Still the Tail on the Dog

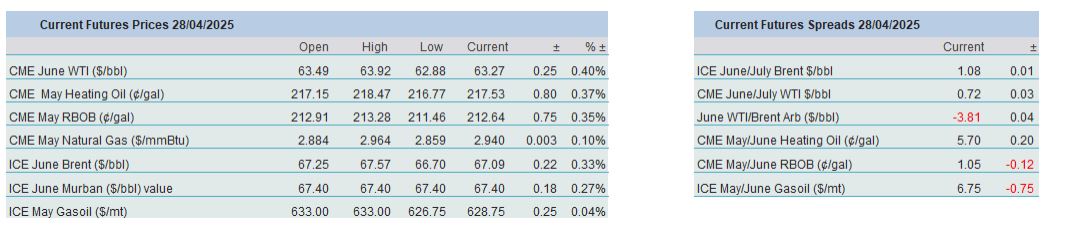

Oil prices endured another contained existence last week and while the high/low ranges were decent enough if one were interested in such short-termism, the overall finishes indicate a market that is in the main, apart from an expiring Brent front spread, unwilling to be too expressive be they in bullish or bearish leanings. The front month futures contracts of WTI finished -$1.66/barrel, Brent -$1.09/barrel, Heating Oil +1.50c/gallon, RBOB +2.01c/gallon and Gasoil -$4.00/tonne. Pulling apart every thread of tariff deviation would only bring flashbacks of exasperation knowing that such a feeling will migrate to this week too. Any hope of some sort of reconciliation in tariff trauma between the two main protagonists was just that, hope. We are used to the murk spilling from the White House, but Beijing has joined in by denying that there are any direct trade negotiations at all. Try as we might, our ‘Oily’ fraternity cannot be diverted from the tariff smother. Not even nuclear talks between Iran and the US or an increasingly fractured OPEC brotherhood can sustain our gaze. It is snatched back by a trade war headline with not so much as a, “that is interesting”, more of a “what now?” Short of an earthquake or warfare laying low any part of the globe’s oil infrastructure we can expect much of the same in the next five trading days. Not only that, but there are also tier 1 data and extremely important company results too. The US will see readings of GDP and importantly for the Federal Reserve, employment data including Non-Farm Payrolls. In Japan, the BoJ will announce an interest rate decision it has fretted on for months, but possibly even more significant are results. Microsoft, Amazon, Apple and Meta all post first-quarter earnings and according to Reuters, around 180 other such corporation recordings will be seen representing 40 percent of the value of the S&P 500.

Oil’s first 100-days is down

It has been interesting to watch Donald Trump wrestling with the oil market since he stormed to victory last year. Let us be clear, he won by significant mandate, not some court-fought, count-off. Even though oil prices were on the wane after the effects of the Middle East war premium had run its course and so the widened sanctions on Russia’s dark fleet ordered by President Biden, they were still in a healthy enough state that the new president could trumpet his love affair with the US oil industry and of course we have forever been blessed with his now stock “drill, baby drill.” The day before his inauguration M1 WTI settled at $77.88/barrel, the day after, $75.49. “We have something that no other manufacturing nation will ever have, the largest amount of oil and gas of any country on Earth, and we are going to use it – let me use it,” was part of the inaugural speech and even though Saudi Arabia would be urged to bring oil prices down, the oil market happily accepted that the US was about to suddenly become fossil-fuel-prolific once more and adjusted its price accordingly lower with few groans. ‘Happily,’ is no exaggeration, at the March CeraWeek in Houston, known as the ‘Coachella of oil’, the oil fraternity all but danced until dawn, caught up in the fervour of executive orders cancelling green energy initiatives and drilling restrictions emplaced by the previous administration. Saudi Aramco said the shift away from fossil fuels had been “doomed to fail”, ConocoPhillips said of the White House, it was “probably the best energy team in the United States we’ve had in decades” and investment giant BlackRock, paraded vestments bearing, “make energy great again.”

What a difference a month makes. WTI has been as low as $55.12 on 9th April before recovering to current levels, but just as important is how volatility has steadily risen this year. Using the CBOE Crude Oil Volatility Index, the reading on inauguration day was 35.0, printed up to 55.0 when WTI made the year-to-date low and has maintained an existence at around 45.0 since. Low prices are the bane of any provider, but high volatility might be argued as being more damaging. Indexing a forward outlook becomes increasingly subjective, investment and confidence must then reduce which is now seeing increased bemoaning among all industries let alone just those of fossil fuel miners. Recently and as heard by Bloomberg, the CEO of Occidental Petroleum was forthright in offering misgivings as to how Trump’s energy policies lacked a pathway. “We don’t have an energy direction right now […], we need a plan.” Some US drillers are already initiating a plan, and it is the very antithesis of drill, baby drill. Blackridge Resources in the Appalachian basin informed Reuters it was paring back drilling and for small independents such as Arena Resources in Wyoming, observing, an administration that welcomes oil prices in the $50s misunderstands the costs of production. “Even the best acreage in the Permian isn't going to make much money in the $50s," its president said. If drilling starts to be shuttered so will investment. Morningstar analysts, as seen on Reuters, estimate that for every $5 decline in crude prices, U.S. shale spending falls by about 5%.

Enthusiasm for the US oil industry is all well and good, but the trade war, the possibility of inflation and a newfound rigidity to the outlook for interest rates is keeping the expectation of oil company executives defensive. What is also hard to join together are current US foreign policies that involve oil production, where the endgame for the US being an arbiter in the Ukraine war and nuclear talks with Iran sits with what might end up being much more oil onto an already sated market. How this benefits shale suction and sand sifting in Permian, Eagle Ford and Uinta Basin for example defies logic and to expect 3 million extra barrels of oil output per day, along with 3% growth and a 3% budget deficit ration, as part of the 3-3-3 US Treasury plan is incoherent. Economists have taken chainsaws to US and world economic growth forecasts of late, and so too have the IEA, EIA and many Wall Street banks for oil demand equivalent. Tomorrow marks President Trump’s first 100 days in office. No doubt the Republican base will be baton-twirling a return to ‘conservative values’, whatever that subjectiveness might mean. However, those on the tillers of oil companies do not want more “torpedoes under the water," as promised by Trump officials. They want strong and healthy platforms of business in which oil prices, even low ones, are not subject to what sometimes appear as caprice and whimsy and where business horizons are made clear and free from this Administration’s adaptation of a trade war.

Overnight Pricing

28 Apr 2025