnecessary fluctuations’ and finally being focused on securing the steady income of member states.

It is more than reasonable to conclude that Sunday’s move falls into the first and the third categories. It is this very decision that triggered a ‘fluctuation’ in prices yesterday whilst the rally has served the interest of member countries and secured steady income. Whether its impact will be protracted, however, is anything but unequivocal.

It is an economic axiom that the major price driver of any product, goods or commodity is the difference between supply and demand. The EIA and the IEA are both confident that the growth in supply by countries outside of the producer group will exceed that of global demand leading to a loosening balance and diminishing call on OPEC+ oil. OPEC takes the opposite view; however, it is precisely their ostensible optimism, that ought to encourage them to add oil back to the market as a means to achieve stable prices. The producer group’s action has been more aligned with the forecasts of the EIA and the IEA than its own projections.

The numbers speak for themselves. In September 2023 the collective output level of the 23 producing nations under the umbrella of the OPEC+ group was 42.734 mbpd. Taking the average OPEC basket price of $96.40/bbl for that month, revenues from petrodollars stood above $4 billion per day. Fast forward 12 months and you will find that the daily proceeds dropped by nearly $1 billion to $3.11 billion. Combined production fell to 40.1 mbpd.

With ever-declining earnings, it is no wonder that the producer bloc does everything in its power to reverse this inauspicious trend. At the same time, it is impossible to ignore the fact that the group’s influence in meaningfully shaping the global oil balance has been on a steady decline. Lower production used to lead to higher prices, but not anymore.

There are possibly two related reasons behind this mitigated market power. The first one is that in the past any structural bull market was the function of an unquenchable thirst for oil, it was demand-driven. With the transition from fossil fuel to renewables irreversibly underway, this might not be the case any longer. The second one is oil supply, both from OPEC+ and non-OPEC+. It is sufficient and any voluntary constraint from the producer group is greeted with a shrug of the shoulders from market players since cuts, in the absence of sizeable demand growth, will only lead to a thicker and reassuring supply cushion. The EIA puts it at 4.41 mbpd in the incumbent quarter and to 3.99 mbpd by the end of next year.

What used to be the inverse relationship between OPEC production and oil prices is now the same negative correlation but between spare capacity and the value of a barrel of oil. Accordingly, yesterday’s strength is not expected to last, at least not because of the measures OPEC+ initiates. It is most plausibly just a question of time when the group changes its modus operandi and concludes that sacrificing market share for a very questionable and brief rally is less effective than being a fierce and long-term competitor to non-OPEC+ producers as well as alternative energy suppliers by re-gaining market share and cheapening the price of oil.

Overnight Pricing

05 Nov 2024