Stock Markets Prowl, Oil Markets Fade

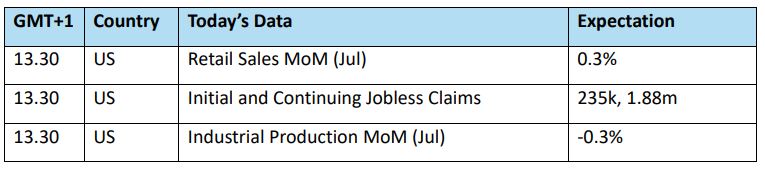

The US CPI data came in within tolerance and the wider suite resumed its assumption of rate cuts from the US Federal Reserve in September. The CME FedWatch tool is still pricing the probability of a cut at 100% with 37.5% representing a 50-basis point cut and an overall 100-basis points cut for the balance of the year is also finding interest. The US bourses were, however, rather contained. Any fervour from bulls was withheld due to the Retail Sales data out today. Would-be friendliness needs to see that the US public has not lost its vim for consumption and wariness is partly added to by how Jobless Claims might come in, bearing in mind the importance FED members place on employment data. The East offers something of mixed picture too. Japan's preliminary annualized Q2 growth came in with a reading of 3.1% which is very much better than the 2.1% expectation and why the Nikkei 225 is the lead bourse once again this morning. However, and keeping in line with news stories having ready counterinfluences, China's macro data continues to show a troubled economy. Apart from a slight pip up in Retail Sales; House Price Index, Fixed Asset Investment, Industrial Production and the Unemployment Rate all disappointed and missed expectation.

Oil prices have failed to benefit from the continued hopefulness of the wider suite. The EIA Inventory Report showed a build in Crude Oil stocks of 1.36mb yesterday, bringing about a swift end to the interest generated by API data that showed a seventh-straight draw of 5.2mb. Such was the shock that a technical flunk in WTI, the leader of oil prices, found acceleration as the US Crude is within range of giving back 50% of its recent rally. Not even a stuttering US Dollar or Hamas' decision not to attend the next round of ceasefire talks is enough to bolster confidence. With days ticking off since warnings of an imminent direct attack by Iran into Israel, war premium erodes allowing the oil fraternity to cast a displeased eye over the state of demand outside of the United States. This is added to by data shared on Reuters that China's refinery runs are down 6.1% year-on-year for July, equivalent to 13.91mbpd down from 14.87mbpd in one year and at the lowest since October 2022.

Can the Land of the Rising Sun keep rising?

Known as the Japanese Economic Miracle, between 1945 and 1994 Japan experienced unprecedented and sustained economic growth. There was an embracing of technological advances that educated a growing and willing workforce adapting to a massive influx of new industrial mechanisation. Productivity soared, efficiency increased, and growth allowed for corporations to reinvest in themselves. This created the base from where Japan grew into the massive trading nation status that it still enjoys. It also heralded a banking system that threw out the rules of fiscal discipline and is probably where the habit of massive state easing, in all its forms, comes from.

The Economic Miracle then turned into the Lost Decade. During the 1990’s the stagnation experienced in Japan was one of the longest crises ever experienced by a nation state. The propensity for a continued loose monetary stance gave rise to a bubble-like state in both the stock and real estate markets. This was then caused to burst by a spooked government that raised interest rates and basically crashed everything. For 30 years an almost state of depression stalked the economy with GDP growth regularly registering negative readings and averaging well under 1% for the period using IMF data. What exacerbated the inability for growth is the historical nature of Japan’s populace to save money and be frugal in consumption. When the ensuing lean years unfolded, in an attempt to guard against an economy that might get worse, savings increased, consumption fell in cycles which is coined by some economists as a ‘savings surplus’. With interest rates high and a strong currency, the liquidity trap was complete and after a few years, made so much worse by the banking crunch of 2008 and the global depression.

After the 2008 crisis other economies were quick to stimulate and bail out where appropriate, but Japan dithered leading to the stagflation and the synonymous ‘Japanification’ label of anything that was failing. Shinzo Abe returned as Prime Minister in 2012 and the portmanteau of ‘Abenomics’ became a thing. Monetary easing and fiscal stimulus were super-sized with interest rates slashed in an attempt to stimulate inflation to 2% and eventual growth. Mocked in many quarters, the long-drawn-out policies have helped lead Japan to its current success. Success being relative, but when compared with recent history it is not an overstatement. There is little doubt that the rise of Japan has been at the expense of China. Not in just the more relaxed attitude towards the pandemic allowing the workplace to function on, but in it now being a preferred investment arena due to current and future-perceived tariff wars and burgeoning state interference that obfuscates what is really happening in economic China. Fortune also plays a part. When Warren Buffet invested heavily into Japan in 2020, he opened the door to follow-on investors that had largely ignored the renaissance in business practice. The corporate job-for-life expectation started to disappear while being replaced by a more vibrant and entrepreneurial younger generation keen on making the best of online businesses and Japan’s love of technology. Defensive practices in the stock market where domestic companies would buy up shares to protect each other from hostile takeovers became a thing of the past. These are just a few examples, but all allowed GDP growth to average 3.5% in both 2022 and 2023 doubling the reading from 2013 to 2019. The Nikkei 225 has gone on to make several new record highs and at long last inflation has made it to the 2% target.

The road to recovery is complete then, the Land of the Rising Sun is about to shine on. Well, no, not exactly. There have been several episodes in the above brief history in which a turnaround has threatened, only to fail. Worryingly, they all have largely centred around stimulus and easing in one shape or another. Even though there is a vibrant younger employment market, it does not change the shape of an ageing demographic with all the problems of pension funding and lack of labour that is not future proof. Another ponderable and valid argument is that some of the inflation Japan enjoys is due to the influence of wider global problems of higher inflation that others are so keen to tackle in diametric opposition. Logic then suggests that if a cooling in price rises from the other centres of trade eventually transpires, then low inflation will return. Government debt cannot be ignored. Conservatives in the United States scream about a Debt to GDP ratio of 122% (2023), but it pales when compared with Japan’s whopping 264%. The Bank of Japan toys publicly with raising interest rates, but the cost to the government in increased interest payments would be eye-watering.

Which brings us eventually to the Monday Madness of August 5. The so-called ‘carry trade’, which is borrowing cheaply in Japan to buy assets elsewhere, unravelled at the hint of another BoJ rate rise and inspired the viral reaction that has left a market that has recovered in price, but maybe not so in complete confidence. There are also questions to answer for the reasons which saw the stepping down of Prime Minister Fumio Kishida. Scandals aside, the role his successor will face is one of impending economic troubles and one the Mr Kishida might not have been prepared to face after promising a ‘new form of capitalism’. Most of the year the weak Yen has led to higher import prices that have been channelled to consumers with wage increases not keeping pace. Economies which rely on government stimulus rely on future GDP growth to pay long-term debt down. Japan’s is unreliable and future forecasts for the next few years do not envisage much of a change. Did the ‘carry trade’ flash crash encourage the Prime Minister to walk away before something much more onerous occurs? It is a misery strewn conspiracy and not at all provable. But Japan is complex, its economic future by no means assured. Its recent elevation into the web of worldwide preferred investment means anymore triggers that emulate the now infamous Monday Madness has already seen a dress rehearsal in what it might mean to market confidence, if repeated.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

15 Aug 2024