Still Bearish

On Friday we expressed in summation that the art of oil price prediction has become a clouded affair. The many-faceted articles of drivers within current events in which oil is so intractably aligned change on a daily basis, and to ball them up into conclusion could only come with a flow chart of caveats so long that the process would fill a physics chalk board. Yet there are a couple of news items over the weekend that cannot but allow us to once again cast shade of a bearish nature over the near future for our market’s fortune.

On Saturday, Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman met virtually, and as the market mostly suspected carried on the process of reintroducing previously self-prescribed productions cuts. This is now the third month in a row where a return of 411kbpd has been announced and is well on the way to a full reversal of the 2.2mbpd mixture of official and voluntary tapering. Given the circumstances of a loss in market share and the almost too honest admission from Kazakhstan that it would not cut output, there does seem little choice. In the post-meeting bulletin, the façade of being in control remains irresistible, as the usual ‘gradual increases may be paused or reversed subject to evolving market conditions, […] this flexibility will allow the group to continue to support oil market stability’ was rolled out. However, it does not take much of a betting person to believe the 411kbd will see an overall a six-month repetition or a mathematician to work out 411 multiplied by 6 is as close enough to the 2.2mbpd as need be which now looks set to come the way of crude markets by the fourth quarter.

There will continue to be short-term issues that allow for contemporary upside risk which at present centres around sour crudes. We will take a closer look at refinery yields at a later date, but with the API grading of US crudes becoming lighter because of a reliance of Permian Basin production and the blending of natural gas liquids, heavier crudes are needed in further blending to allow refineries runs that can produce motor fuels. Without sour crudes in the mix, yields are lower and therefore might just heighten whatever issues of gasoline tightness ensues as we enter the ‘driving season’. But whatever damage is being done to how US refiners set up because of the wildfires restricting Canadian crude or lack of Venezuelan imports due to sanctions will over the next few months find repair and appeasement with plenty of sour crudes available in the barrels being returned by OPEC+. Gasoline historically comes in a bullish charge each year to save oil prices and there is little to believe that changes in this annual cycle particularly with inventories being tight, but if a kicker is expected due to sour crude supply, such a notion might just well be ill-fated due to OPEC+ resupply.

The other bothersome cause of oil price anxiety is a visceral turn of diplomatic language from the White House toward China. Oil derivatives have never experienced the ‘rather buy them than count them’ attitude from an incredibly resilient investor populace of US stock markets. It is oil prices that have much more represented the damage which tariffs heap on international trade. Late last week, U.S. Treasury Secretary Scott Bessent stated that trade negotiations between the US and China had stalled and would likely need intervention from both Presidents Trump and Xi. Well, it did not take long and with customary both barrels, enter the US President. ‘Truth Social’, which drips with titled irony, was the usual scene of The Donald’s insights, “China, perhaps not surprisingly to some, has totally violated its agreement with us. So much for being Mr. Nice Guy!” The recent Geneva consensus and 90-day mutual tariff pause is not standing up as a sedative to increasing acrimony. The US on Friday suspended aspects of aviation, chemical and semiconductor industry exports to China following China’s recent restrictions on exports of critical minerals to the United States. China no longer feels it necessary to veil its attitude, “China once again urges the US to immediately correct its erroneous actions, cease discriminatory restrictions against China and jointly uphold the consensus reached at the high-level talks in Geneva,” so said Liu Pengyu of China’s US Embassy.

No doubt the balance of the 90-day tariff pause will see many such spats and in this world of smoke and mirrors, they might just be transactional. However, they will not denude the power that such language has on global trade confidence and thereby oil demand. The oil market does not have the luxury of Nvidia, its peers and battalions of acolytes. The post-repairment rally after ‘Liberation Day’ seen in the world’s conventional ‘buy’ investment tools is strikingly absent from oil prices. With the two largest trading nations taking bites from each other and the world’s oil price controlling cartel finally giving in to market forces we cannot enter the week believing that there is some sort of long-term oil price reprieve asset or narrative that changes an oil price set in continued downward grind.

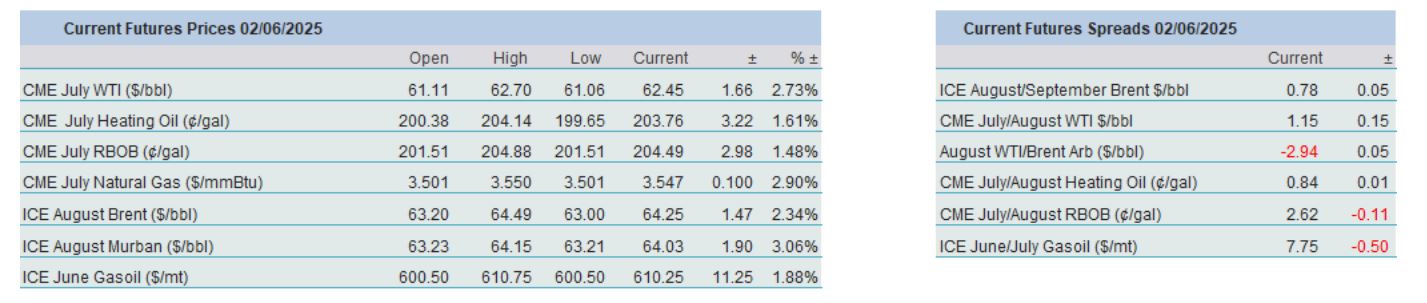

As it stands this morning the oil suite is in pursuit of provisional relief with a feeling that the OPEC+ decision could have been worse. Yet, this shows the short-termism of how headlines are traded in the here and now rather than seeing greater liquidity in the forward puzzles of structure. If an increased 411kbpd per day is ‘priced in’, one wonders when the market will chew on a warning from Goldman Sachs over the weekend that it expects both a similar decision and amount of oil return in August. There is a certain comfort, particularly in Brent and WTI in how the ‘roll up’ trade is showing some success. This being when the M2/M3 spread takes up the higher backwardation seen at expiry in the preceding M1/M2. However, looking down the board, each spread is starting its journey from successive lower outsets and at the turn of the year all the calendar structure of 2026 is in contango. The myopia in this strategy is being fuelled by Gasoline, its coming season and low stocks. But it is something of one-trick pony and unless bullish allies can be gathered the ‘roll up’ will soon become vapid.

Last week’s performance within the oil complex was once again a negative one. Front month WTI and Brent finish around 1% lower with products between 2% and 3% under that of the previous Friday’s settlement. Scrolling out and taking a weekly flyover, and with RBOB aside, in the last 20 weeks of trading there have only been 6 positive weekly changes in WTI and Brent and 7 in Heating Oil and Gasoil. Structure will be the home of expressions of bullishness and indeed at present risk in spreads and flat price is to the upside. Yet for all the ephemeral bullish interludes, a constantly decreasing outright price will eventually pour cold water on positive inter-month verve. Bullish headlines and expiries will be whipped to within an inch of their apposite lives, but in the end, flat price never lies.

Overnight Pricing

02 Jun 2025